Top Story | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Key Wells | IP Rates-24 Hour | Initial Production Rates | Financial Results | Hedging | Capital Markets | Capital Expenditure

EQT's Record-Breaking Utica IP, Marcellus Wells Boost 2Q Results

EQT Corporation has reported its second quarter 2015 results. The company also highlighted the Marcellus as the driving force behind its current operations and strategy.

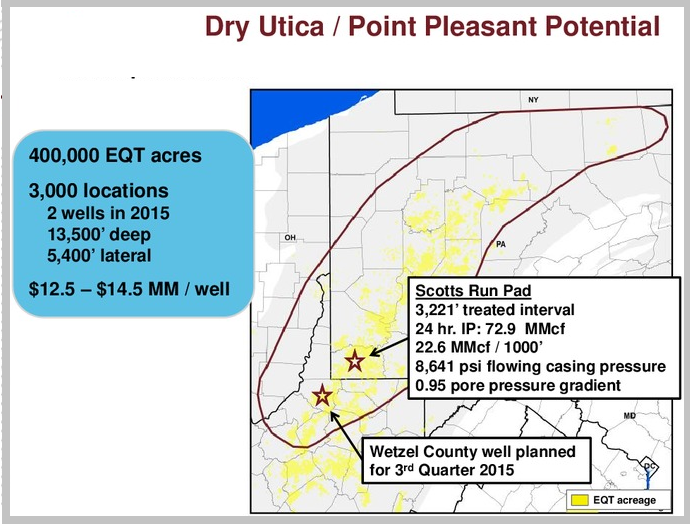

Utica (Dry Gas) Key Well

The company also touted the results of its first dry gas Utica Shale well, which is being touted as the highest reported IP of any Utica well to-date.

Steven T. Schlotterbeck, Executive VP of Exploration and Production, commented: "Last week we successfully completed the fracking of this [Utica] well. The frac was an 18 stage job in a 3,221 foot lateral that utilized ceramic proppant. We were able to successfully place 100% of the planned proppant while maintaining our desired pumping rates.

"Last night we concluded a 24 hour deliverability test to sales of this well. During this test, the well averaged 72.9 million cubic feet per day with an average flowing casing pressure of 8,641 psi. This equates to a 24 hour IP per 1,000 foot of lateral of 22.6 million cubic feet per day. To the best of our knowledge, this is the highest reported IP of any Utica well to-date and the per-foot rate is more than double the previous high. As you might expect, we're very pleased with the results of this well."

Highlights:

- Production sales volume was 34% higher

- Midstream gathering revenue was 35% higher

- Midstream transmission revenue was 19% higher

- Realized natural gas price was 40% lower

- Successful IPO of EQT GP Holdings, LP

- Cash balance of $2 billion (excluding EQM)

- A $1.5 billion undrawn, unsecured revolver

Marcellus update

Marcellus Horizontal Well Status (cumulative since inception):

Marcellus Well Cost

EQT Production

The Company drilled (spud) 48 gross wells during the second quarter 2015, which included 38 Marcellus wells, with an average length-of-pay of 4,865 feet; and 10 Upper Devonian wells, with an average length-of-pay of 5,510 feet.

Adjusted net operating revenue for the quarter (a non-GAAP financial measure) was $206.8 million, which was $123.8 million lower. Operating loss for the second quarter was $66.9 million, including noncash losses on hedges of $25.9 million, compared to operating income of $144.7 million last year, including noncash losses on hedges of $9.5 million.

EQT Production's operating expenses for the quarter were $310.5 million, which was $50.7 million higher than the same period last year and consistent with the significant growth in sales volume. Depreciation, depletion, and amortization (DD&A) was $37.1 million higher. Transportation and processing expenses were $11.2 million higher; exploration expense was $4.0 million higher; and lease operating expense (LOE), excluding production taxes, was $2.8 million higher. However, production taxes were $3.2 million lower resulting from a lower average unhedged price; while selling, general and administrative (SG&A) was $1.2 million lower.

EQT Production achieved sales volume of 147.1 Bcfe in the second quarter 2015, 33.5% higher than the second quarter 2014; however, the increase in revenue from the higher volume was more than offset by a 53% lower average realized sales price compared to the same quarter last year, at $1.41 per Mcfe for the quarter.

Guidance

The Company increased its 2015 guidance for production sales volume to 595 - 605 Bcfe, including liquids volume of 9,000 - 10,000 MBBls. Third quarter volume is estimated at 150 - 155 Bcfe, with liquids of 2,300 - 2,400 MBBls. The Company also expects the average differential to the NYMEX price forecast of negative $0.35 - negative $0.45 per Mcf for 2015; with an average differential to the NYMEX price of negative $0.85 - negative $0.95 per Mcf for the third quarter of 2015.

Hedging

During the quarter, the Company added to its hedge position. The Company's total natural gas production hedge position through 2017 is:

EQT Midstream

EQT Midstream's second quarter 2015 operating income was $108.2 million, 22% higher than the second quarter of 2014. Net operating revenue was $189.4 million, 24% higher than the same period last year. Net gathering revenue was 35% higher at $122.9 million, resulting from a 35% increase in gathered volume. Net transmission revenue increased by 19% to $61.1 million, due to an increase in firm transmission contracted capacity added in the fourth quarter of 2014. Operating expenses for the quarter were $81.2 million, which was $10.6 million higher than the same period last year. Per unit gathering and compression expense decreased by 19% as volume continued to grow faster than expenses.

Guidance

The Company is projecting 2015 midstream earnings before interest, taxes, depreciation, and amortization (EBITDA) between $555 and $575 million.

Realized Price

In the second quarter, the Company's average realized price was $2.36 per Mcfe, 40% lower than the $3.93 per Mcfe realized in the second quarter 2014 - with $1.41 per Mcfe allocated to EQT Production and $0.95 per Mcfe allocated to EQT Midstream.

Financial Results

EQT announced second quarter 2015 net income attributable to EQT of $5.5 million, or $0.04 per diluted share (EPS), compared to second quarter 2014 earnings of $110.9 million, or $0.73 EPS. Adjusted net income for the quarter was $1.1 million, or $0.01 adjusted EPS, compared to adjusted EPS of $0.61 in the second quarter of 2014. Adjusted operating cash flow attributable to EQT was $80.7 million in the second quarter 2015; $202.3 million lower than the same period last year.

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Frac / Completion Crew (s) |

|

|

|

|

| Wells Completed/Frac(net) |

|

|

|

|

| Production Daily Equivalent(mmcfe/d) |

|

|

|

|

Related Categories :

Key Wells

More Key Wells News

-

Kolibri Preps to Drill Three Wells at SCOOP Prospect

-

APA Corp. Strikes Oil Offshore Suriname at Baja-1 Well; Dry Hole at Block 58

-

APA Corp. Hits Pay at Krabdagu Exploration Well Offshore Suriname

-

ExxonMobil, Murphy Come Up Empty at Cutthroat-1 Well Offshore Brazil

-

Matador Resources Fourth Quarter, Full Year 2021 Results

North America News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Bonterra Eneergy Corporation First Quarter 2023 Results

-

Hammerhead Energy Inc. First Quarter 2023 Results

-

Spartan Delta Corp. First Quarter 2023 Results -

-

Baytex Energy Corp. First Quarter 2023 Results