Service & Supply | Oilfield Services | Frac Markets - Pressure Pumping | Capital Markets | Private Equity Activity

US Pressure Pumping Market Report - Q3

Using our proprietary frac database, Shale Experts is taking a look at the market share of the US Pressure Pumping market.

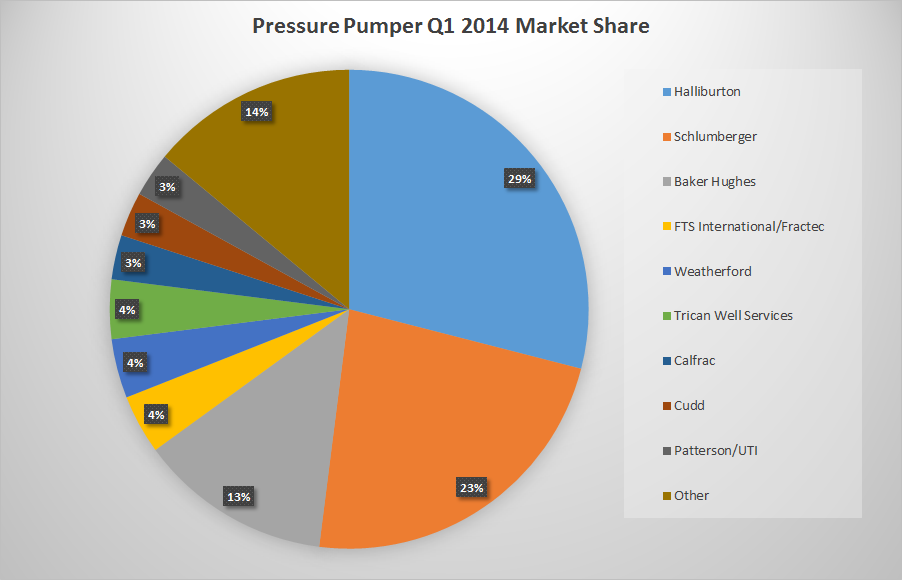

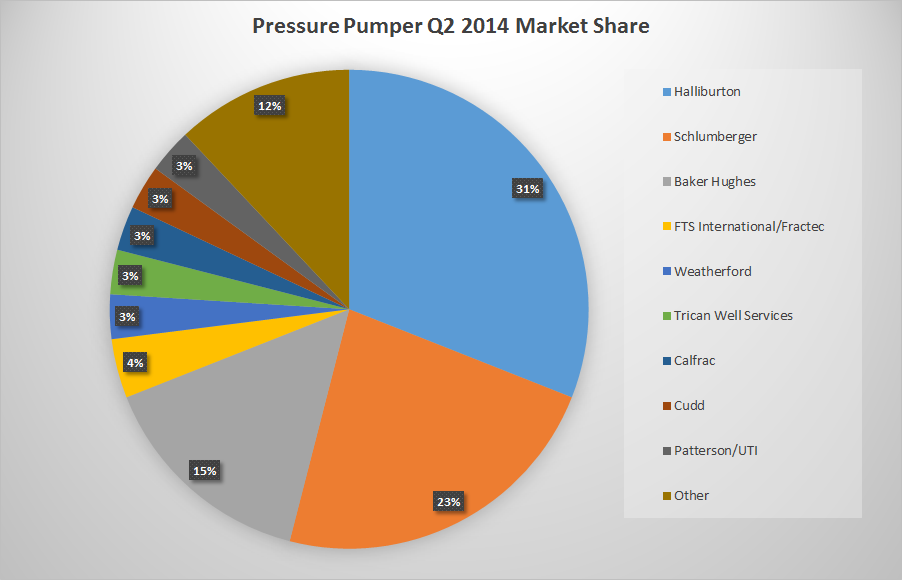

We are looking at the market share, calculated by the percentage number of wells fracced in the first and second quarter of 2014.

Not all wells are reported, and the comparison is based on reported wells.

First Quarter Market Share:

Second Quarter Market Share:

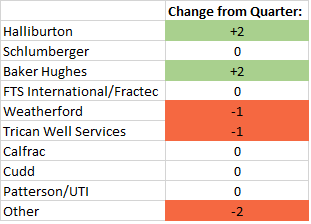

Among the top three pressure pumpers, Halliburton and Baker Hughes gained 2% of the market share each. Schlumberger defended its position at 23%, with no change from 1Q.

Weatherford and Trican each lost 1% of the market, while FTS, Cudd, Patterson and Calfrac saw no movement. The rest of the market lost 2% overall of the share, possibly putting greater pressure on smaller operators.

While the overall movement is small, it seems that larger pressure pumpers continue to gain in the market.

Halliburton Company

Jeff Miller - President

Thank you, Mark and good morning everyone. I’m excited about our results this quarter, the Halliburton team is dead focused on strategy execution, and the results are clearly evident in the quarter’s industry-leading growth, with both of our divisions setting revenue records as well as revenue records for 11 of 13 product lines. As a reminder, our strategy is built around three key growth markets unconventionals, deepwater and mature fields.

Our unconventional strategy is designed to deliver the lowest cost per barrel of oil equivalent for our customers with surface efficiency, custom chemistry and subsurface insight. Clearly these strategies are working. In North America unconventional market the topic on everyone’s mind this quarter was logistics, driven by big increases in both horizontal activity and completions intensity which is right in the sweet spot of surface efficiencies.

Now compared to the prior year, US horizontal recount in the third quarter was up more than 20%. Over the same timeframe our stage count was up more than 30% and our average sand per well increased by more than 50%.While the rising recount was predominantly a Permian basin phenomena, our customers are experimenting with larger completion volumes in almost every basin. This is a fundamental change in well design that we believe is part of a continuing trend. As Dave said, earlier in the quarter, we experienced issues related to logistical disruptions, primarily around proppant. Cast in terms of surface efficiency increasing intensity presents a terrific opportunity for us. We’ve addressed these rising completion volumes by expanding our infrastructure and transport capability. Read more..

Baker Hughes Inc.

" And within our United States onshore business, the recent increase in activity and service intensity per well has caused strong demand for pressure pumping services and rapid tightening across the market.

The trend of more horizontal drilling, longer laterals, more stages per well, and more profit per stage has soaked up the remaining spare capacity in the market. These market forces, along with actions we have taken to transform our pressure pumping business, have set the stage for robust growth in our North America segment accompanied by solid increase in margins for the fourth quarter. In the end, although the sequential results remain positive, including a 5% increase in revenue and more than a 10% growth in adjusted net income, the quarter fell short of our expectations. At the same time, in our onshore operations, we were very pleased with the tremendous growth in our pressure pumping business.

This one product line grew almost 25% in one quarter and accounted for 75% of the sequential revenue increase in North America. The earnings contribution from this growth more than offset the lost operating profit in the Gulf of Mexico. Although pressure pumping margins did increase sequentially, due to rising input costs that we were not able to recoup until later in the quarter, incremental margins were not as strong as we expected. With better commercial terms now in place, our pressure pumping business today is substantially stronger than it was only three months ago. Efficiency is better, utilization is high, and new pricing has now taken hold.

Our strategy to transform our pressure pumping business is hitting all its metrics. Here are the three main reasons why we project profitability to increase significantly for this product line in the fourth quarter and into next year.

First, better utilization. We entered the third quarter with a handful of fleets that were idled, and today, we are essentially fully utilized with no idle equipment remaining. This will result in higher utilization and better absorption in the fourth quarter.

Second, increased stage counts. The trend of more horizontal wells, longer laterals and higher stage density continues. Additionally, the transition of our fleets to 24-hour operations is ahead of schedule, and today, 70% of our fleets are operating around the clock and we expect this figure to increase by the end of the quarter. Based on higher utilization rates and more 24-hour operations, we are on a pace to complete the highest stage counts since early last year.

And third, and most importantly, higher revenue per stage. Tightening market conditions have allowed us to be more selective with the customers we work for. Just as we secured more 24-hour operations, we’ve also secured contracts with better pricing. More than half of our business today is performed under new commercial terms, which were secured just in the last couple of months, and we’re now seeing the full benefit of this turnaround today. Read more..

Patterson-UTI Energy, Inc.

"As announced earlier this week, we completed our second pressure pumping acquisition of the year, adding 148,250 frac horsepower to our fleet. Collectively, the 2 acquisitions added approximately 180,000 frac horsepower to our fleet and provided us with 3 new facilities to support our operations in East and South Texas. In total, we paid $176 million for these acquisitions. This represents less than $1,000 per horsepower. In addition, we received inventory and took over lease facilities.

We have fundamentally changed our company through the transformation of our rig fleet and the substantial increase in our pressure pumping horsepower. Our rig fleet continues to evolve as we align our fleet with customer demand and focus on modern, highly efficient APEX rigs, with a preponderance of our rig fleet now under term contract. In pressure pumping, our fleet consists of the latest technology, high horsepower pumps and has increased by more than 500% during the last 5 years to $1 million horsepower."

Turning now to pressure pumping. We generated record quarterly revenues of $349 million from pressure pumping during the third quarter, a sequential increase of $42 million due to higher activity levels and the full quarter impact of our June acquisition. We're pleased that in the third quarter, we generated more than 90% of our frac revenue from 24-hour operations. We still see opportunity improve utilization by reducing the white space in our schedule. During the quarter, we incurred higher costs related to sand transportation and equipment maintenance. We also had startup costs and crew activations associated with our June acquisition and a new frac spread that started in early October.

At the end of the third quarter, late September flooding in the Permian basin negatively impacted revenue and increased costs with sand demurrage and crews that were still being paid to manage equipment on suspended jobs. As a result of these factors, our pressure pumping EBITDA increased by $3.3 million during the quarter to $62.8 million, which was a smaller than expected increase. Read more..

Basic Energy Services, Inc.

Trey A. Stolz - IBERIA Capital Partners LLC

Good morning, guys. Focusing on Completion and Remedial segment for a bit if you can, the margin progression there, if you could breakdown what you had in pressure pumping versus higher end frac jobs, I guess what percent higher in frac jobs, what I’m looking for I guess is, what exposure you might be – you might have on that end to sand costs, where did sand costs play a role in your quarter. And how do we see that market margin progression or how did we see it with pricing improvement if you could break that down a little bit more for us.

Thomas Monroe Patterson

Well, as far as sand, any cost increases that we’re getting from our suppliers we’re passing on to our customers. So I think we’re doing a pretty good job of covering those cost increases. But we are starting to see slight net pricing increases in those areas that we can get; we’re going to our customers. Directly those new customers that were fracking for – we’re able to get those price increases.

J. Marshall Adkins - Raymond James & Associates, Inc.

Good morning, guys. I’ll try to limit it to two; pressure pumping is obviously driving the boat here, can we get the revenue per horsepower back to the peak we saw in 2011, do you think that’s achievable over the next 18 months?

Thomas Monroe Patterson

I think so. With the trajectory we’re on right now, right now we’d have to say yes, it looks like we could get there. The manufacturers out there typically don’t have the same capacity to put out new equipment that they had in 2011; again they rent back up, yes, and will they? I’m sure they will. But we’re not there yet, so that could be the rest of pit to get back on that trajectory for revenue per horse power that we saw in 2011. So I don’t think that’s unachievable.

Schlumberger Limited

Angie Sedita - UBS

Nice to see that big $1.5 billion buyback. As a follow-up to one of the earlier questions on pressure pumping and the just the soft North America and obviously its influx, I do believe that Schlumberger was considering building incremental new build capacity for 2015 given the market dynamics. How do you feel on that now? Is that on hold? What are your thoughts?

Paal Kibsgaard - Chief Executive Officer

Well, we have a pretty sizeable pressure pumping business, which is including both North America and international. So we have made some orders for new pumps. We still have some pumps left in the idle asset program. But we made some orders for new pumps by the level that it doesn't really worry me. These new pumps will be distributed in between North America and international. And we've had fairly significant growth both in Argentina and Saudi Arabia over the past six to 12 months. So the orders that we've made is generally what we want to have on order in terms of long lead items to make sure that we can cover the business in any eventuality.

Brad Handler - Jefferies

In an environment if there's a somewhat lower commodity price, what is your sense of the impact on artificial lift on the production side of the business, maybe a little bit more broadly presumably in the North America market?

Paal Kibsgaard - Chief Executive Officer

Well, for the overall production business in the event that activity is down in North America, any part of the business might have challenges and pressure on pricing. I think again where you'll see it the fastest and the most will likely be in pressure pumping. In terms of artificial lift, we have not seen the same uptick in pricing when activity is very high, and I don't expect to see the same kind of pressure there as well. But any flattening of growth or reduction in activity will likely have an impact on pricing in any product line. But I think it's way too early to say even for North America whether we will be in that situation in 2015. Read more..

Weatherford International Ltd.

Ole Slorer - Morgan Stanley

In pressure pumping Bernard, would you consider doing a neighbor style deal where you take this – where you maybe you can get access by having this as a minority ownership rather than majority? Bernard

Duroc-Danner - Chairman, President and Chief Executive Officer

I will probably let Krishna answer that question. I would simply say that our team is already extremely busy with the let’s call it the three transactions that we are working on which one I think will be announced and may be two I don’t know before year end, we don’t know. So the issue of what we could or could not do with U.S. stimulation I don’t think has been defined yet, and rather not do it now."

Krishna Shivram - Chief Financial Officer

"North America revenue grew 9.3% sequentially, with margins increasing by 92 basis points to 16.1% reflecting the seasonal rebound in Canada and strong growth on U.S. line more than offsetting cost headwinds in the U.S. pressure pumping business." Read more..