Pioneer Natural Resources Company has reported its 2015 reserve report.

2015 Reserves

Pioneer announced that the Company added proved reserves totaling 210 million barrels oil equivalent (MMBOE) during 2015 from discoveries, extensions and technical revisions of previous estimates (excludes negative price revisions of 269 MMBOE and proved reserves added from acquisitions of 1 MMBOE). These drillbit proved reserve additions equate to a drillbit reserve replacement of 273% of Pioneer’s full-year 2015 production of 77 MMBOE, which includes production used for field fuel of 3 MMBOE. The Company’s substantial reserve additions in 2015 are primarily due to (i) the continued successful execution of Pioneer’s horizontal drilling program in the Spraberry/Wolfcamp and (ii) improved performance and reduced costs in the Spraberry/Wolfcamp, Raton and West Panhandle areas. The Company’s drillbit finding and development (F&D) cost was $10.18 per barrel oil equivalent (BOE).

The NYMEX prices used for 2015 proved reserves reporting purposes were $50.11 per barrel for oil and $2.59 per million British thermal units (MMBTU) for gas. The oil price for 2015 was 47% below the oil price used to calculate proved reserves for 2014 of $94.98 per barrel. The gas price for 2015 was 40%, below the gas price used to calculate proved reserves for 2014 of $4.35 per MMBTU. The substantial decrease in the 2015 oil and gas prices, as compared to 2014, led to the negative price revisions of 269 MMBOE across all of Pioneer’s assets. The Company would expect to recover approximately 50% of the negative price revisions if oil and gas prices used to calculate proved reserves improved to $60 per barrel and $3.50 per MMBTU, respectively.

As of December 31, 2015, all of Pioneer’s proved reserves were in the United States, and 89% were proved developed (PD) reserves. Approximately 47% of the Company’s proved reserves are oil, 19% are NGLs and 34% are gas. Pioneer’s proved reserves are long-lived with a total reserves-to-production ratio of nine years and a PD reserves-to-production ratio of eight years.

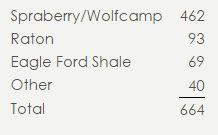

The table below shows Pioneer’s year-end 2015 proved reserves by asset in MMBOE:

Total costs incurred during 2015 were $2.2 billion, which included $2.0 billion for exploration and development spending; $36 million for small bolt-on property acquisitions in the Spraberry/Wolfcamp area; and $163 million for asset retirement obligations, capitalized interest and geological and geophysical G&A. The cost for asset retirement obligations of $102 million was higher than in recent years primarily due to the decline in the 2015 NYMEX pricing used for proved reserves reporting purposes, having the effect of shortening the economic lives of the Company’s wells. This accelerated the timing of when those wells are assumed to be plugged and abandoned, resulting in an increase to the present value of the Company’s future plugging and abandonment obligation.

In 2015, Pioneer added 136 million barrels of proved developed reserves from (i) discoveries and extensions and (ii) transfers from proved undeveloped reserves at year-end 2014, including any revisions associated with those transfers, at a cost of $2.0 billion. This equates to a proved developed F&D cost of $14.96 per BOE.

The commodity prices used to determine proved reserves for 2015 resulted in a pre-tax present value of future net cash flows discounted at 10% (PV-10) of $3.2 billion.

Netherland, Sewell & Associates, Inc., an independent reserve engineering firm, audited the proved reserves of significant fields. The audit covered properties representing 82% of Pioneer’s total proved reserves at year-end 2015.

Related Categories :

Reserves

More Reserves News

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Coterra Energy Q4, Full Year 2022 Results; 2023 Plans

-

Civitas Resources Q4, Full Year 2022 Results; 2023 Capital Plans

-

Coterra Energy Third Quarter 2022 Results

Gulf Coast - South Texas News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

North America News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?