Whiting Acquires Kodiak in Deal Worth $6.0 Billion

Multiples

Transaction Details:

Closing Announcement - December 8, 2014

Whiting Petroleum Corporation has completed its previously announced acquisition of Kodiak Oil & Gas Corp., creating the largest Bakken/Three Forks producer.

The closing of the transaction follows the issuance of a final order by the Supreme Court of British Columbia approving the Arrangement on December 5, 2014. The all-stock transaction was previously approved by Whiting stockholders and Kodiak securityholders at special meetings held on December 3, 2014.

The transaction enhances Whiting’s leading oil-weighted platform and is expected to drive production, reserve growth and operational efficiencies. Based on the closing price of Whiting stock on December 5, 2014, the combined company has a market capitalization of approximately $6.2 billion.

James Volker, Whiting’s Chairman, President and Chief Executive Officer, commented: "We are excited to move forward as one company that is even better positioned to deliver value to our stockholders, customers and employees. Uniting our complementary acreage positions and substantial inventory of high return drilling locations provides Whiting with an expanded platform for growth. I am pleased to welcome Lynn Peterson and Jim Catlin to the Whiting Board of Directors and look forward to continuing to work closely with them and all of our employees, including our new team members from Kodiak, to ensure a seamless transition as we continue to drive production and significant value growth."

As a result of the completion of the merger, the common stock of Kodiak Oil & Gas Corp. is no longer listed for trading on the New York Stock Exchange. Pursuant to the terms of the Arrangement, each share of common stock of Kodiak Oil & Gas Corp. will be exchanged for 0.177 of a share of Whiting common stock.

Initial Announcement - July 14, 2014

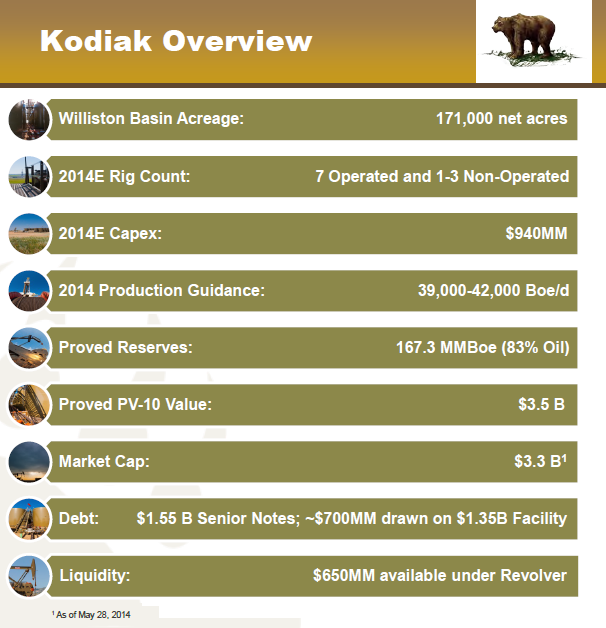

Whiting Petroleum Corporation and Kodiak Oil & Gas Corp. announced a definitive agreement pursuant to which Whiting will acquire Kodiak in an all-stock transaction valued at $6.0 billion, based on the closing price of Whiting on July 11, 2014, and including Kodiak’s net debt of $2.2 billion as of March 31, 2014.

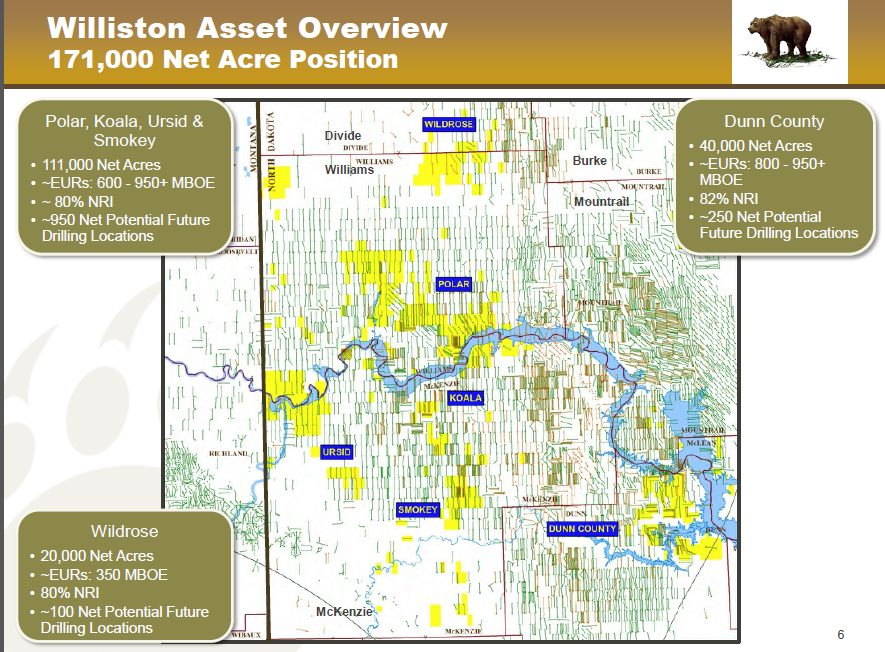

The transaction will create the largest Bakken/Three Forks producer with over 107,000 barrels of oil equivalent per day of production in the first quarter of 2014, 855,000 combined net acres and an inventory of 3,460 net future drilling locations.

The combined company’s leading oil-weighted platform will drive meaningful production and operational synergies through complementary acreage positions, the application of technological expertise and greater access to capital to accelerate drilling.In addition, the transaction materially enhances the combined company’s scale, providing a stronger credit profile and greater financial flexibility.

The all-stock transaction will allow both Whiting and Kodiak shareholders to participate in the substantial upside potential inherent in the combination.

Source : Kodiak June 2014 Presenation, Shale Experts Presenation Database

Whiting’s Chairman, Chief Executive Officer and President James J. Volker said, “We believe this transaction represents a significant opportunity for both Whiting and Kodiak shareholders to benefit from the strength of our combined company. The addition of Kodiak’s complementary acreage position and substantial inventory of high return drilling locations will provide the opportunity to drive significant value growth for both Whiting and Kodiak shareholders through an acceleration in drilling and increase in operational efficiencies.

The combined company’s shareholders will also participate in Whiting’s 175,000 gross (123,000 net) acre, oil-rich Redtail-Niobrara prospect in the NE DJ Basin, where production is rapidly growing. We expect the combined entity to have an initial enterprise value of $17.8 billion, total 2014 production of 152 thousand barrels of oil equivalent per day, and proved reserves of 606 million barrels of oil equivalent (80% oil), providing a leading platform for future oil-driven growth.”

Mr. Volker continued, “We expect that the transaction will be accretive to Whiting’s cash flow per share, earnings per share and production per share for 2015 and increasingly accretive thereafter. Furthermore, the combined company is expected to have significant financing flexibility, with a ratio of debt to 2014E EBITDA of approximately 1.6x. Additionally, we believe the all-stock transaction structure is credit enhancing.”

Lynn A. Peterson, Chairman, President and Chief Executive Officer of Kodiak said, “We are proud to have reached an agreement that provides Kodiak shareholders with the opportunity to own a company with significant upside potential. We expect the combined company to have increased operational and financial flexibility that will allow for accelerated and efficient development of the assets of both companies. In particular, we have been very impressed by Whiting’s operating capabilities and technical expertise, and we expect the combined company will benefit from the operating expertise Whiting will be able to bring to bear on the combined portfolio. Additionally, we expect the transaction to be tax free to Kodiak’s U.S. shareholders.”

Transaction Details

Under the definitive agreement, Kodiak shareholders will receive .177 of a share of Whiting stock in exchange for each share of Kodiak common stock they hold, representing consideration to each Kodiak shareholder of $13.90 per share based on the closing price of Whiting common stock on July 11, 2014. This represents a premium of approximately 5.1% to the volume weighted average price of Kodiak for the last 60 trading days. Following the transaction, shareholders of Whiting are expected to own approximately 71% of the combined company on a fully diluted basis, and shareholders of Kodiak are expected to own approximately 29%.

The Whiting senior management team will lead the combined company. Lynn A. Peterson and James E. Catlin will join the Board of Directors of the combined company at closing of the transaction.

Whiting has secured underwritten financing to increase its borrowing base to $4.5 billion with commitments totaling $3.5 billion. This amount is sufficient to provide for all current drawings under Kodiak’s credit facility and fund the combined company’s ongoing liquidity needs.

Approvals

The Boards of Directors of both companies have unanimously approved the definitive agreement, and each will recommend the approval of the transaction to its respective shareholders. Completion of the transaction is subject to the approval of both Whiting and Kodiak shareholders and certain regulatory approvals and customary conditions. The transaction is expected to close in the fourth quarter of 2014.

Acreage

Source : Kodiak June 2014 Presenation, Shale Experts Presenation Database

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Apr-03-2023 | Grayson Mill Adds More Bakken, Acquires Ovintiv's Assets For $825 Million | -  |

-  |

| Sep-06-2022 | Sitio Royalties, Brigham to Merge in All-Stock Deal Worth $4.8 Billion | -  |

-  |

| Jun-08-2022 | Devon Acquires Williston Assets from PE-Backed E&P in $865 Million Cash Deal | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jun-03-2013 |

-  |

-  |

Click here | North Dakota | E&P |

| Nov-14-2011 |

-  |

-  |

Click here | North Dakota | E&P |

| Sep-28-2011 |

-  |

-  |

Click here | North Dakota | E&P |

| May-23-2011 |

-  |

-  |

Click here | North Dakota | E&P |

| Nov-30-2010 |

-  |

-  |

Click here | North Dakota | E&P |

Other Whiting Petroleum Corp. Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Mar-07-2022 |

-  |

-  |

Click here | North Dakota | E&P |

| Feb-08-2022 |

-  |

-  |

Click here | North Dakota | E&P |

| Jul-21-2021 |

-  |

-  |

Click here | Colorado | E&P |

| Jul-21-2021 |

-  |

-  |

Click here | North Dakota | E&P |

| Jul-31-2019 |

-  |

-  |

Click here | North Dakota | E&P |