Reserves | Production Rates | Capital Markets | Capital Expenditure

Kelt Increases Proved Reserves by 52% in 2015; 150.5 MMBOE

Kelt Exploration Ltd. reported its reserves and operating results for the year ended December 31, 2015.

Key Points:

- At December 31, 2015, Kelt’s proved plus probable reserves were 150.5 million BOE, up 52% from 99.1 million BOE at December 31, 2014.

- Average production for the fourth quarter of 2015 was 20,086 BOE per day, up 29% from average production of 15,559 BOE per day in the fourth quarter of 2014.

Kelt’s audit of its 2015 annual consolidated financial statements has not been completed and accordingly all financial amounts relating to 2015 referred to in this news release are unaudited and represent management’s estimates. Readers are advised that these financial estimates are subject to audit and may be subject to change as a result.

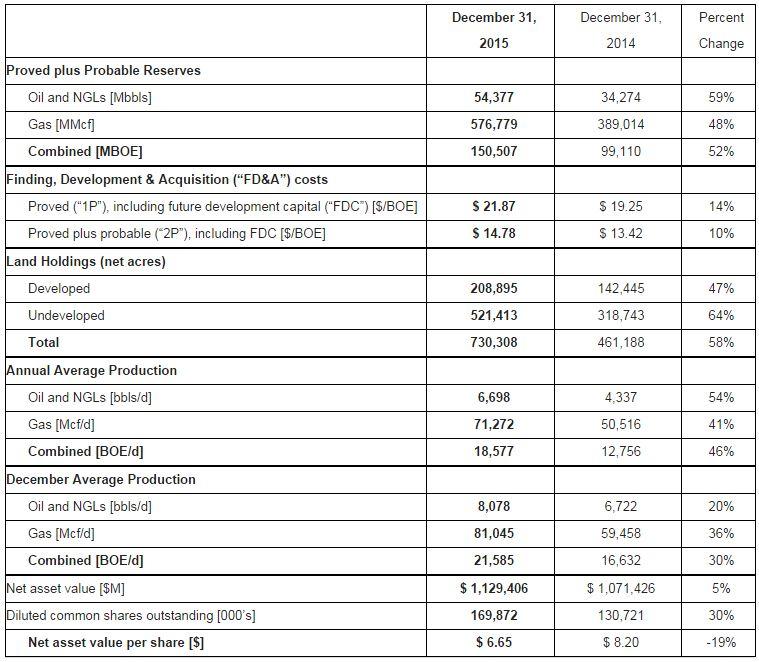

A summary of the results is as follows:

Production

Kelt achieved record production levels in 2015. Average production for 2015 was 18,577 BOE per day, up 46% from average production of 12,756 BOE per day in 2014. Production per million shares was 120 BOE per day, up 14% from 105 BOE per day in 2014. Production for 2015 was weighted 36% oil and NGLs and 64% gas.

Average production for the fourth quarter of 2015 was 20,086 BOE per day, up 29% from average production of 15,559 BOE per day in the fourth quarter of 2014. Production for the fourth quarter of 2015 was weighted 35% oil and NGLs and 65% gas. The Company showed significant year-over-year growth in fourth quarter production despite having approximately 1,862 BOE per day of average production downtime during the three months ended December 31, 2015 as a result of third party pipeline restrictions (accounting for approximately 89% of total downtime) and facility related outages. In order to strengthen the Company’s access to alternative gas markets and to reduce the risk of future production downtime, Kelt entered into transportation agreements on the Alliance pipeline, tapping into Chicago gas markets effective December 1, 2015.

Reserves

Kelt retained Sproule Associates Limited, an independent qualified reserve evaluator to prepare a report on its oil and gas reserves. The Company has a Reserves Committee which oversees the selection, qualifications and reporting procedures of the independent qualified reserves evaluator. Reserves as at December 31, 2015 were determined using the guidelines and definitions set out under National Instrument 51-101.

At December 31, 2015, Kelt’s proved plus probable reserves were 150.5 million BOE, up 52% from 99.1 million BOE at December 31, 2014. The Company’s net present value of proved plus probable reserves at December 31, 2015, discounted at 10% before tax, was $1.2 billion, relatively unchanged from $1.1 billion at December 31, 2014, despite significant reductions in commodity prices year-over-year. Sproule’s forecasted commodity prices for 2016 used to determine the present value of the Company’s reserves at December 31, 2015, are US$45.00/bbl for WTI oil and $2.13/GJ for AECO gas.

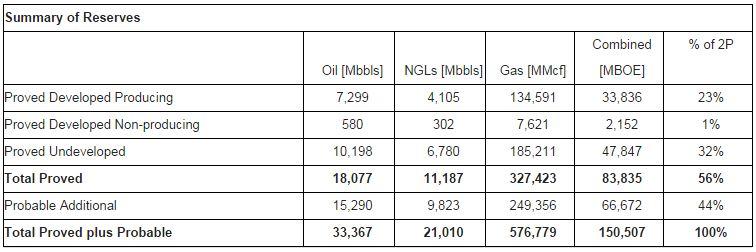

The following table outlines a summary of the Company’s reserves at December 31, 2015:

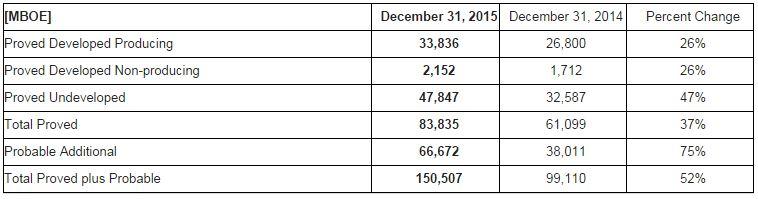

Proved developed producing reserves at December 31, 2015 were 33.8 million BOE, an increase of 26% from 26.8 million BOE at December 31, 2014. Total proved reserves at December 31, 2015 were 83.8 million BOE, up 37% from 61.1 million BOE at December 31, 2014. Proved plus probable reserves at December 31, 2015 were 150.5 million BOE, an increase of 52% from 99.1 million BOE at December 31, 2014.

The following table shows the change in reserves year-over-year by category:

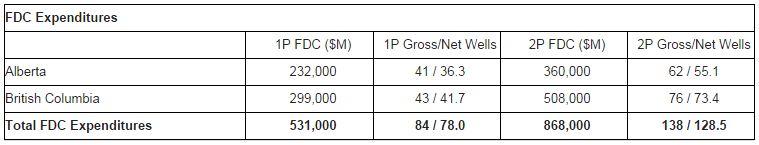

Future development capital expenditures of $531 million are included in the reserve evaluation for total proved reserves and are expected to be spent as follows: $40 million in 2016, $125 million in 2017, $106 million in 2018, $113 million in 2019, and $147 million thereafter. FDC expenditures of $868 million are included for proved plus probable reserves and are expected to be spent as follows: $63 million in 2016, $183 million in 2017, $169 million in 2018, $168 million in 2019 and $285 million thereafter.

The following table outlines FDC expenditures and future wells to be drilled by province, included in the December 31, 2015 reserve evaluation:

The WTI oil price during the years 2013 to 2015 averaged US$79.93 per barrel. After a precipitous decline since December 2014, Sproule is forecasting an average WTI oil price of US$45.00 per barrel in 2016. Natural gas prices during the 2013 to 2015 period at AECO-C averaged $3.27 per GJ. Sproule is forecasting an average AECO-C gas price of $2.13 per GJ in 2016.

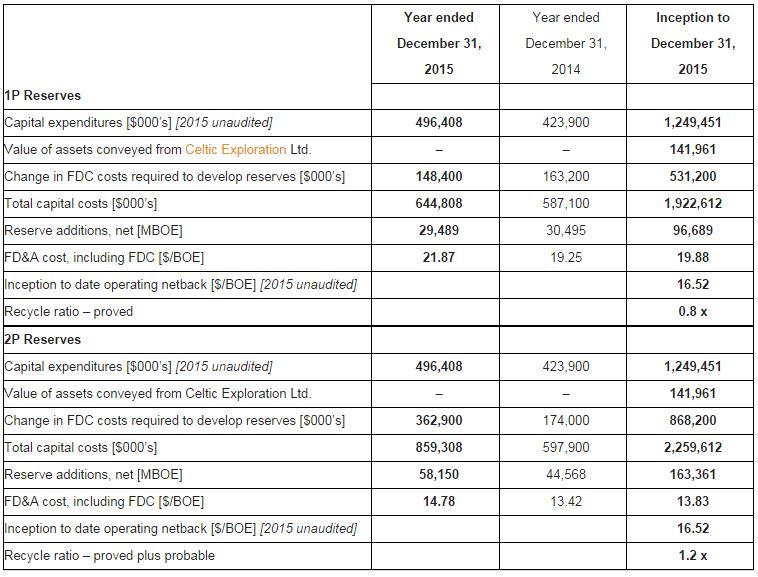

During 2015, the Company’s capital expenditures, net of dispositions, resulted in proved plus probable reserve additions of 58.2 million BOE, resulting in 2P FD&A costs of $14.78 per BOE, including FDC costs. Proved reserve additions in 2015 were 29.5 million BOE, resulting in 1P FD&A costs of $21.87 per BOE, including FDC costs. The Company considers this to be a good result considering the significant amount of undeveloped land that was acquired on the Company’s Montney plays, in addition to the large infrastructure build conducted in 2015.

The recycle ratio is a measure for evaluating the effectiveness of a company’s re-investment program. The ratio measures the efficiency of capital investment. It accomplishes this by comparing the operating netback per BOE to the same period’s reserve FD&A cost per BOE. Since inception, Kelt has successfully added high quality reserves at an all-in 2P FD&A cost of $13.83 per BOE. Since inception, corporate operating netbacks have averaged $16.52 per BOE, giving the Company an inception to date recycle ratio of 1.2 times. With the purchase and construction of facilities and infrastructure in 2015, along with land and asset acquisitions during the year, Kelt has positioned itself to achieve high efficiencies in production additions and finding and development costs over the upcoming years.

Kelt’s 2015 capital investment program resulted in net reserve additions that replaced 2015 production by a factor of 4.4 times on a proved basis and 8.6 times on a proved plus probable basis.

The following table provides detailed calculations relating to FD&A costs for 2015 and 2014:

Related Categories :

Reserves

More Reserves News

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Coterra Energy Q4, Full Year 2022 Results; 2023 Plans

-

Civitas Resources Q4, Full Year 2022 Results; 2023 Capital Plans

-

Coterra Energy Third Quarter 2022 Results

Canada News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)

-

Rubellite Energy Inc. First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)