Forecast - Production | Hedging | Capital Markets | Capital Expenditure | Drilling Program

Halcon Slashes 2015 Budget In Half Again; Bakken, Eagle Ford

Halcón Resources Corporation announced additional reductions to its 2015 drilling and completion budget.

Current Budget January 2015

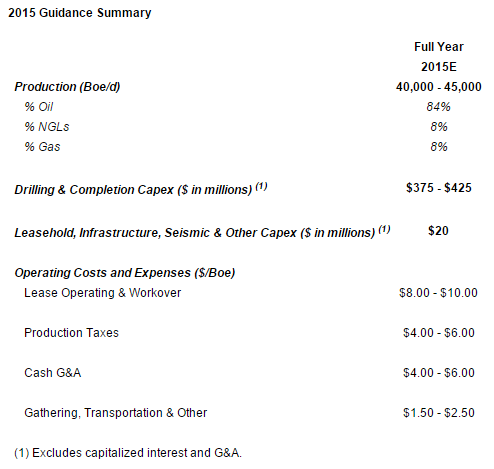

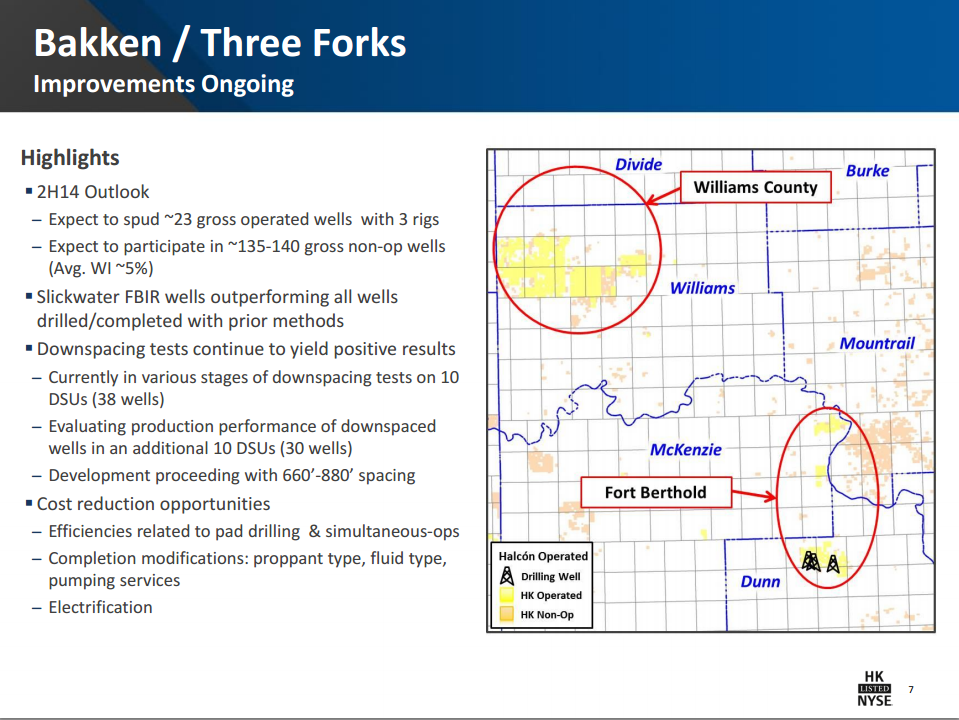

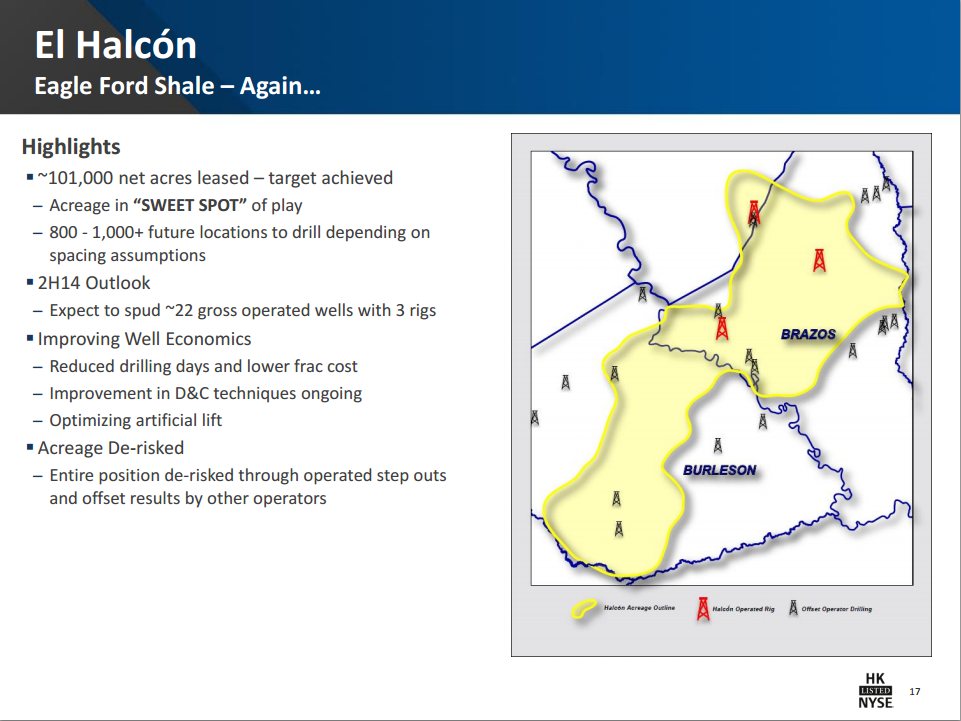

Halcón's drilling and completions budget for 2015 is $375 - 425 million. Capital will be directed towards locations in the Fort Berthold area of theWilliston Basin and El Halcón in East Texas. In addition, the Company expects to spend approximately $20 million on leasehold, infrastructure, seismic and other in 2015.

Halcón is planning to operate an average of two rigs in the Fort Berthold area and one rig in El Halcón in 2015. The Company does not anticipate any meaningful lease expirations despite this reduced rig count.

The Company expects to produce an average of 40,000 - 45,000 barrels of oil equivalent per day (Boe/d) in 2015.

Previous Budget November 2014

Back in November the company had inititally set a budget of 6 rigs and $700-800 million. The company also said " Despite the reduced capital budget, the Williston Basin and El Halcon assets are expected to drive year-over-year pro forma production growth of 15% to 20% in 2015."

Hedging Strategy

Halcón is significantly hedged throughout 2015 and into 2016. Based on the midpoint of the aforementioned 2015 production guidance range, the Company is approximately 88% hedged on its estimated oil volumes at a weighted average price of $87.29/Bbl and approximately 86% hedged on its estimated natural gas volumes at a weighted average price of $4.00/MMBtu.

Floyd C. Wilson, Chairman and Chief Executive Officer, commented, "Our plan is to deploy capital to assets where results indicate EURs and initial production rates higher than our published type curves. We are comfortable with our current liquidity position and we expect our strong hedge portfolio to continue generating income well into 2016. Although we are significantly hedged, the continued weakness in crude oil prices, combined with elevated service costs, calls for conservative planning. We expect to see these costs come down dramatically during 2015."

Bakken / Williston Basin & East Texas Eagle Ford Assets

Source : Halcon Resource November 2014 Presentation

Source : Halcon Resources November 2014 Presentation

Related Categories :

Gulf Coast - South Texas News >>>

-

Empire Petroleum First Quarter 2023 Results

-

Vitesse Energy, Inc. First Quarter 2023 Results -

-

Exxon Mobil First Quarter 2023 Results -

-

ExxonMobil Fourth Quarter, Full Year 2022 Results -

-

ConocoPhillips Fourth Quarter, Full Year 2022 Results; IDs $11B 2023 Capex -

Williston Basin News >>>

-

EOG Resources Q4, Full Year 2022 Results; IDs $6.0B Budget for 2023

-

Northern Oil Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Chesapeake Energy Q4, Full Year 2022 Results; IDs $1.8B 2023 Capex

19.jpg&new_width=60&new_height=60&imgsize=false)

-

Enerplus Corp. Q4, Full Year 2022 Results; Bets Big on Bakken for 2023

-

Hess Increases Capex + 42%; Bakken Development Up +40% -