EOG Acquires Yates For $2.5 Billion; Bulks Up On Delaware Basin

Multiples

Transaction Details:

EOG Resources, Inc. is acquiring Yates Petroleum Corporation and its subsidaries , Abo Petroleum Corporation, MYCO Industries, Inc. for $2.5 billion in cash and stock.

EOG will issue 26.06 million shares of common stock valued at $2.3 billion and pay $37 million in cash, subject to certain closing adjustments and lock-up provisions.

EOG will assume and repay at closing $245 million of Yates debt offset by $131 million of anticipated cash from Yates, subject also to certain closing adjustments.

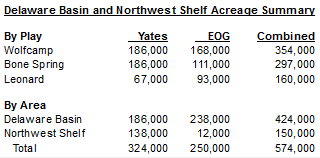

Delaware Basin Map

Powder River Basin Map

Yates is a privately held, independent crude oil and natural gas company with 1.6 million net acres across the western United States:

- Production of 29,600 barrels of crude oil equivalent per day, net, with 48 percent crude oil

- Proved developed reserves of 44 million barrels of oil equivalent, net

- Delaware Basin position of 186,000 net acres

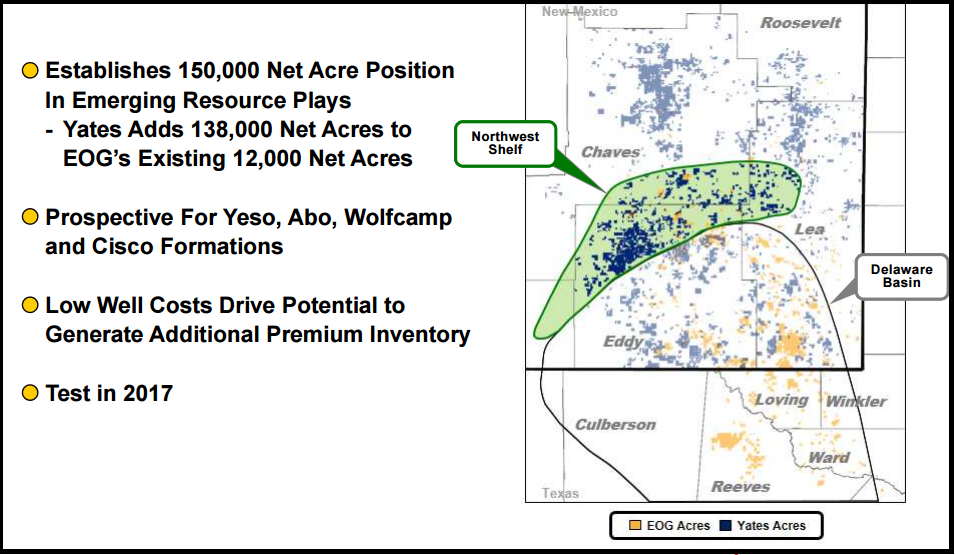

- Northwest Shelf position of 138,000 net acres

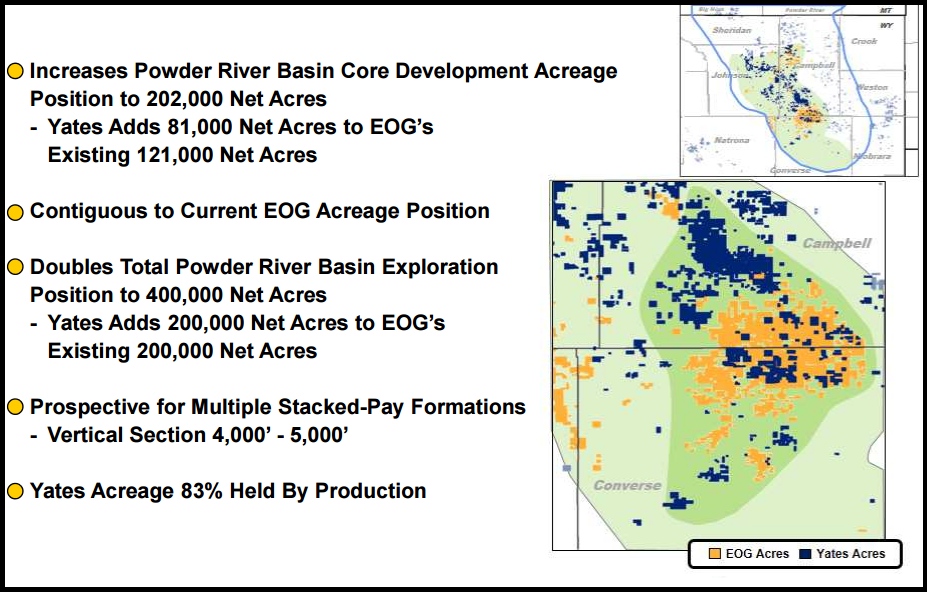

- Powder River Basin position of 200,000 net acres

- Additional 1.1 million net acres in New Mexico, Wyoming, Colorado, Montana, North Dakota and Utah.

EOG is the largest oil producer in the Lower 48, with average net daily production of 551 thousand barrels of crude oil equivalent:

- Yates immediately adds an estimated 1,740 net premium drilling locations in the Delaware Basin and Powder River Basin to EOG's growing inventory of premium drilling locations, a 40 percent increase.

- A premium drilling location is defined by EOG as a direct after-tax rate of return of at least 30 percent assuming a $40 flat crude oil price. EOG plans to commence drilling on the Yates acreage in late 2016 with additional rigs added in 2017.

Doubles Position in Delaware Basin and Adjacent Plays

Yates has 186,000 net acres of stacked pay in the Delaware Basin in New Mexico that is highly prospective for the Wolfcamp, Bone Spring and Leonard Shale formations. This brings the combined company's total Delaware Basin acreage position to approximately 424,000 net acres, a 78 percent increase to EOG's existing holdings.

Additionally, Yates has 138,000 net acres on the Northwest Shelf in New Mexico that is prospective for the Yeso, Abo, Wolfcamp and Cisco formations. These shallow plays have the potential to contribute additional amounts of premium inventory with the application of EOG's advanced completion and precision targeting technologies and low cost structure. Along with EOG's existing acreage, the newly combined company will have 574,000 net acres in the Delaware Basin and Northwest Shelf. A summary of the acreage is listed below.

Transaction Terms

Under the terms of the agreements, which were approved by the boards of directors of EOG and Yates, and the Yates stockholders, EOG will issue 26.06 million shares of common stock valued at $2.3 billion and pay $37 million in cash, subject to certain closing adjustments and lock-up provisions.

EOG will assume and repay at closing $245 million of Yates debt offset by $131 million of anticipated cash from Yates, subject also to certain closing adjustments. Closing is anticipated in early October 2016, subject to customary closing conditions.

Following the transaction closing, EOG intends to maintain Yates' office in Artesia, N.M., to support the newly combined operation.

Wells Fargo Securities, LLC acted as exclusive financial and technical advisor to Yates Petroleum Corporation, Abo Petroleum Corporation and MYCO Industries, Inc. for this transaction. Thompson & Knight LLP, Modrall Sperling Law Firm and Kemp Smith LLP acted as legal advisors to Yates Petroleum Corporation, Abo Petroleum Corporation and MYCO Industries, Inc., respectively. Akin Gump Strauss Hauer & Feld LLP acted as legal advisor to EOG

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jan-04-2024 | APA Corp to Acquire Permian Pure Player- Callon In All Stock Deal | -  |

-  |

| Nov-21-2023 | Northern Oil Acquires Additional Permian Working Interest; Enters Utica | -  |

-  |

| Aug-21-2023 | Permian Resources Acquires Earthstone Energy | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Nov-06-2020 |

-  |

-  |

Click here | Pennsylvania | E&P |

| May-23-2017 |

-  |

-  |

Click here | Oklahoma | E&P |

| Nov-02-2016 |

-  |

-  |

Click here | Louisiana | E&P |

| Nov-02-2016 |

-  |

-  |

Click here | Texas | E&P |

| Aug-06-2016 |

-  |

-  |

Click here | Texas | E&P |