Bankruptcy / Restructure Update | Financial Trouble | Capital Markets

Breitburn Energy Partners Files for Bankruptcy

Breitburn Energy Partners LP announced that it and certain of its affiliates filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of New York.

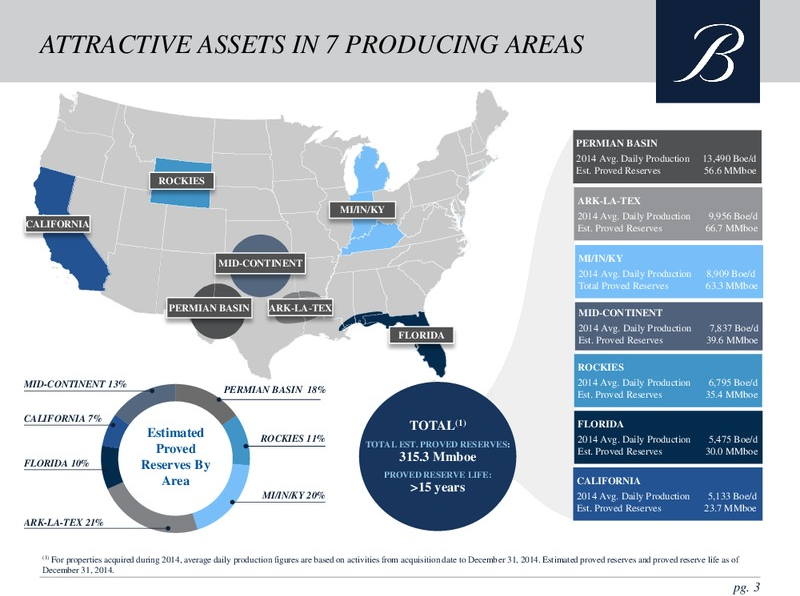

Areas of Operations

More About Breitburn

Breitburn expects to continue its operations without interruption, and cash from its operations, cash on hand, and a $75 million debtor-in-possession financing facility (DIP Financing Facility) will provide Breitburn with more than adequate liquidity to fund its operations during the restructuring process. Breitburn’s DIP Financing Facility lenders have offered to arrange an additional $75 million of DIP financing at Breitburn’s request. The Chapter 11 Cases will facilitate the restructuring of Breitburn’s balance sheet.

During the last 30 days, Breitburn has been engaged in constructive discussions with its second lien noteholders and the advisors to its unsecured noteholders regarding the need for, sponsorship of, and terms of a balance sheet restructuring. Simultaneously, Breitburn has been engaged in constructive discussions with its revolving lenders regarding their support for emergence financing, as well as the treatment of Breitburn’s valuable hedging assets in conjunction with its emergence from the Chapter 11 Cases. Breitburn plans to utilize the Chapter 11 Cases to continue and complete these discussions with key stakeholders and evaluate other value-maximizing opportunities to facilitate an expedited balance sheet restructuring that will leave Breitburn as a stronger, deleveraged, and recapitalized enterprise.

Hal Washburn, Chief Executive Officer, said, “The prolonged decline in commodity prices that began in 2014 has placed significant financial stress on today’s oil and gas industry. Our long-lived, low-decline portfolio of diverse assets continues performing in line with our expectations, but the current outlook for commodity prices makes our existing debt burden unsustainable. Taking this action now gives us flexibility in maximizing the value of the ongoing business. By continuing the proactive approach we started 15 months ago and restructuring our balance sheet now, we expect to create a stronger and more financially sound company for the benefit of all our stakeholders. During the restructuring process, we will continue managing our business and operating our assets as we do today. Cash from our operations, cash on hand and cash available under the DIP Financing Facility will provide us with more than sufficient funds to operate our business during the restructuring process. We look forward to working with our service providers, suppliers, customers, vendors, and partners to ensure that Breitburn emerges from the restructuring process a stronger company.”

Breitburn has filed a variety of “first-day” motions with the court seeking, among other things, authority to maintain its existing cash management system, approval of the DIP Financing Facility, authority to make payments to royalty interest holders and with respect to its lease operating expenses, drilling and production costs, and other related operating costs, and other customary relief. When granted, such motions will assure Breitburn’s ability to maintain business-as-usual operations throughout the restructuring process.

Related Categories :

Bankruptcy / Restructure Update

More Bankruptcy / Restructure Update News

-

ION Geophysical Files for Bankruptcy

-

Vista Proppants Emerges from Bankruptcy; Rebrands as V SandCo LLC

-

Gulfport Energy Emerges from Bankruptcy

-

HighPoint Resources' Bankruptcy Plan Approved by the Courts

-

HighPoint Files Chapter 11 Ahead of Merger with Bonanza Creek

Ark-La-Tex News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -