Top Story | Forecast - Production | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Activity | Drilling Program

Continental Unveils 2016 Budget, Rig Counts, Well Plans; Production Slowdown

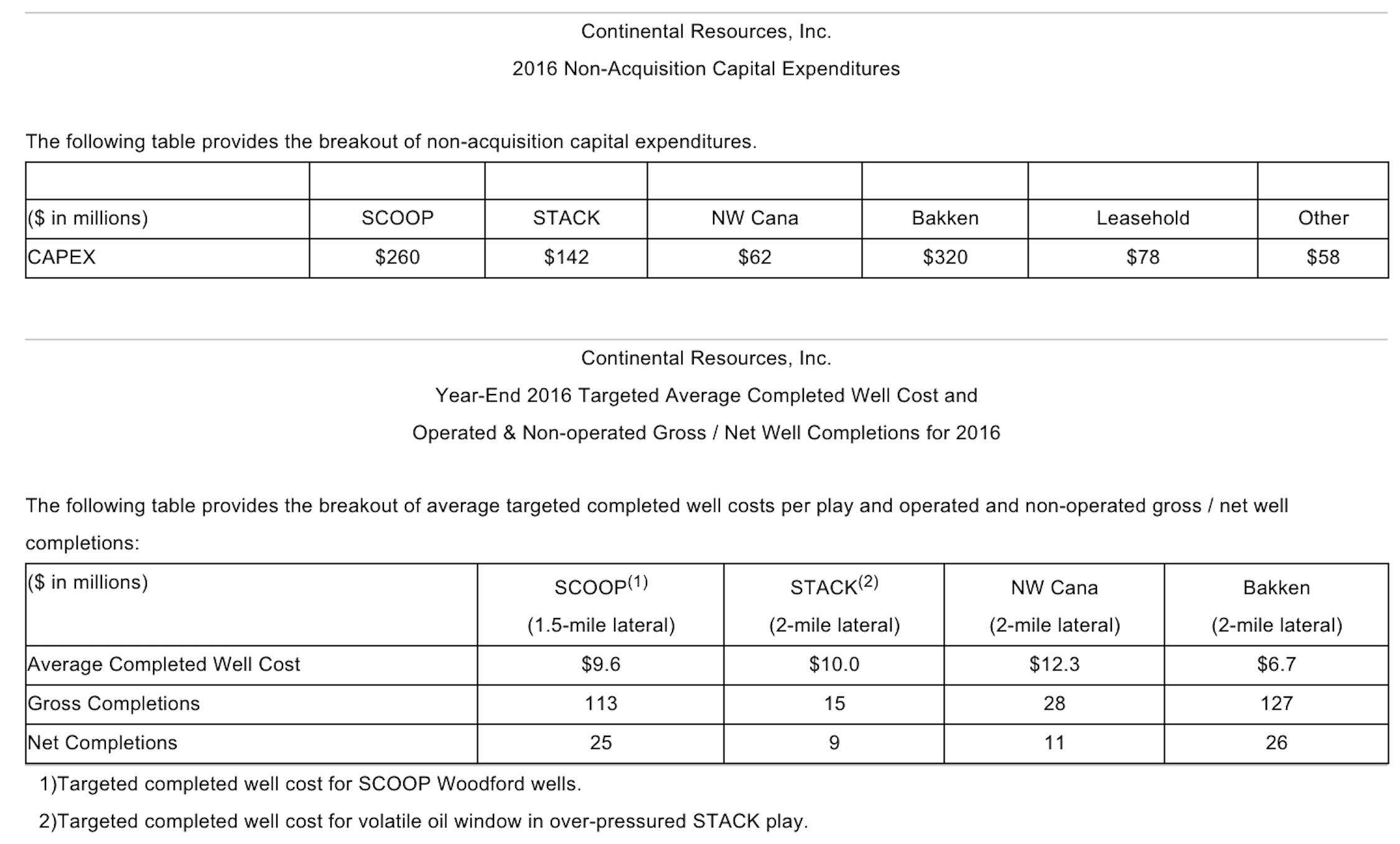

Continental Resources, Inc. announced a budget of $920 million in non-acquisition capital expenditures for 2016, a 66% reduction from 2015's $2.7 billion budget. The Company expects average production of approximately 200,000 barrels of oil equivalent (Boe) per day for 2016.

Key Points:

- $920 Million Capex (excluding acquisition capital)

- 200,000 BOEPD guidance

- 35% allocated to the Bakken

- 28% allocated to the SCOOP

- 15% allocated to the STACK

- 7% allocated to Northwest Cana JDA

- 15% Other

- 19 Rigs

- 71 net wells planned

2016 Capital Expenditures by Play

The Company expects to spend 35% of its 2016 capital expenditures in the North Dakota Bakken and 28% in the SCOOP play in Oklahoma. Other key investment areas will be the STACK play in Oklahoma, with 15% of capital expenditures, and the Northwest Cana Joint Development (JDA) area, with 7% of capital expenditures. The remaining 15% portion of the 2016 budget will target other capital expenditures such as routine leasing and renewals, work-overs, and facilities.

Continental's 2016 capital expenditures budget anticipates an average of 19 operated drilling rigs for the year, with four in the North Dakota Bakken, five to six in SCOOP, five in Northwest Cana JDA, and four to five in STACK. Continental recently decreased its operated rig count from 23 to 19 by dropping four rigs in Bakken, and therefore the current deployment of operated rigs is in line with the expected averages for the 2016 budget.

In terms of wells, the Company expects to complete 71 net operated and non-operated wells in 2016, with 26 in Bakken, 25 in SCOOP, 11 in Northwest Cana JDA and nine in STACK.

Continental plans to defer completing most Bakken wells in 2016, which will increase the drilled but uncompleted inventory from 135 gross DUCs at year-end 2015 to 195 gross DUCs at year-end 2016. This is a high-graded inventory of DUCs, with an average estimated ultimate recovery (EUR) per well of 850,000 Boe.

In Oklahoma, Continental plans to deploy an average of 2.5 completion crews in 2016. The Company ended 2015 with approximately 35 gross DUCs in Oklahoma, and expects to end 2016 with approximately 50 gross DUCs, with an average EUR per well of 1.8 million Boe.

"This high quality DUC inventory represents a significant asset for the Company as prices recover," said Jack Stark.

Harold Hamm, Chairman and Chief Executive Officer for the Company, said: "Continental's 2016 budget confirms our intense focus on cash flow neutrality. Strategically, we are dedicated to preserving the value of our premier assets and building operational efficiencies in preparation for crude oil prices to stabilize and start recovering later this year. Fortunately our lean organization and strong liquidity have us well-positioned to manage through this period until the recovery begins."

The Company currently estimates 2015 actual non-acquisition capital expenditures were approximately $2.5 billion, or approximately $200 million under budget for 2015. Continental expects average production for 2015 to be approximately 221,700 Boe per day, above previously revised guidance. The Company expects to report year-end 2015 total long term debt that is essentially flat with long-term debt at September 30, 2015, up only $7 million quarter over quarter. Continental plans to report full-year 2015 results on February 24, 2016, after the close of market trading.

2016 Guidance Detail

Looking to the current year, the Company expects first quarter 2016 production will be in a range of 210,000 and 220,000 Boe per day and expects to exit 2016 with fourth quarter production between 180,000 and 190,000 Boe per day, reflecting reduced drilling and a lower level of well completion activity. The Company's 2016 production mix is expected to average 60% crude oil and 40% natural gas. Full 2016 guidance is available at the conclusion of this press release.

Non-acquisition capital spending is expected to be approximately $300 million in first quarter 2016, down from an estimated $395 million in the fourth quarter of 2015. By fourth quarter 2016, capital expenditures are expected to decline to approximately $200 million.

The Company estimates its 2016 capital expenditures budget will be cash flow neutral at an average WTI price of $37 per barrel for the full year. At an average WTI price of $40, the Company estimates 2016 results would be cash flow positive in excess of $100 million.

Jack Stark, President and Chief Operating Officer, said: "Our 2016 budget reflects the improved operating efficiencies and well performance we achieved over the past year. These accomplishments are a testament to the quality of Continental's assets and operations, which continue to provide us strategic optionality to deal with the volatility in today's energy market."

Continental has the ability to further reduce discretionary capital expenditures in 2016 if necessary.

John Hart, Senior Vice President and Chief Financial Officer, said: "We will continue to focus our investments in our core operating areas and expect to realize further efficiency gains and cost reductions as we optimize our portfolio. In terms of our budget, each $5 move in WTI prices impacts our full-year cash flow by $150 million to $200 million."

Continental has $1.9 billion in available borrowing capacity under its revolving credit facility. The Company's revolver is unsecured, and there are no terms in the facility that would mandate collateral or a borrowing base calculation coming back into place. The revolver's sole financial covenant is a debt to total capitalization ratio of no greater than 0.65, and as of December 31, 2015, the Company's debt to total capitalization ratio was 0.58, well under the limit. Under the terms of the credit agreement, this calculation of total capitalization specifically excludes any non-cash impairment charges after mid-2014.

Related Categories :

North America News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Bonterra Eneergy Corporation First Quarter 2023 Results

-

Hammerhead Energy Inc. First Quarter 2023 Results

-

Spartan Delta Corp. First Quarter 2023 Results -

-

Empire Petroleum First Quarter 2023 Results

1.jpg&new_width=60&new_height=60&imgsize=false)