Top Story | Deals - Property For Sale | Deals - Acquisition, Mergers, Divestitures | Financial Trouble | Capital Markets | Private Equity Activity

Quicksilver Auctions Barnett, Delaware Basin Assets

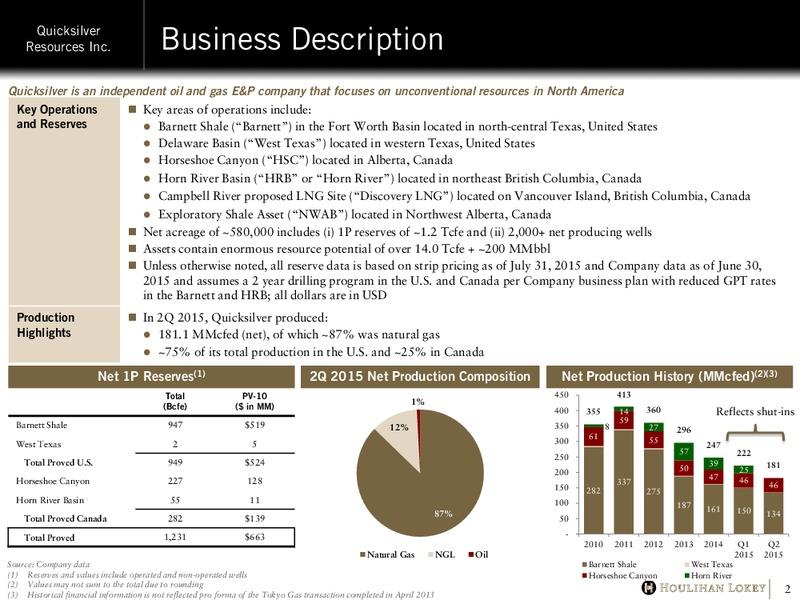

Quicksilver Resources Inc. has successfully completed a Bankruptcy Court-approved auction for their U.S. oil and gas assets located primarily in the Barnett Shale in the Fort Worth basin of North Texas as well as assets in the Delaware basin in West Texas , which are concentrated in Pecos County, Texas and to a lesser extent Crockett and Upton Counties, Texas.

The completion of the auction follows a months-long marketing process of all of Quicksilver's and its U.S. subsidiaries' U.S. assets that began in September 2015 . At the auction, which was held on January 20 and 21, 2016, Quicksilver and its U.S. subsidiaries declared an all-cash bid from BlueStone Natural Resources II, LLC in the amount of $245 million the highest or otherwise best bid for the oil and gas assets, and the successful bid.

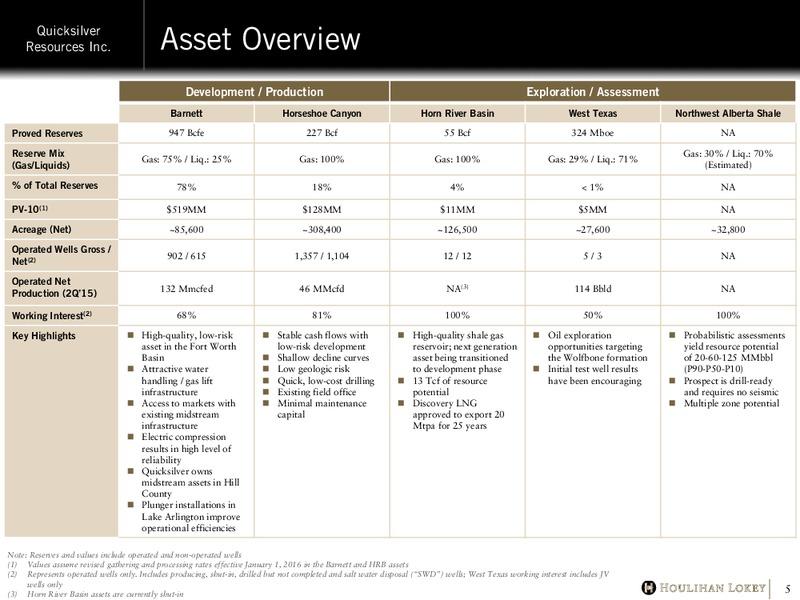

A Look at the Assets:

- Barnett Acreage: 85,600 net

- Reserves: 947 Bcfe

- Delaware Basin Acreage: 27,600 net

- Primary Targets: Wolfcamp, Bone Spring

- Counties: Pecos and Crockett

- Reserves: 324 MBOE

Regarding the outcome of the auction, Glenn Darden , President and CEO of Quicksilver, said, "We believe that the marketing and sales process was thorough and resulted in a successful outcome. This sale maximizes value for the benefit of our creditors in the face of difficult market conditions."

Quicksilver and BlueStone executed the asset purchase agreement for the sale of the oil and gas assets on January 22 , 2016. Quicksilver and its U.S. subsidiaries will seek final approval for the sale from the United States Bankruptcy Court for the District of Delaware on January 27, 2016 . Quicksilver and its U.S. subsidiaries intend to continue normal operations pending the consummation of the sale.

Quicksilver and its U.S. subsidiaries filed voluntary petitions under chapter 11 of title 11 of the United States Code on March 17, 2015 , in the United States Bankruptcy Court for the District of Delaware . The chapter 11 cases are being jointly administered under the case number 15-10585. Quicksilver's Canadian subsidiaries were not included in the chapter 11 filing and are not subject to the requirements of the Bankruptcy Code. The assets of Quicksilver's Canadian subsidiaries are not included in this sale, and the sale process for those assets remains ongoing.

Related Categories :

North America News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?