Quarterly / Earnings Reports | Production | Third Quarter (3Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

Epsilon Maintains Marcellus Drilling Furlough

Epsilon Energy reported third quarter 2016 financial and operating results.

Key Points:

- No wells drilled during Q3 - Seven gross wells awaiting completion

- 33 MMcf/d in Marcellus production (an increase of 50% YOY (produced 22 MMcf/d in Q3 2015)).

Highlights:

- EBITDA of $3.4 million for the quarter of which Upstream EBITDA of $1.3 million and Midstream EBITDA of $2.1 million for the quarter.

- Marcellus working interest (WI) gas averaged 33 MMcf/d for the third quarter of 2016. Working interest gas production as of this release is approximately 36 MMcf/d.

- Gathered and delivered 25 Bcfe gross (8.7 Bcfe net to Epsilon’s interest) during the quarter, or 270 MMcfe/d through the Auburn System which represents approximately 75% of the maximum throughput. Current system throughput as of this release is 235 MMcfe/d.

- Auburn Gas gathering and compression services included third party gas of 1.5 Bcfe during the quarter or approximately 16 MMcf/d.

Capital Expenditures

Epsilon’s total capital expenditures were $0.1 million for the three months ended September 30, 2016. All capital was allocated to the ongoing build-out and maintenance of the Auburn Gas Gathering system.

Epsilon’s 2016 capital forecast for the remainder of the year is $0.2 million allocated to ongoing build-out and maintenance of the Auburn Gas Gathering system.

Marcellus Operational Guidance

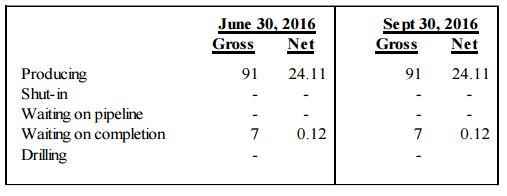

The Operator did not drill or propose any new wells during the quarter. The table below details Epsilon’s well development status at September 30, 2016:

Epsilon has not received any well proposals from the Operator subsequent to quarter end.

Third Quarter Results

Epsilon generated revenues of $5.9 million for the three months ended September 30, 2016 compared to $5.4 million for the three months ended September 30, 2015. The Company’s Upstream Marcellus net revenue interest production was 2.6 Bcfe in the third quarter.

Realized natural gas prices averaged $1.26 per Mcf in the third quarter of 2016. Operating expenses for Marcellus Upstream operations in the third quarter were $1.5 million.

The Auburn Gas Gathering system delivered 24.8 Bcfe of natural gas during the quarter as compared to 22.2 Bcfe during the second quarter of 2016. Primary gathering volumes were flat quarter over quarter at 13.3 Bcfe. Imported cross-flow volumes increased 28.7% to 11.6 Bcfe primarily as a result of adjacent system operators responding to improving natural gas prices.

Epsilon reported net after tax loss of $0.7 million attributable to common shareholders or ($0.01) per basic and diluted common shares outstanding for the three months ended September 30, 2016, compared to net loss of $7.6 million, and ($0.16) per basic and diluted common shares outstanding for the three months ended September 30, 2015.

For the three months ended September 30, 2016, Epsilon’s Adjusted Earnings Before Interest, Income Taxes, Depreciation, Amortization was $3.4 million as compared to $2.8 million for the three months ended September 30, 2015. The increase in Adjusted EBITDA was primarily due to increased production and higher natural gas prices.

Related Categories :

Drilling Activity

More Drilling Activity News

-

Chevron Fourth Quarter, Full Year 2022 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

-

Coterra Energy Third Quarter 2022 Results

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?