Exploration & Appraisals | Key Wells | Production Rates | Drilling Program - Wells | Drilling Activity | Drilling Program

Geopark Oil Production Up From Colombian Drilling

GeoPark Limited operational update for the three-month period ended September 30, 2016.

All figures are expressed in US Dollars.

Production

- Oil and gas production up 15% to 22,070 boepd

- Oil production up 15% to 16,942 bopd

- Gas production up 13% to 30.8 mmcfpd

- Consolidated exit production targeting increase to approximately 23,500-24,500 boepd at the end of 4Q2016

Exploration / Drilling

- Successful exploration, appraisal and development drilling in Tigana/Jacana oil field trend in Llanos 34 Block (GeoPark operated with 45% WI) in Colombia

Jacana 3, 4 and 5 wells drilled, tested and put on production with currently 7,200 bopd gross production, with Jacana 5 appraisal well extending the northwest limits of the field - Jacana 6 appraisal well currently being drilled to test southwest extension of the field

- Completion and testing of Tigana 4 development well currently underway

- Increased drilling program and expected production in Q4 2016

- 2-3 additional wells expected to be drilled in Llanos 34 Block (GeoPark operated with 45% WI) before year end

Oil and Gas Production Update

Consolidated:

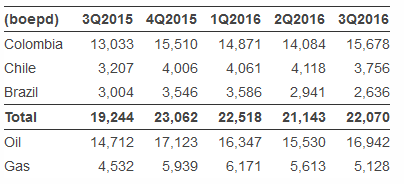

Oil and gas production increased 15% to 22,070 boepd in Q3 2016 compared to 19,244 boepd in Q3 2015.

The increase was mainly attributed to higher production in Colombia (production from Jacana Field - discovered in 3Q2015 - with three new wells put into production during 3Q2016) and Chile (increased gas production from the Ache Field - put into production in 3Q2015), partially offset by lower gas production in the Manati Field, due to lower gas consumption in northeastern Brazil.

Compared to 2Q2016, increased production in Colombia (+11%), partially compensated by lower production both in Brazil (-10%) and Chile (-9%).

Production mix showed a slight increase in oil weight to 77% of total reported production in 3Q2016 (vs. 73% in 2Q2016) explained by the successful drilling campaign in Llanos 34 Block (GeoPark operated with 45% WI) in 3Q2016.

Colombia:

Average net production in Colombia increased 20% to 15,678 boepd in 3Q2016 compared to 13,033 boepd in 3Q2015, primarily attributed to the Jacana Field; discovered in 3Q2015 and with three new wells drilled and put into production during 3Q2016.

By the end of the 2Q2016, GeoPark resumed drilling activities in the Llanos 34 Block (GeoPark operated with 45% WI) with the following results:

Jacana 3 and 5 appraisal wells were drilled and completed in early July and August 2016, to a total depth of approximately 11,000-11,400 feet and tested hydrocarbons in the Guadalupe formation without identifying the oil-water contact. Jacana 5 appraisal well extended the northwest limits of the field

Jacana 4 development well was drilled and completed during the same period to a total depth of 10,370 feet and is on production

These wells are currently producing 7,200 bopd gross, with a 1% water cut

GeoPark expects to continue exploring and appraising the Tigana/Jacana oil field trend to determine the full extent of the oil accumulation.

GeoPark has begun completing and testing the Tigana 4 development well. In addition, the Jacana 6 appraisal well is currently being drilled with the purpose of evaluating the southwest extension of the field. Following the Jacana 6 well, GeoPark plans to drill approximately 2-3 additional wells on the Llanos 34 Block (GeoPark operated with 45% WI), as part of its risk balanced and fully funded 2016 work program.

The Llanos 34 Block represented 94% of GeoPark’s Colombian production in 3Q2016.

With regards to drilling activities in non-operated blocks, the operator plans to drill an exploration well in Llanos 32 Block (GeoPark non-operated with 10% WI) during 4Q2016.

Chile:

Average net oil and gas production in Chile increased by 17% to 3,756 boepd in 3Q2016 compared to 3,207 boepd in 3Q2015. This increase consists of 64% higher gas production, due to new production coming from the Ache Field (gas treatment facility put on stream by the end of 3Q2015) and the Pampa Larga 16 well (drilled in early 1Q2016) in the Fell Block (GeoPark operated with a 100% WI), and 24% lower oil production, due to natural decline of the fields and no new oil drilling activity since 2014.

Compared to 3Q2015, the increased gas production represented an increase in the overall Chilean production mix from 47% to 66% in 3Q2016.

The Fell Block (GeoPark operated with a 100% WI) represented 99% of GeoPark’s Chilean production. No drilling activity is expected in Chile during 4Q2016.

Brazil:

Average net oil and gas production in Brazil decreased 12% to 2,636 boepd in 3Q2016 compared to 3,004 boepd in 3Q2015, primarily attributed to lower gas consumption.

Manati Field production capacity remained unaffected and it is expected to continue at levels of 2,600-2,900 boepd until the end of 2016. On a yearly basis, production is expected to average 3,000 boepd.

The Manati Field (GeoPark non-operated with a 10% WI) represented 100% of GeoPark’s Brazilian production. No drilling activity is expected in Brazil during 4Q2016 with regards to GeoPark’s exploration blocks.

Argentina:

Ongoing exploration activity in Puelen Block (GeoPark non-operated with 18% WI) in Neuquen Basin, with the ongoing acquisition and processing of 200 km2 of 3D seismic on an attractive heavy oil and shallow exploration play. GeoPark expects to re-start drilling in Argentina during 1H2017.

Related Categories :

Production Rates

More Production Rates News

-

Ranger/Penn Virginia Provides Production Update -

-

Apache Reports Prelim 1Q'21 Data; Production Down Signifcantly

-

Ring Energy Progresses Drilling Ops at Permian NWS Project

-

Devon Sells Wind River/CO2 Oil Asset; Production Update

-

Ovintiv IDs 2021 Budget; Talks Preliminary Q4, Full Year 2020 Results

Latin America News >>>

-

Hess Corporation First Quarter 2023 Results -

-

Shell Fourth Quarter, Full Year 2022 Results -

-

Shell CEO van Beurden to Step Down; Wael Sawan Tapped as Successor -

-

APA Corp. Strikes Oil Offshore Suriname at Baja-1 Well; Dry Hole at Block 58 -

-

GeoPark Limited Second Quarter 2022 Results -