Exploration & Production | Drilling / Well Results | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Key Wells | IP Rates-30-Day | Production Rates | Initial Production Rates | Forecast - Production

Storm Resources Raising CapEx in 2015

Storm Resources Ltd. has announced its financial and operating results for the three and nine months ended September 30, 2014.

Third Quarter 2014 Highlights

- Production was 7,160 Boe per day (22% oil plus NGL), an increase of 88% from the same period last year and 31% from the previous quarter. On a per-share basis, the year-over-year increase was 31% using common shares outstanding at the end of each period.

- The increase was the result of growth at the Umbach property where third quarter production was 5,823 Boe per day which is 168% higher than a year ago and 46% higher than the previous quarter.

- NGL production was 1,154 barrels per day, a year-over-year increase of 554 Boe per day, or 92%. Increased NGL production was the result of production growth from the liquids-rich Montney formation at Umbach where recovery was 39 barrels per Mmcf sales in the third quarter. With 62% of the NGL mix being condensate plus pentanes, the NGL price of $73.09 per barrel was 75% of the average Edmonton Par light oil price.

- Activity was focused on Storm's 100% working interest lands at Umbach South where three Montney horizontal wells (3.0 net) were drilled, three horizontal wells (2.6 net) were completed, and the new field compression facility was started up ahead of schedule on August 19th.

- To date in 2014, seven horizontal wells (6.6 net) have started producing at Umbach which has resulted in corporate production increasing from 5,068 Boe per day in the first quarter to more than 10,500 Boe per day in October. The new facility at Umbach is full with throughput averaging 25 Mmcf per day since mid-September and there is an inventory of four completed horizontal wells (4.0 net) that will commence production as facility capacity becomes available plus five standing horizontal wells (5.0 net) that are awaiting completion.

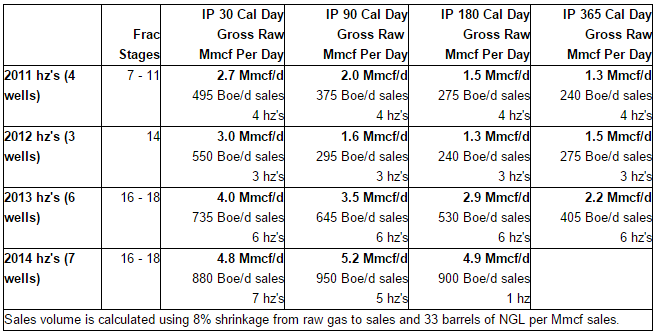

- At Umbach, the five Montney horizontal wells that started production in 2014 with enough history have averaged 5.2 Mmcf per day gross raw gas (950 Boe per day sales) over the first 90 calendar days, a 50% improvement from the average 2013 horizontal well. Notably, over the first 180 calendar days, the first of the 2014 horizontal wells with enough history has averaged 4.9 Mmcf per day (900 Boe per day sales), a 70% improvement from the average 2013 horizontal well.

- The corporate field operating netback, excluding hedging gains or losses, was $20.59 per Boe, an increase of $0.20 per Boe from the previous year. The year-over-year improvement is mainly due to an 8% decrease in operating costs which were $9.53 per Boe.

- Net income was $5.5 million or $0.05 per share, a significant improvement when compared to the loss of $0.02 per share in the previous year.

- Capital investment was $30.4 million with major expenditures being $17.5 million for facilities and pipelines plus $11.5 million for drilling and completions.

- Debt plus working capital deficiency, net of investments, totaled $56.1 million at the end of the quarter which is 1.2 times annualized third quarter cash flow. In November 2014, Storm's banking syndicate increased the revolving bank facility to $130.0 million.

Operations Review

Umbach, Northeast British Columbia

Storm's land position at Umbach is prospective for liquids-rich natural gas from the Montney formation and currently totals 141 net sections (167 gross sections), or 100,000 net acres. To date, the focus has been on exploiting the upper and middle Montney intervals. There are three project areas:

- Umbach South with 88 net sections at a 100% working interest where third quarter production was 4,761 Boe per day;

- Umbach North with 33 net sections of jointly owned lands (59 gross sections with Storm's working interest being 60% on most of the lands) where third quarter production was 1,061 Boe per day;

- Nig with 20 net sections at a 100% working interest.

- Third quarter production from Umbach was 5,823 net Boe per day (19% NGL) with NGL production of 1,099 barrels per day representing a recovery of 39 barrels per Mmcf sales (62% higher priced condensate plus pentanes). Revenue after deducting transportation costs was $34.34 per Boe ($4.34 per Mcf sales and $69.49 per barrel of NGL), royalties were $5.45 per Boe, operating costs were $7.81 per Boe and the operating netback was $21.08 per Boe.

Activity in the third quarter included drilling three Montney horizontal wells (3.0 net), completing three Montney horizontal wells (2.6 net), and commissioning the second field compression facility at Umbach South. To date in 2014, 14 Montney horizontal wells (14.0 net) have been drilled and 11 horizontal wells (10.6 net) have been completed which includes two wells (1.6 net) drilled in 2012 and 2013. Seven (6.6 net) of the completed horizontal wells are producing. There remains an inventory of nine horizontal wells (9.0 net) that have not started production which includes six completed horizontal wells and three standing horizontal wells awaiting completion.

At Umbach South, the first field compression facility is full with throughput averaging 18 Mmcf per day of gross raw gas. The second field compression facility was started up ahead of schedule on August 19, 2014 with the estimated final cost being $15.1 million (8% higher than earlier guidance). Since mid-September, the new facility has been full with throughput averaging 25 Mmcf per day gross raw gas. With nine horizontal wells not yet producing because both facilities are full, expansion of the second facility to 48 Mmcf per day is being moved forward into late March 2015 at an estimated cost of $13.0 million ($3.5 million to purchase equipment in 2014 and the remaining $9.5 million in the first quarter of 2015). In the second quarter of 2015, a condensate stabilizer and other equipment will be installed at the second facility with the estimated cost being $4.9 million.

Given the improvement in horizontal well performance and existing facility capacity constraints, a third field compression facility with initial capacity of 35 Mmcf per day will be constructed in 2015 with start-up planned for October 2015. Cost of the third facility is estimated to be $24.0 million and it will be expandable to 70 Mmcf per day for an additional investment of $7.0 million.

Comparing calendar day rates over the first 90 days, the five 2014 Montney horizontal wells with enough history are 50% better than the average 2013 horizontal well. Following is a comparison of calendar day rates for all of the producing Montney horizontal wells.

Based on the performance of the 2013 and 2014 horizontal wells, Storm management is now using a 5.0 Bcf raw gas type curve for internal budgeting purposes (the previous 4.4 Bcf raw gas type curve was based on performance of the 2013 horizontal wells). Using a 5.0 Bcf raw gas type curve, the first year average rate is 2.9 Mmcf per day gross raw gas or 530 Boe per day sales (8% shrinkage from raw gas to sales and 33 barrels of NGL per Mmcf sales). Based on a cost of $4.9 million to drill, complete, and tie in a horizontal well, the payout is approximately 18 months assuming a flat natural gas price of $3.25 per GJ over the life of a well (see presentation on website for further details). To date in 2014, the cost to drill a horizontal well has averaged $2.2 million with the completion cost averaging $2.3 million. Drilling times have averaged approximately 14 days. Tie-in costs have averaged $0.4 million per horizontal well which doesn't include the cost of longer gathering pipelines to connect multi-well pads to field compression facilities.

Horn River Basin, Northeast British Columbia

Storm has a 100% working interest in 123 sections in the HRB (81,000 net acres) which is prospective for natural gas from the Muskwa, Otter Park and Evie/Klua shales. Third quarter production averaged 318 Boe per day (100% natural gas) at an operating netback of $7.39 per Boe with revenue of $21.67 per Boe, an operating cost of $11.06 per Boe and a royalty of $3.22 per Boe. Production is from one horizontal well with 12 fracture stimulations which currently produces 2.4 Mmcf per day gross raw gas with cumulative production of 4.4 Bcf gross raw gas since start-up in March 2011.

A resource evaluation completed by InSite Petroleum Consultants Ltd., effective December 31, 2011, estimates that the best estimate of DPIIP in the core producing area is 3.1 Tcf gross raw gas with the best estimate of contingent resources being 616 Bcf. The evaluated area includes 30 sections at a 100% working interest and represents 24% of Storm's total land holdings in the HRB. Commerciality has been proven across the core producing area with a horizontal well that has been producing for 41 months plus two vertical wells that were completed and tested with final test rates of 900 Mcf per day over the final 24 hours of each flow test.

Grande Prairie Area, Northwest Alberta and Northeast British Columbia

Production in the third quarter was 1,019 Boe per day (44% oil plus NGL), a year-over-year decline of 22%. The operating netback was $13.71 per Boe with revenue of $42.56 per Boe, an operating cost of $18.18 per Boe and a royalty of $9.90 per Boe. Equipment failures on six wells plus outages at third party facilities reduced production by approximately 170 Boe per day in the quarter and increased the operating cost by $3.70 per Boe. Production in October was approximately 1,200 Boe per day based on field estimates. Cash flow from this area continues to be re-invested to grow production at Umbach.

Hedging Update

Current commodity price hedges for the fourth quarter of 2014 include:

- 12,100 Mcf per day (14,500 GJ per day) of natural gas with an average floor price of approximately $4.07 per Mcf and an average ceiling price of $4.28 per Mcf (AECO monthly index $3.39 per GJ for the floor and $3.57 per GJ for the ceiling);

- 450 barrels per day of oil with an average floor price of WTI Cdn$102.43 per barrel and an average ceiling price of WTI Cdn$104.83 per barrel.

For January to September of 2015, commodity price hedges include:

- 18,000 Mcf per day (21,700 GJ per day) of natural gas with an average floor price of approximately $4.18 per Mcf and an average ceiling price of $4.61 per Mcf (AECO monthly index $3.48 per GJ for floor and $3.84 per GJ for ceiling);

- 533 barrels per day of oil with a price of WTI Cdn$98.43 per barrel.

- The purpose of Storm's commodity price hedges is to reduce the effect of commodity price fluctuations on capital investment and growth over the next 12 months. A maximum of 50% of current production (most recent monthly or quarterly average), before royalties, will be hedged; production growth is not hedged.

Outlook

Production in October was more than 10,500 Boe per day based on field estimates, and fourth quarter production is forecast to be approximately 10,500 Boe per day. Corporate production is expected to increase to approximately 13,500 Boe per day in April 2015 after the new field compression facility at Umbach is expanded to 48 Mmcf per day.

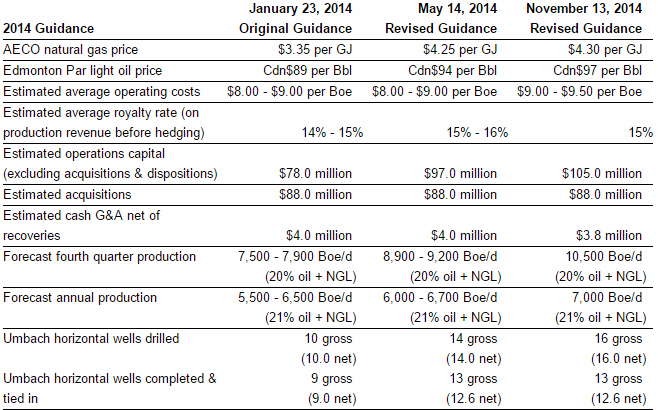

Updated guidance for 2014 is provided below. Forecast fourth quarter production is expected to be 10,500 Boe per day which is higher than previous guidance and represents year-over-year growth of 70% on a per-share basis. Operations capital expenditures will increase by $8.0 million with $3.5 million to purchase equipment to expand the second field compression facility at Umbach and $4.5 million to drill an additional two horizontal wells in December 2014. Total debt at the end of 2014 is forecast to be approximately $59.0 million which would be approximately 0.9 times annualized funds from operations in the fourth quarter of 2014 (assuming commodity prices in the fourth quarter of 2014 are AECO $3.50 per GJ and Edmonton Par Cdn$88.00 per barrel).

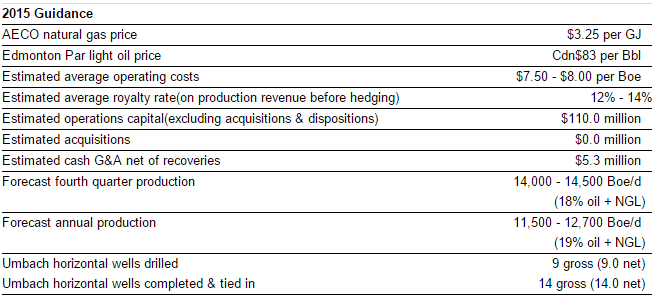

Guidance for 2015 includes operations capital expenditures of $110.0 million with forecast fourth quarter production averaging 14,000 to 14,500 Boe per day (year-over-year growth of 35% on a per-share basis). Forecast annual production of 11,500 to 12,700 Boe per day assumes Umbach South is shut in for approximately 3 weeks during June 2015 for a scheduled maintenance turnaround at the McMahon Gas Plant (reduces production in the second quarter of 2015 to approximately 10,400 Boe per day). At Umbach South, $41.0 million will be invested to further expand infrastructure including $2.5 million for pipelines, $9.5 million to expand the second field compression facility, $4.9 million for a condensate stabilizer plus other equipment at the second field compression facility, and $24.0 million to construct a third field compression facility. Total debt is forecast to be $95.0 to $100.0 million at the end of 2015 which would be approximately 1.2 times annualized funds from operations in the fourth quarter of 2015 (assuming commodity prices in 2015 average AECO $3.25 per GJ and Edmonton Par Cdn$83.00 per barrel).

At Umbach Storm has now drilled 29 horizontal wells (25.4 net) and 16.4 net horizontal wells are on production. The existing field compression facilities are full and there are six completed Montney horizontal wells (6.0 net) which will begin producing as facility capacity becomes available. In addition, three standing Montney horizontal wells (3.0 net) are awaiting completion. With the productivity of horizontal wells continuing to improve, and with the existing facilities forecast to remain full throughout 2015 even after expanding the second facility, the decision was made to add a third, larger field compression facility with initial capacity of 35 Mmcf per day. This results in field compression capacity increasing to 101 Mmcf per day at the end of 2015 and ensures that there will be enough capacity if horizontal well productivity continues to exceed the 5.0 Bcf raw gas type curve used for internal budgeting purposes. The large increase in field compression capacity will also allow for additional Montney horizontal wells to be drilled and completed in 2015 if commodity prices and results are supportive of doing so.

Storm has accumulated a large, higher quality land position at Umbach and approximately one third (47.6 net sections) has been delineated by the 25.4 net horizontal wells that have been drilled to date in the Montney formation. Assuming four horizontal wells per section, there is an inventory of 165.0 net horizontal wells that remain to be drilled. The remaining two thirds of Storm's lands (94.0 net sections) have not yet been tested with horizontal wells, but appear to be highly prospective given results from horizontal wells drilled by other operators on offsetting acreage.

Storm's land position in the HRB continues to be a core, long-term asset with significant leverage to improving natural gas prices.

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)