Exploration & Production | Drilling / Well Results | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Key Wells | Forecast - Production | Capital Markets | Private Equity Activity

Black Ridge Production Grows to 761 Bopd

Black Ridge Oil & Gas, Inc., a growth-oriented exploration and production (E&P) company focused on non-operated Bakken and Three Forks properties, today announced financial and operating results for the quarter ended September 30, 2014.

Third Quarter 2014 Highlights

- Record quarterly production averaged 761 barrels of oil equivalent per day (Boe/d), representing 147% year over year and 6% sequential quarter over quarter growth

- The Company recorded adjusted EBITDA of $3.6 million in the third quarter of 2014, an increase of 114% compared to adjusted EBITDA of $1.7 million in the third quarter of 2013 and equaling our record $3.6 million in the second quarter of 2014

- Participated in the development and start-up of five gross (0.62 net) Mandaree wells in EOG's Antelope Extension prospect

- Drilling activity commenced on the Company's 22 gross well (1.37 net) Teton project, production expected in mid-2015

- Increased borrowing base on senior-secured credit facility from $20 million to $35 million. The facility carries interest rates of LIBOR + 3% to LIBOR + 3.50%. Availability as of September 30, 2014 was $17.25 million

- As of September 30, 2014, the Company was participating in an additional 65 gross (1.61 net) wells that were preparing to drill, drilling, awaiting completion or completing

Fourth Quarter 2014 Guidance

- The Company anticipates fourth quarter 2014 average production between 950 to 1,100 Boe/d

- Black Ridge has 45,000 barrels of oil hedged for the fourth quarter at an average price of $94.49

- As of October 31, 2014, the Company was participating in an additional 86 gross (2.48 net) wells that were preparing to drill, drilling, awaiting completion or completing

Management Comment

Black Ridge's Chief Executive Officer Ken DeCubellis said: "The third quarter of 2014 was another excellent quarter for the Company. Despite planned shut-ins for additional well completions in the Stockyard Creek prospect, we were still able to achieve a production record.

As we look to the remainder of 2014 and into 2015, the five gross (0.62 net) well Mandaree prospect in EOG's prolific Antelope area of McKenzie County began producing at the tail end of the third quarter of 2014 and will be the main driver for growth in the fourth quarter. We expect fourth quarter production to average between 950 and 1,100 Boe/d net to the Company. In this environment of lower oil prices the Company is maintaining a disciplined, return driven approach to investments. Our Mandaree and Teton projects are expected to exceed our hurdle rate of 30% IRR at current oil prices."

Mandaree Update

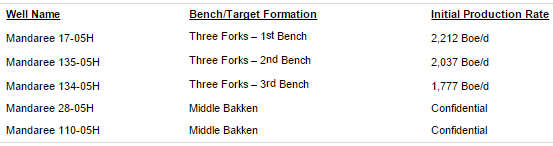

The following table summarizes initial results in the Mandaree Project operated by EOG Resources, Inc. The Company has a 12.5% working interest in each well:

Third Quarter 2014 Operational Results

Production for the third quarter of 2014 totaled 70 thousand barrels of oil equivalent (MBoe), averaging a record 761 Boe/d, representing 147% growth over the third quarter of 2013 and 6% growth over the second quarter of 2014 on a Boe/d basis. Production growth in the quarter was limited by shut-ins for offset completions in the Stockyard Creek prospect.

Throughout the third quarter of 2014, the Company participated in the completion of 24 gross (1.08 net) wells compared to 11 gross (0.40 net) wells in the third quarter of 2013. Well additions were driven primarily by the completion of the five gross (0.62 net) Mandaree wells in the final days of the quarter.

As of September 30, 2014, the Company had participated in a total of 231 gross (7.36 net) producing wells compared to 92 gross (3.22 net) producing wells in the third quarter of 2013, representing an increase of 129% on a net well basis.

In addition to the 7.36 net producing wells, the Company owned working interests in 65 gross (1.61 net) wells that were preparing to drill, drilling, awaiting completion, or completing as of September 30, 2014.

The Company controlled approximately 10,000 net mineral acres prospective for the Bakken and Three Forks formations in North Dakota and eastern Montana as of September 30, 2014.