Exploration & Production | Well Cost | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Forecast - Production | Capital Markets | Capital Expenditure

Yangarra Increases Production 36%

1.jpg)

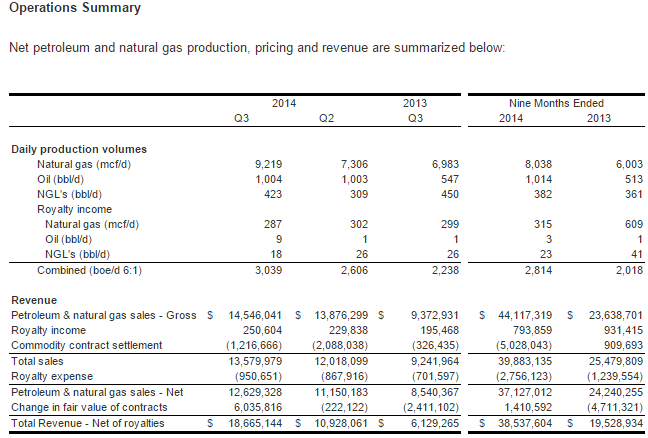

Yangarra Resources Ltd. has announced its financial and operating results for the three and nine months ended September 30, 2014.

Third Quarter Highlights

- Production for the quarter was 3,039 boe/d (48% oil and NGL's), a 36% increase from the same period in 2013 and a 17% increase from the previous quarter.

- Oil and gas sales, after royalties, were $13.6 million with funds flow from operations of $9.3 million ($0.16 per share - basic). Both are a 46% increase from the same period in 2013.

- Net Income of $8.0 million ($10.6 million before future income taxes).

- Operating costs were $6.45 per boe and transportation costs were $1.52 per boe, an increase of 18% and 3%, respectively, from the same period in 2013. Operating costs have been reduced by 7% when compared to the second quarter of 2014.

- Field net backs (operating netback excluding commodity contracts) were $42.33, an increase of 17% from the same period in 2013. Operating netback were $37.20 per boe, an 8% increase from $34.56 per boe reported in the same period of 2013.

- G&A costs were $2.23 per boe, which is a 27% increase from the third quarter of 2013 due to the fees required to graduate to the Toronto Stock Exchange.

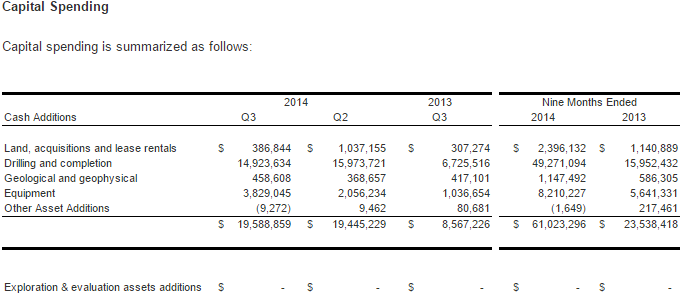

- Total capital expenditures were $19.6 million. The Company drilled 5 gross (4.2 net) wells.

- Net debt, excluding the current portion of the fair value of commodity contracts, was $51.2 million.

- The annualized third quarter debt to cash flow ratio was 1.4 : 1.

- The Company had utilized 57% of its total debt facility as at September 30, 2014.

- Yangarra has 60% of its 2015 liquids production hedged at an average price of $93.32 CDN/bbl.

Operations and Guidance Update

- The Company drilled 5 gross (4.2 net) wells and completed and brought on-stream 8 gross (4.6 net) wells during the third quarter. Production during the quarter continued to be negatively affected by third party restrictions as well as the below type curve results from a two well Glauc oil pad. No mechanical issues were experienced in the Glauc oil wells, however, the frac fluids appear to be impeding inflow with production slowly improving over time.

- In Q4, third party restrictions have mostly been alleviated as of November 1st, and Yangarra plans to bring on-stream 4 gross (2.4 net) wells drilled and completed in the previous quarter. Subsequent to quarter end, Yangarra plans to drill, complete and bring on-stream 6 gross (3.6 net) wells.

- A Duvernay well was spud in Willesden Green October 2, 2014 and is drilling according to program with an estimated cost of $6.0 million. Yangarra will provide an update upon on the well and Duvernay strategy once the well is drilled and rig released.

- The Company has revised the fourth quarter pricing to an average price of US$80.00/bbl for WTI crude oil (CDN$79.20/bbl Edmonton par) and an average price of $3.50/GJ for AECO natural gas. With the reduced pricing and third party constraints the Company now expects fourth quarter cash flow of $12 million and full year cash flow of $40 million (a 56% increase from 2013).

- Fourth quarter production is expected to be 3,500 boe/d and full year production is expected to average 3,000 boe/d (a 36% increase from 2013).

- The Company has $14 million remaining to spend on its $75 million 2014 capital budget in the fourth quarter and expects year-end 2014 debt of $53 million resulting in a net debt to annualized fourth quarter cash flow ratio of 1.1 to 1.0.

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)