Finance & Investing | Hedging | Capital Markets

Energen Takes Advantage of Price Increase; Add Hedges

They say a bird in the hand is worth two in the bushes. Energen is certainly not taking any chances, the company has seen oil price steadily increase (breaking through the $50/bbl WTI) steadly.

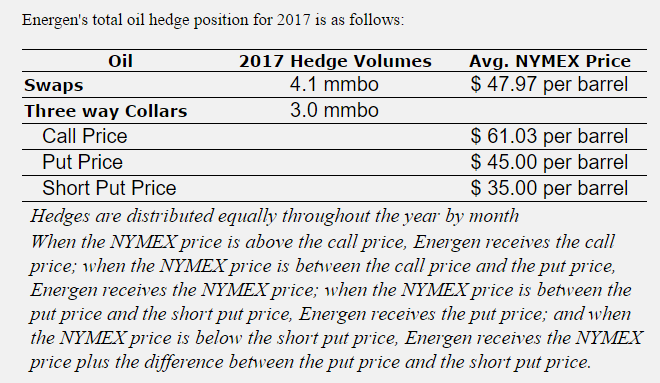

The company is reporting it has recently added swaps for 1.6 million barrels of its 2017 oil production at a average NYMEX of $50.55 per barrel. To provide some upside protection the company also entered into three way collars for $3.0 million barrels of its 2017 oil production at a average call price of $61.03 per barrel, average put price of $45 per barrel and average short put price of $35 per barrel.

The company also has added 7.2 Bcf of Permian Basin-specific contracts to its 2017 natural gas hedge position at an average contract price of $2.85 per Mcf. This brings Energen's total natural gas hedge position in 2017 to 10.8 Bcf of basin-specific gas at an average contract price of $2.82 per Mcf. Assuming a $0.15 per Mcf differential, the company's NYMEX-equivalent price for its 2017 natural gas hedges is $2.97 per Mcf.

Related Categories :

Hedging

More Hedging News

-

Earthstone Energy Talks 2022 Results; Plans Five-Rig Program for 2023

-

Vermilion Energy Inc. Second Quarter 2022 Results

-

Crescent Energy Co. Second Quarter 2022 Results

-

Murphy Oil Second Quarter 2022 Results

-

Silverbow Resources Second Quarter 2022 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -