Exploration & Production | Drilling / Well Results | Top Story | Quarterly / Earnings Reports | First Quarter (1Q) Update | Deals - Acquisition, Mergers, Divestitures | IP Rates-30-Day | Initial Production Rates | Financial Results | Capital Markets

Whiting Slick Water Frac Grows Productions;Lower Well Cost

Whiting’s production in the first quarter 2015 totaled 15.0 million barrels of oil equivalent (MMBOE), 88% crude oil/natural gas liquids (NGLs). First quarter 2015 production averaged 166,930 barrels of oil equivalent per day (BOE/d). This represents a 3% pro forma increase over the full fourth quarter 2014.

Bakken / Williston Basin

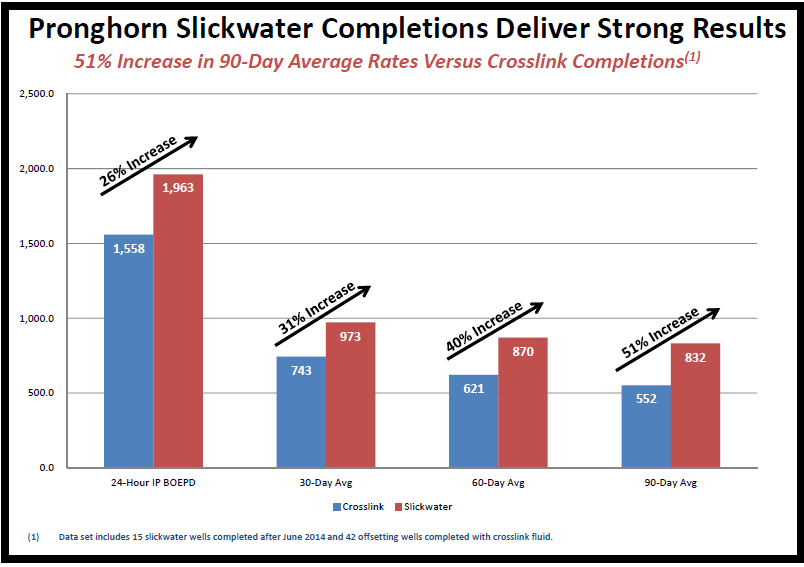

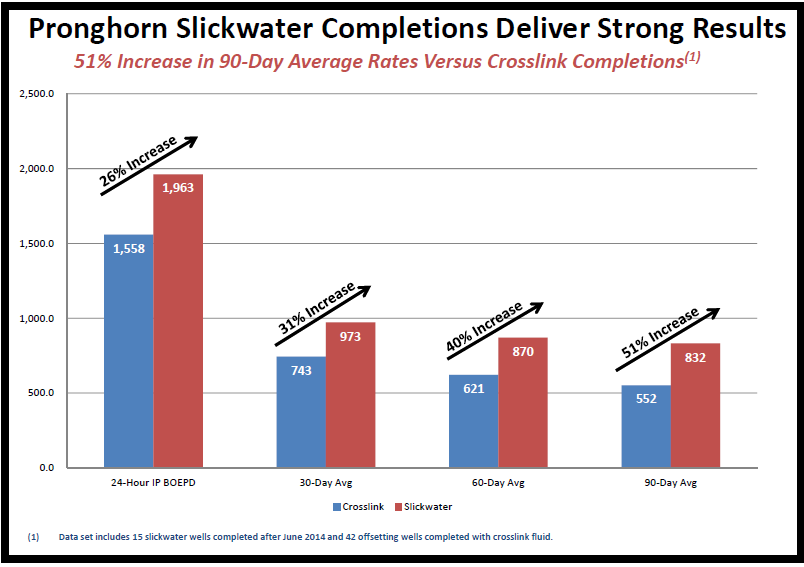

Slickwater fracs at Pronghorn result in significant productivity increases. In July 2014, we began to implement slickwater completion technology at our Pronghorn field in Stark County, North Dakota. We have completed a total of 15 slickwater wells. On average, the slickwater wells had 90-day rates of 832 BOE/d, an increase of 51% over the 42 offsetting wells completed with crosslink fluid.

As recently reported in several publications, Whiting has the top two wells in the Williston Basin in terms of initial production rates. The wells are located in our Tarpon field in McKenzie County, North Dakota. The Flatland Federal 11-4TFH produced at an initial rate of 7,824 BOE/d during a 24-hour test of the Three Forks formation, making this the best well in the Basin. The Flatland Federal 11-4TFH was completed October 11, 2014 with a cemented liner and a 104 stage coiled tubing frac. The Flatland Federal 11-4HR produced at an initial rate of 7,120 BOE/d during a 24-hour test of the Middle Bakken formation. The Flatland Federal 11-4HR was completed on October 10, 2014 with a cemented liner and coiled tubing frac.

Source : Whiting Petroleum via PetroleumResearch.org Enlarge Image

James J. Volker, Whiting’s Chairman, President and CEO, commented, “While we are reducing rig count and well cost, production was strong in Q1 2015. We had solid results in the Bakken/Three Forks and Niobrara. Our operations in the first quarter generated record production of 166,930 BOE/d. As a result of stronger production growth in the first quarter, our production guidance is 59.1 MMBOE for 6% year-over-year production growth despite the $108 million asset sale.

Our budget remains at $2 billion. Our capital expenditures decline sharply in the second half of 2015. Our total rig count will average 11 rigs in the second half of 2015. Nine of these rigs will operate in the Bakken/Three Forks and two rigs will drill in the Niobrara. This compares to 25 rigs working for us in the second half of 2014.

“The reaffirmation of our credit facility with a $4.5 billion borrowing base demonstrates the confidence our banking group has in the value of our producing assets at current prices and our long-term growth prospects. Our robust liquidity position provides us with excellent financial flexibility. We are seeing lower completed well costs through service company price reductions, operational efficiencies and new technology applications.

Bakken/Three Forks wells are being drilled and completed for $6.5 million, down from $8.5 million in 2014. Our completed well cost in the Niobrara is approximately $4.5 million, down from $6.0 million in 2014.The full impact of these cost reductions will be realized in the second half of 2015. Additionally, our unit costs in the first quarter 2015 have decreased significantly from the first quarter 2014 due in large part to cost control measures and technology driven productivity increases. Our DD&A rate per BOE has dropped 28%, LOE per BOE has decreased 13% and G&A per BOE is down 18%.”

Non-Core Property Sales

On April 15, 2015, Whiting sold older, conventional, operated and non-operated properties to a private buyer for $108 million. The properties were predominantly assets from Whiting USA Trust I, which reverted to Whiting Petroleum Corporation ownership in January 2015. The effective date of the sale is May 1, 2015 and the sale closed on April 15, 2015. The properties spanned approximately 4,000 wells, including several multi-well units, in 187 fields across 14 states. Reserves totaled an estimated 8.2 MMBOE (86% oil) as of the effective date of the sale with estimated remaining 2015 production of 2,200 BOE/d. The sale was consistent with Whiting’s continuing 2015 plans to sell mature properties with higher LOE per BOE than its core Bakken and Niobrara assets. LOE for the properties averaged approximately $25.00 per BOE versus $6.50 per BOE in the Bakken and $9.00 per BOE in our core Niobrara area.

Operations Update

Williston Basin Development

We hold 1,270,092 gross (774,022 net) acres in the Williston Basin of North Dakota and Montana. In the first quarter 2015, production from the Bakken/Three Forks averaged a record 133,500 BOE/d, an increase of 82% over the 73,325 BOE/d in the first quarter 2014 prior to the Kodiak acquisition in December of 2014 which added 41,190 BOE/d. The Bakken/Three Forks represented 80% of Whiting’s total first quarter production. As of December 31, 2014, Whiting had an estimated 7,541 future gross drilling locations in the Bakken/Three Forks formations, of which approximately 60% target the Bakken formation.

At our Dunn field in Dunn County, North Dakota, initial production rates from four Whiting-operated wells completed in mid-January averaged 3,181 BOE/d per well while 30-day rates averaged 1,255 BOE/d per well. At the Polar field in Williams County, North Dakota, initial production rates from four Whiting-operated wells completed in late February averaged 2,630 BOE/d per well while 30-day rates averaged 1,130 BOE/d per well. At the Koala field, which is located near our Hidden Bench field in McKenzie County, North Dakota, we completed four pad wells in mid-March that flowed an average rate of 2,584 BOE/d per well while 30-day rates averaged 1,395 BOE/d per well.

Slickwater fracs at Pronghorn result in significant productivity increases. In July 2014, we began to implement slickwater completion technology at our Pronghorn field in Stark County, North Dakota. We have completed a total of 15 slickwater wells. On average, the slickwater wells had 90-day rates of 832 BOE/d, an increase of 51% over the 42 offsetting wells completed with crosslink fluid.

As recently reported in several publications, Whiting has the top two wells in the Williston Basin in terms of initial production rates. The wells are located in our Tarpon field in McKenzie County, North Dakota. The Flatland Federal 11-4TFH produced at an initial rate of 7,824 BOE/d during a 24-hour test of the Three Forks formation, making this the best well in the Basin. The Flatland Federal 11-4TFH was completed October 11, 2014 with a cemented liner and a 104 stage coiled tubing frac. The Flatland Federal 11-4HR produced at an initial rate of 7,120 BOE/d during a 24-hour test of the Middle Bakken formation. The Flatland Federal 11-4HR was completed on October 10, 2014 with a cemented liner and coiled tubing frac.

Denver Julesburg Basin Development

Redtail Field: Our Economic Sweet Spot in the Niobrara. We hold a total of 184,348 gross (134,027 net) acres in our Redtail field, located in the Denver Julesburg Basin in Weld County, Colorado. Whiting has established production in four zones, the Niobrara “A,” “B” and “C” zones and the Codell/Fort Hays formations. Net production from the Redtail field averaged 13,000 BOE/d in the first quarter 2015, a 28% sequential increase over the fourth quarter 2014. At year-end 2014, we had an estimated 6,685 future gross drilling locations in the Niobrara “A,” “B,” “C” zones and the Codell/Fort Hays formation.

Our first Codell/Fort Hays formation test continues to perform well. The Razor 25B-2551 well, completed in the Codell/Fort Hays on September 9, 2014, averaged 355 BOE/d in its first 200 days on production or a total of 71,000 BOE. The well was drilled on a 640-acre spacing unit and is trending above a 400 MBOE type curve, which indicates returns should be competitive with Niobrara “A” and “B” wells drilled on 960-acre spacing units with an estimated 450 MBOE EUR per well. The Codell formation is prospective throughout our acreage base at Redtail.

We recently began selling our crude oil production from Redtail under a fixed-differential contract across a connection to the Pony Express Pipeline to Cushing, Oklahoma. We are selling approximately 20,000 gross barrels of oil per day (15,825 barrels net) at a $4.75 per barrel discount to the NYMEX price. This compares favorably to differentials of $12.00 per barrel prior to the new connection.

Other Notable Developments

Reaffirmation of $4.5 Billion Borrowing Base

In April, the lenders under Whiting’s revolving credit agreement completed their semi-annual redetermination of the borrowing base. Under their current price deck, lenders reaffirmed a $4.5 billion borrowing base and Whiting has elected to request $3.5 billion of commitments. There were no changes to the interest rates, fees or repayment terms of the credit line, which matures in December 2019. In addition, Whiting and its lenders replaced the 4.0 to 1.0 total debt to EBITDAX covenant with a 2.5 to 1.0 senior secured debt to EBITDAX covenant. The revised covenant applies each quarter through and including the quarter ending December 31, 2016, after which the prior covenant becomes applicable. No funds were drawn on the credit facility as of March 31, 2015. Also, Whiting terminated its $1 billion delayed draw facility, which was set to expire December 31, 2015.

Gas Capture and Crude Oil Conditioning

Whiting is capturing over 85% of its natural gas production in North Dakota. State regulations require that a minimum of 77% of a company’s natural gas production be captured. Whiting also has the equipment in place to condition all of its crude oil production so that it meets the specifications of recent regulations enacted by the North Dakota Industrial Commission.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Rockies News >>>

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Devon Said To be In Talks to Acquire Enerplus

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans