Well Cost | Well Lateral Length | Quarterly / Earnings Reports | Production | Second Quarter (2Q) Update | Hedging | Capital Markets | Capital Expenditure | Capex Increase | Drilling Program-Rig Count

CONSOL's Well Cost Down 71%; Expects Production Bump in 2018

CONSOL released its Q2 2017 results and defended its decrease in production from the previous quarter and highlighted its operational results.

- Capital expenditures increased in 2Q to $142.3 million from $100.8 million in the previous quarter, a 42% increase

- Production:

- Utica production volumes were 13.8 bcfe down 41% from 23.3 bcfe in Q2 2016

- Marcellus production volumes were 56.9 bcfe, 7% higher than the 53.1 bcfe from Q2 2016

- Increasing production guidance by 30 bcf

Production in Q2 was 92.2 bcfe, or a 3% decrease from the first quarter. Timothy C. Dugan, CONSOL Executive, attributed this decrease to an asset sale in WV and unforeseen operational delays that occurred in the quarter. When asked about whether another event might cause additional delays in the future, the company assured that these events are few and far between.

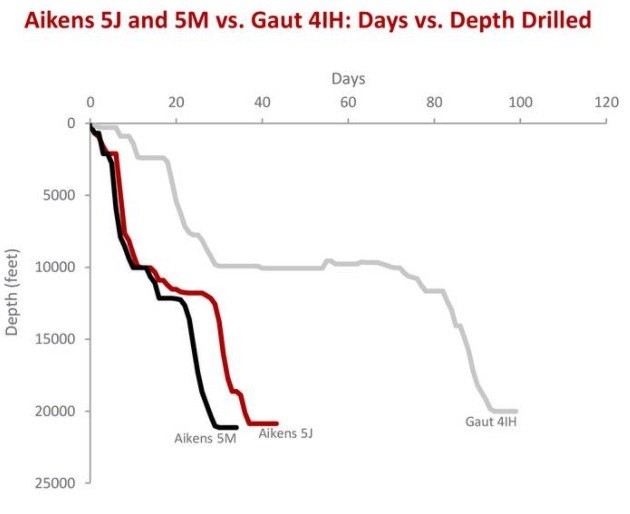

In this quarter, CONSOL operated 2 rigs and drilled 7 Utica wells, 5 in Monroe County, OH and 2 (Aikens 5J and 5M) in Westmoreland County, PA. The Aikens 5J and 5M are offsets of its previous Gaut 4IH well. From the previous design, CONSOL made significant improvements in efficiency. The Aikens wells averaged a lateral length of 7,500 on 38.5 days compared to 99 days it took to drill a 7,000 foot lateral on the Gaut well.

As a result of this increased efficiency, the Aikens 5J and 5M wells cost $5.5 million and $4.6 million respectively, which is down 71% from the cost of the Gaut well. Although the expected total capital on these wells is expected to be under $15 million, it is slightly above the previously stated guidance of $12.6 million. The company says the higher cost is related to the increased pumping cost. When asked about the difference between the Gaut and Aikens wells, CONSOL said that its better understanding of the geology combined with increased proppant and switching the blend were the main drivers behind the Aikens' results.

CONSOL has a strong hedge position exiting 2017 and entering into 2018. Currently, the company's 2017 production is 80% hedged. In 2018, thus far, the company has 50% production hedged which it anticipates will be higher by December 2017.

The management team was questioned about its outlook regarding the recent increased cost of pressure pumping. Nicholas J. DeIuliis, CONSOL executive, responded that the company attributes most of the increase in pressure pumping price to inflation. As a result, the company has built a 2% inflation rate into its 2018 spending plan. The company, however, is confident that the increased price will not last too much longer. CONSOL has heard talk of service companies planning to bring more frac crews into the area which would help stabilize the prices.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?