Apollo-backed Northwood Energy Acquires SM Energy Powder River Property For $500 Million

Multiples

Transaction Details:

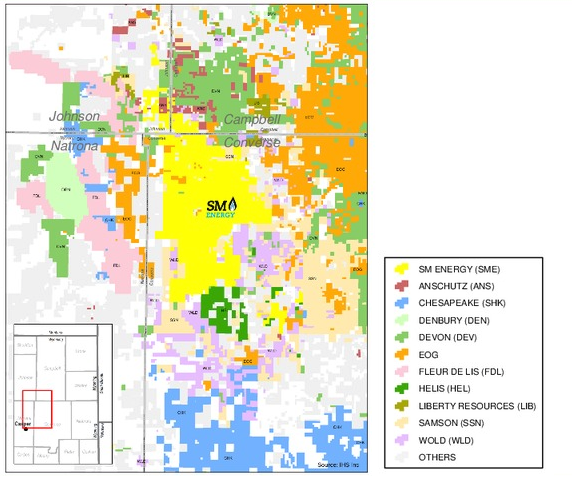

SM Energy is selling its 112,000 net acres powder river asset for $500 million to Apollo-backed Northwood Energy LLC.

This deal closed on March 27, 2018.

Northwoods is led by Chief Executive Officer Tom Tyree, who has extensive experience in the acquisition and development of upstream oil and gas properties in the Rocky Mountains, Marcellus Shale, and Barnett Shale. Mr. Tyree was Co-Founder, President, and CFO of Vantage Energy from 2006 to 2016.

He is currently on the board of directors of Bonanza Creek Energy and served as CFO of Bill Barrett Corporation prior to Vantage Energy. The Apollo funds, including Apollo Investment Fund VIII and Apollo Natural Resources Partners II, have committed to invest up to an aggregate of $850 million in Northwoods.

Mr. Tyree said, “Northwoods is excited to be working with Apollo to build a leading Powder River Basin-focused independent E&P business. We believe the basin has some of the best geology of any play in the Lower 48 and that Northwoods has a tremendous opportunity to develop this highly contiguous, core acreage position.”

SM Energy reported some good wells with IP 30 of 1,657 - 2,337 Boe/d (80% oil) from the Frontier formation in december of last year though JV program.

EOG has also reported some 30-day ip rates of 1000 bopd.

Transaction Details

- Land : 112,000 Net Acres

- Production : 2,200 boe/d (50% oil)

- Reserves : 4.2 MMBOE (1P)

- Formations : Shannon, Frontier, Niobrara

SM Energy (Yellow)

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-25-2022 |

-  |

-  |

Click here | Wyoming | E&P |

| Feb-17-2021 |

-  |

-  |

Click here | Wyoming | E&P |

| Nov-30-2020 |

-  |

-  |

Click here | Texas | E&P |

| Feb-07-2019 |

-  |

-  |

Click here | Texas | E&P |

| Oct-26-2018 |

-  |

-  |

Click here | Wyoming | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jan-25-2022 | Continental to Buy Chesapeake's PRB Assets for $450MM in Cash | -  |

-  |

| Feb-17-2021 | Continental Resources Enters the PRB; Inks $215MM Deal | -  |

-  |

| Nov-30-2020 | Contango to Acquire Oily Assets in Big Horn, PRB, Permian Basins | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Apr-04-2018 |

-  |

-  |

Click here | Texas | E&P |

| Nov-04-2017 |

-  |

-  |

Click here | Texas | E&P |

| Jan-03-2017 |

-  |

-  |

Click here | Texas | E&P |

| Oct-18-2016 |

-  |

-  |

Click here | North Dakota | E&P |

| Oct-18-2016 |

-  |

-  |

Click here | Texas | E&P |