Operational Updates | Service & Supply | Quarterly / Earnings Reports | Oilfield Services | Third Quarter (3Q) Update | Financial Results | Capital Markets | Private Equity Activity

Triangle Petroleum Tags 1,259 MBOE in 3Q Production

Triangle Petroleum Corporation reported an operational update and reports its third quarter fiscal year 2016 financial results for the three-month period ended October 31, 2015 ("Q3 fiscal 2016" or "Q3 FY 2016").

Third Quarter Highlights for Fiscal Year 2016 (ended October 31, 2015)

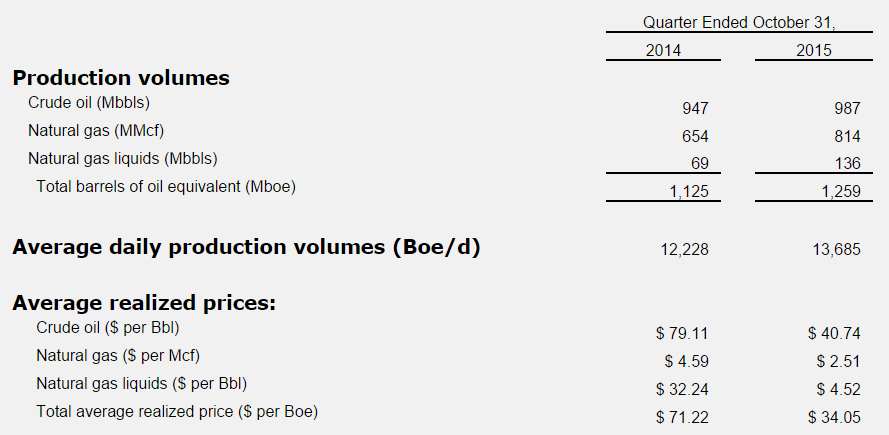

- Quarterly production volumes of ~1,259 Mboe (13,685 Boepd)

- Consolidated cash flow from operations (before working capital changes) of $31.4 million and operating cash flow of $62.2 million

- Consolidated adjusted revenue of $93.0 million including $27.9 million of cash receipts from hedge settlements

- Consolidated adjusted EBITDA of $38.5 million

- $293.0 million of total liquidity as of October 31, 2015 (+2% q/q), including $36.3 million of cash on hand and available borrowing capacity on the Triangle USA Petroleum ("TUSA") and RockPile Energy Services ("RockPile") credit facilities

- TUSA and RockPile reduced debt by $26 million, or ~4%, including the repurchase and retirement of $10 million of face value of TUSA 6.75% Senior Notes and a net reduction in the outstanding balance of the combined TUSA and RockPile credit facilities of $16 million

- TUSA and RockPile in full compliance with all financial covenants of respective credit facilities

- TUSA generated adjusted revenue of $70.7 million in Q3 FY 2016 including $27.9 million of cash receipts from hedge settlements as compared to $80.8 million of comparable revenue in Q3 FY 2015 (-13% y/y)

- TUSA's pre-hedge oil price differential declined ~16% q/q to $4.14/Bbl

- Completed 2 gross (1.7 net) operated wells, maintaining inventory of 18 gross (15.8 net) operated wells waiting on completion as of October 31, 2015

- Latest completion design delivering 15%+ and 25%+ improvement in 60- and 90-day cumulative production, respectively, over analogue offset wells over a broad geographic area

- TUSA's cash operating expenses (LOE, Gathering, Transportation and Processing, production taxes, and G&A) per unit were $17.14/Boe in Q3 FY 2016 compared to $19.64/Boe in Q2 FY 2016 (-13% q/q) and $20.65/Boe in Q3 FY 2015 (-17% y/y)

- RockPile generated $25.8 million of stand-alone revenue in Q3 FY 2016 as compared to $143.5 million in Q3 FY 2015 (-82% y/y)

- RockPile had -$4.0 million of stand-alone EBITDA during the quarter as efforts to reduce operating and input costs were offset by lower utilization

- Completed 27 wells in the quarter including 25 for third parties and 2 for TUSA

- RockPile's Q4 FY 2016 activity levels are trending well ahead of Q3 FY 2016 supported by increased activity in legacy basins and the establishment of operations in new markets including the Permian Basin where one completion crew is active and other ancillary services are being provided

Well Activity

- Completed 2 gross (1.7 net) operated wells, maintaining inventory of 18 gross (15.8 net) operated wells waiting on completion as of October 31, 2015

Production Mix & Rate

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

North America News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Bonterra Eneergy Corporation First Quarter 2023 Results

-

Hammerhead Energy Inc. First Quarter 2023 Results

-

Spartan Delta Corp. First Quarter 2023 Results -

-

Empire Petroleum First Quarter 2023 Results

1.jpg&new_width=60&new_height=60&imgsize=false)