Blackstone Acquires Eagleclaw Midstream Assets for $2.0 Billion

Transaction Details:

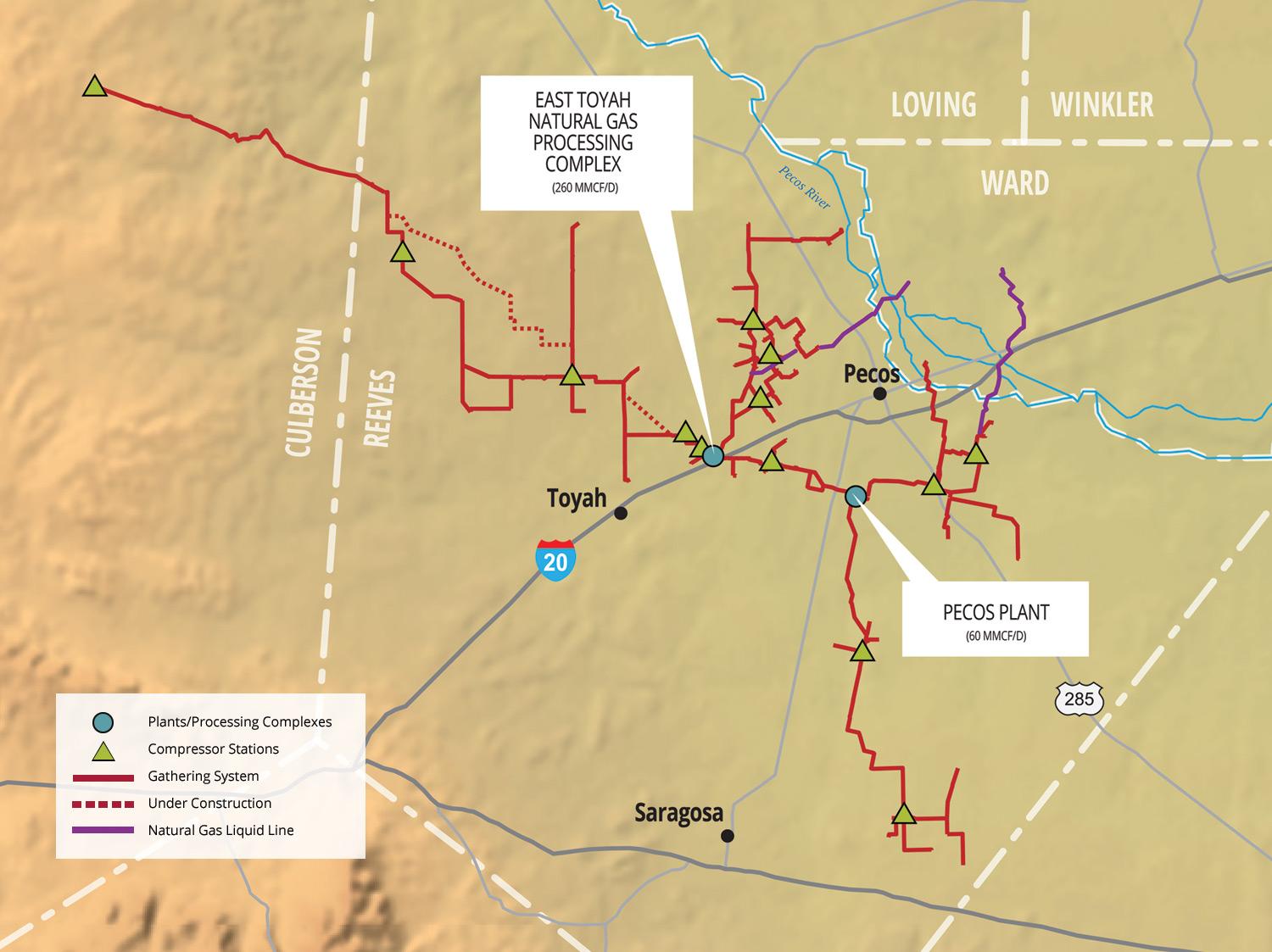

Blackstone Energy Partners has signed a deal to acquire EnCap-backed EagleClaw Midstream Ventures for $2.0 billion. The assets include 375 miles of natural gas gathering lines and 320 MMcf/d of processing capacity.

The all-cash transaction is expected to close by the end of July 2017 and includes approximately $1.25 billion in stapled debt financing provided by Jefferies LLC.

EagleClaw is the largest privately held midstream operator in the Permian’s Delaware Basin in West Texas. The company’s assets are strategically located in Reeves, Ward and Culberson counties and include more than 375 miles of natural gas gathering pipelines and 320 million cubic feet per day (MMcf/d) of processing capacity with an additional 400 MMcf/d under construction. EagleClaw serves many of the region’s leading oil and gas producers, which have made to the company long-term dedications of natural gas volumes from more than 220,000 acres.

Source : Eagleclaw Midstream

EagleClaw will retain its name and operate as a Blackstone portfolio company. The leadership team and fundamentally all of the company’s employees will remain in their current roles and are investing alongside Blackstone in this transaction.

Below is a list of transactions for Permin Basin Midstream assets

| Annoc Date | Buyer | Seller | $mm | Region | Asset |

| 04/17/2017 | Blackstone Capital | Eagleclaw Midstream; | $2,000 | Delaware Basin | Pipelines |

| 04/11/2017 | NuStar | Navigator Energy | $1,475 | Midland Basin | Pipelines; Processing, Storage |

| 01/24/2017 | Plains All American | Frontier Midstream;Concho | $1,215 | Delaware Basin | Pipeline & Gathering System |

| 01/23/2017 | Targa Resources | Outrigger | $1,215 | Delaware; Midland | Pipelines |

Advisers

Jefferies LLC acted as EagleClaw’s exclusive financial adviser in connection with the transaction and was the sole provider of the committed debt financing. The Jefferies team was led by Co-Head of Energy Investment Banking Peter Bowden. Blackstone was advised by Trevor Heinzinger of Morgan Stanley & Co. LLC and Skip McGee of Intrepid Partners LLC.

Frost Brown Todd LLC served as legal counsel to EagleClaw with partner Edward W. Moore, Jr. in the lead role from the firm’s Dallas office. Thompson & Knight LLP represented EnCap Flatrock Midstream, with partner Sarah E. McLean in the lead role from the firm’s Houston office. Blackstone was represented by Vinson & Elkins LLP, whose team was led by partner Keith Fullenweider.

Permian - Delaware Basin Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| May-25-2022 |

-  |

-  |

Click here | New Mexico | Midstream |

| Feb-26-2020 |

-  |

-  |

Click here | Texas | Midstream |

| Dec-20-2019 |

-  |

-  |

Click here | Texas | Midstream |

| Nov-15-2019 |

-  |

-  |

Click here | Texas | Midstream |

| Aug-01-2019 |

-  |

-  |

Click here | New Mexico | Midstream |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| May-08-2019 |

-  |

-  |

Click here | Texas | Midstream |

| Sep-05-2018 |

-  |

-  |

Click here | Texas | Midstream |

| Aug-27-2016 |

-  |

-  |

Click here | Texas | Midstream |

Other Blackstone Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Feb-19-2019 |

-  |

-  |

Click here | North Dakota | Midstream |

| Dec-23-2013 |

-  |

-  |

Click here | Midstream |