Well Lateral Length | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Key Wells | Production Rates | Financial Results | Capital Markets | Drilling Activity

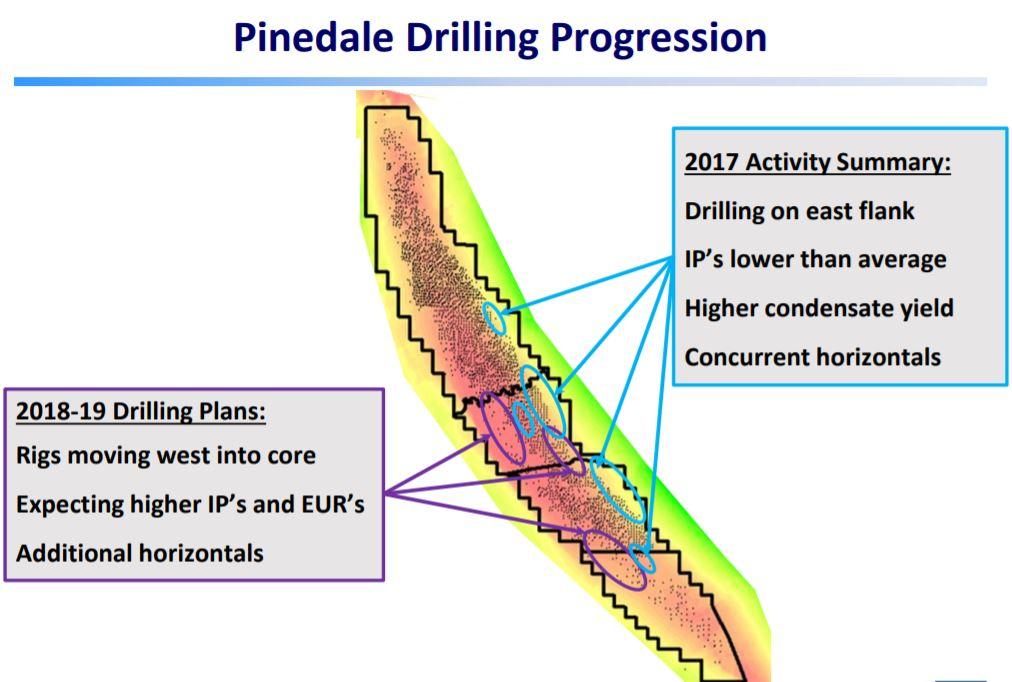

Ultra Drills Two-Mile Pinedale Lateral; Selling Marcellus, Uinta

Ultra reported its Q3 2017 results. Highlights include:

- Production grew 6% compared to second quarter 2017, with oil and natural gas volumes of 71.1 Bcfe

- Trimming Portfolio: In the final stages of selecting investment banks to begin the marketing process for non-core Uinta and Marcellus assets

2-Mile Pinedale Lateral (10,300')

Drilled on the East flank of the play, the well is currently flowing at 21 MMcfe/d (10% condensate) and increasing

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Northeast - Appalachia News >>>

-

CONSOL Energy Inc., First Quarter 2023 Results

-

Diversified Energy Company PLC First Quarter 2023 Results -

1.jpg&new_width=60&new_height=60&imgsize=false)

-

Pioneer Natural Resources Company First Quarter 2023 Results

-

Antero Resources Corporation First Quarter 2023 Results -

-

EQT Corporation First Quarter 2023 Results

Rockies - Piceance/Uinta News >>>

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023 -

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance -

-

Coterra Energy Q4, Full Year 2022 Results; 2023 Plans -

-

Southwestern Energy 4Q, Full Year 2022 Results; Talks 2023 Plans

-

Chesapeake Energy Q4, Full Year 2022 Results; IDs $1.8B 2023 Capex

19.jpg&new_width=60&new_height=60&imgsize=false)