Exploration & Production | Production Rates | Forecast - Production | Capital Markets | Capital Expenditure

Painted Pony 3Q Update, Production Up 55%

Painted Pony Petroleum Ltd. has announced a recent acquisition of northeast British Columbia Montney land and third quarter 2014 financial and operating results from its Montney natural gas growth initiatives.

Current and third quarter 2014 highlights include:

- Acquisition at a recent Crown land sale of 14.5 sections (100% working interest) northeast BC Montney lands, directly contiguous to the Corporation's premium liquids-rich natural gas project in the Townsend area;

- Entry into a 15-year Strategic Alliance with AltaGas for processing infrastructure and marketing services, including the construction of a 198 MMcf/d natural gas processing facility in the Corporation's Townsend area that is expected to commence operations by the end of 2015; and

- Closing of the sale of the Corporation's southeast Saskatchewan crude oil assets for approximately $100 million.

- Financial and operational highlights for the third quarter of 2014 versus the third quarter of 2013 include:

- 60% increase in average production volumes to 14,283 boe/d (53% increase per share);

- 105% increase in natural gas liquids production to 964 bbls/d;

- 29% reduction in operating costs per boe to $6.75;

- 26% reduction in general and administrative costs per boe to $1.46;

- $63.4 million of positive working capital.

Northeast BC Montney Land Acquisition

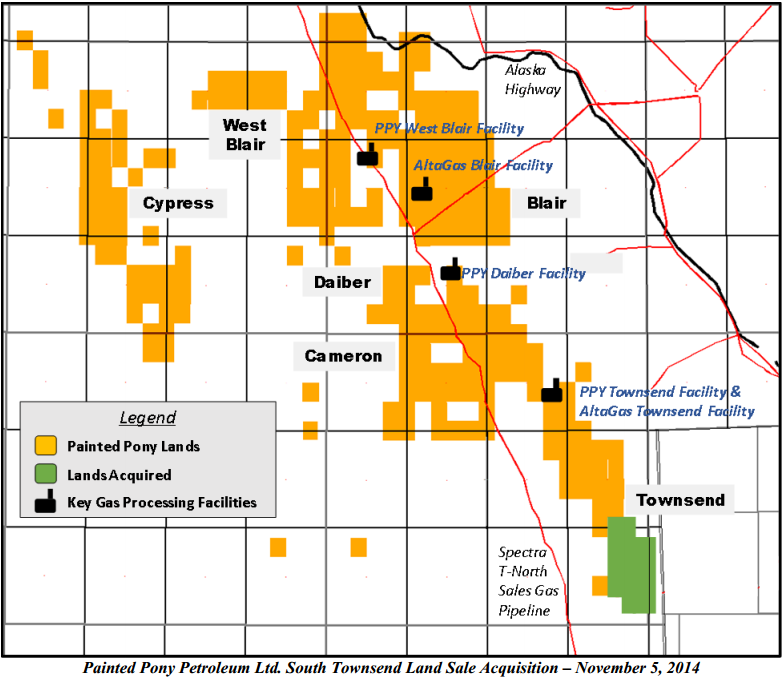

At the November 5, 2014 British Columbia Crown land sale Painted Pony acquired 14.5 sections of 100% working interest prospective Montney land for $66.8 million. The land acquired consists of 3,710 hectares or 9,275 acres immediately adjacent to Painted Pony's liquids-rich Montney natural gas project in the Townsend area of northeast British Columbia. As there are limited opportunities to acquire Crown land in this area, this was a strategic land acquisition for the Corporation. This acquisition increases Painted Pony's land base in the Townsend area by 50% and is in close proximity to the AltaGas Ltd. (AltaGas) Townsend gas processing facility that will be built through a strategic alliance between Painted Pony and AltaGas. With this acquisition the Corporation's total Montney land position has expanded by 7% to 217 net sections (76% average working interest).

As shown on the map below, the newly acquired land is directly contiguous to Painted Pony's Townsend area, a "sweet spot" of the northeast BC Montney where the average reservoir thickness is approximately 340 metres (1,100 feet) and the liquids yields are substantially higher than regional averages. The acquired land is expected to add over 170 liquids-rich drilling locations within three prospective intervals of the Montney. The new acreage is believed to exhibit the same over-pressured geological characteristics as the Corporation's existing Townsend block, with wells expected to yield similar liquids recovery of 40 to 80 bbls/MMcf of condensate, propane and butane (C3+). An offsetting land block to the east, consisting of 32.6 sections (8,350 hectares or 20,875 acres), was purchased by a third party at the same Crown land sale for approximately $124 million.

Strategic Alliance with AltaGas

In the third quarter of 2014, as previously announced on August 19, 2014, the Corporation entered into a 15-year strategic alliance with AltaGas for the development of processing infrastructure and marketing services for natural gas and natural gas liquids. The Strategic Alliance is expected to provide for the development of essential liquids-rich gas processing infrastructure in northeast BC and provide preferred access to international energy markets for the Corporation's Montney production. In the first phase of the Strategic Alliance, AltaGas will construct and operate a 198 MMcf/d shallow-cut gas processing facility (the "AltaGas Townsend Facility") on the Montney resource play, of which the Corporation will maintain the right to a minimum of 150 MMcf/d of firm capacity. Engineering work, application preparations and field lease construction for the AltaGas Townsend Facility began in the third quarter of 2014.

The Corporation also closed a private placement of common shares with AltaGas for total cash consideration of approximately $50 million. The proceeds from this transaction further strengthened the Corporation's balance sheet in support of execution of the five-year plan.

Disposition of Saskatchewan Assets

On July 30, 2014 the Corporation closed the sale of its southeast Saskatchewan assets, with an effective date of June 1, 2014, for total cash consideration of $100 million, subject to adjustments. The Corporation used the proceeds of the disposition in its high return Montney initiatives, further supporting the five-year plan by focusing the Corporation as a pure-play Montney natural gas and natural gas liquids producer on a go forward basis.

Third Quarter 2014 Financial and Operational Results

Production

- Average production volumes for the third quarter of 2014 reached 14,283 boe/d, weighted 91% to natural gas, representing an increase of 60% over third quarter 2013 average production of 8,925 boe/d (83% natural gas).

- Natural gas liquids volumes for the third quarter of 2014 averaged 964 bbls/d, representing an increase of 105% over the third quarter of 2013 average natural gas liquids production of 470 bbls/d. This is despite third quarter production being negatively impacted by unscheduled facility outages.

Funds Flow and Netbacks

- During the third quarter of 2014, Painted Pony generated funds flow from operations of $23.2 million, which represents a 90% increase over the third quarter of 2013. On a per share basis, Painted Pony generated funds flow from operations of $0.25 per share, an increase of 79% over the third quarter 2013. Similarly, funds flow from operations for the nine months ended September 30, 2014 of $76.3 million ($0.84 per share) was almost double the funds flow from operations for the nine months ended September 30, 2013 of $38.9 million ($0.44 per share). Painted Pony continued to realize excellent field operating netbacks in 2014 as a result of ongoing cost reductions and efficiencies in operations coupled with increased natural gas pricing. Painted Pony realized field operating netbacks of $19.12 per boe or $3.19 per Mcfe for the three months ended September 30, 2014, a 14% improvement over realized field operating netbacks for the comparable period in 2013. Realized natural gas prices for the three months ended September 30, 2014 increased to $4.15 per Mcf, an increase of 41% over the realized natural gas prices for the three months ended September 30, 2013 of $2.95 per Mcf.

Capital Expenditures

- For the nine months ended September 30, 2014, capital expenditures totaled $126.4 million, which included $91.7 million on drilling and completions and $24.5 million on facilities and equipment.

- The Corporation drilled 7 (6.0 net) Montney natural gas wells during the third quarter of 2014, bringing the total for the first nine months of 2014 to 14 (13.0 net) Montney natural gas wells.

- All of the wells drilled in 2014 utilized the industry leading open-hole ball drop completion system. Painted Pony continues to see significant increases in per well production rates due to the implementation of new drilling and industry leading completion technology. This technology includes completing the wells with open-hole ball drop completions, shifting most of the drilling to parallel-pairs, and most recently, moving to shorter stage lengths for fracturing. Although at varying stages of implementation, all three of these techniques have delivered strong improvements in well productivity.

- During the third quarter of 2014, the Corporation initiated expansion of its 50% working interest dry gas facility in the Daiber area (the "Daiber Facility") from its current processing of 25 MMcf/d to 50 MMcf/d. This expansion is expected to be completed by the end of 2014.

- Also in the third quarter of 2014, the Corporation initiated construction of a 25 MMcf/day natural gas compression and dehydration facility in the West Blair area (the "West Blair Facility"). Construction is expected to be completed by the end of 2014.

Operating and G&A Costs

- During the third quarter of 2014, Painted Pony improved its operating and general and administrative costs on a per boe basis. Operating costs were $6.75 per boe for the three months ended September 30, 2014, a 29% reduction from operating costs for the comparable period in 2013 of $9.47 per boe. G&A costs were reduced to $1.46 per boe for the three months ended September 30, 2014, a 26% improvement over G&A costs for the three months ended September 30, 2013 of $1.98 per boe.

Outlook

- Painted Pony continues to expect production volumes for 2014 to average approximately 13,500 boe/d (90% natural gas). This would result in a 55% increase over 2013 average production of 8,693 boe/d. Fourth quarter 2014 average production is expected to be approximately 15,000 boe/d, with 7 (5.5 net) wells currently being completed and an additional 7 (7.0 net) wells ready for completion in early 2015.

- In the fourth quarter of 2014, the Corporation plans to drill 8 (7.5 net) Montney natural gas wells. With respect to facilities, the Corporation anticipates that the expansion of its 50% working interest Daiber Facility will be completed in the fourth quarter of 2014, bringing gross processing capacity to 50 MMcf/d (25 MMcf/d net) and allowing the Corporation to address near-term processing constraints. Engineering work, application preparations and field lease construction for the AltaGas Townsend Facility will be ongoing through the fourth quarter of 2014, targeting a facility start-up by the end of 2015, subject to receipt of the required regulatory approvals.

- Painted Pony will announce its 2015 budget in December. The Corporation is well positioned to execute on its five-year plan to grow production to over 100,000 boe/d by 2018 as a result of a strong balance sheet, the Strategic Alliance with AltaGas, the expanded land position and continued improvements in well results.

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)