Exploration & Production | Production Rates | Forecast - Production | Capital Markets | Capital Expenditure

Kelt Exploration Moves Capex Downward

Kelt Exploration Ltd. has released its 2014 production results and has updated its 2014 and 2015 financial and operating guidance.

The Company expects to release a summary of its December 31, 2014 engineering reserve evaluation on February 10, 2015 and its audited year-end financial results on March 10, 2015.

The oil and gas industry around the world is currently facing a challenging environment after the recent precipitous decline in global crude oil prices. Due to market instability and volatile commodity prices, many oil and gas companies are reducing their 2015 capital spending plans. Ultimately, lower capital investment in oil and gas drilling can be expected to balance the supply and demand ratio. Kelt believes that the current business environment creates opportunities to add value at a reasonable cost. As a result, the Company has adjusted its 2015 capital spending program in order to create further financial flexibility to take advantage of opportunities as they arise. Kelt continues to remain optimistic about the long-term outlook for oil and gas producers.

2014 Highlights:

- 2014 average daily production was approximately 12,700 BOE per day, compared to previous guidance of 12,600 BOE per day;

- Fourth quarter 2014 average daily production was approximately 15,300 BOE per day and based on field estimates, average daily production for the month of December 2014 exceeded 16,500 BOE per day;

- Capital expenditures in 2014 are estimated to be approximately $426 million, compared to previous guidance of $428 million. Included in the 2014 estimated capital expenditures is a $10.6 million "tuck-in" acquisition of land, facilities and production of approximately 450 BOE per day, completed in late December 2014 in the Company's Inga/Fireweed core area;

- Bank debt, net of working capital as at December 31, 2014 is estimated to be approximately $108 million, compared to previous guidance of $111 million; and

- Kelt's current credit facility allows for borrowings of $235 million, leaving the Company with significant unused bank lines as at December 31, 2014.

2015 Guidance:

- Capital expenditures for 2015 have been reduced to $152 million from the Company's previous budget of $215 million;

- Commodity price forecasts for 2015 have also been reduced:

- WTI crude oil is estimated to average US$59.50 per barrel, down 25% from our previous estimate of US$79.50 per barrel;

- AECO natural gas is estimated to average $3.10 per GJ, down 10% from our previous estimate of $3.45 per GJ;

- Despite a 29% reduction in forecasted capital expenditures, estimated average daily production for 2015 has been lowered by only 3% to 16,600 BOE per day compared to previous guidance of 17,200 BOE per day; and

- Bank debt, net of working capital as at December 31, 2015 is forecasted to be approximately $172 million, compared to previous guidance of $190 million.

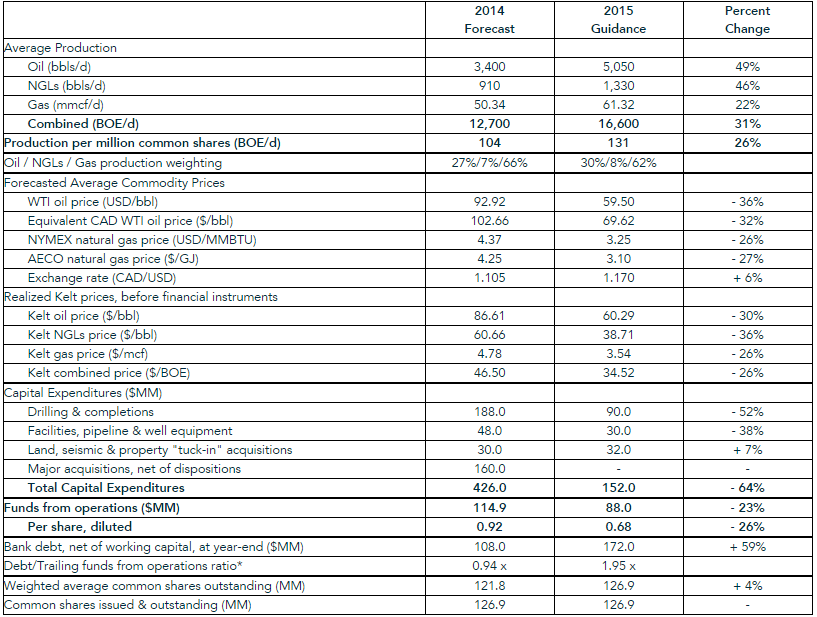

Updated 2015 financial and operating guidance with comparisons to the Company's 2014 forecast is summarized in the following table:

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)