Hedging | Capital Markets | Capital Expenditure | Corporate Strategy | Capital Expenditure - 2021

Athabasca Oil Corp. Reveals 2021 Plans

Athabasca Oil Corp. has detailed its 2021 budget.

2021 Budget

- Capital Budget: Athabasca is planning expenditures of $75 million. Capital will be allocated $70 million to Thermal Oil and the remainder to Light Oil.

- Production: Annual corporate production of 31,000 – 33,000 boe/d (90% liquids) which maintains annual 2020 production estimated to average approximately 32,250 boe/d.

Thermal Oil Activity. At Leismer, two infill wells at Pad L6 and an additional well pair at Pad L7 will be drilled in early 2021. These wells will support production in H2 2021 with payouts within one year at current commodity prices. The Company will progress readiness (long lead items, lease site and road construction, pipeline access) for a 5 well-pair sustaining pad (L8) with the option to initiate drilling during this winter season. The sanctioning of capital to drill these wells will be determined at a later date and will depend on the commodity price environment and available liquidity. Hangingstone will have no capital allocation other than routine pump replacements. The Hangingstone project is expected to continue its production ramp up in 2021 following the five month shut-in over the summer this year in response to unprecedented oil price volatility. Hangingstone’s current production is approximately 7,500 bbl/d.

Light Oil Activity. Minimal activities are planned with no new wells expected to be placed on-stream during the year. The assets continue to demonstrate top decile industry netbacks and will contribute significant cash flow to the Company. Future development opportunities are substantial, with approximately 150 well locations in Placid Montney and 700 well locations in Kaybob Duvernay. The land positions in these areas have minimal near term expiries and the capital program is flexible to adjust to commodity prices.

Financial Position

Ample Liquidity. The Company is well positioned to navigate the current challenging environment with estimated liquidity of approximately $170 million at year-end 2020 (excluding $150.9 million of restricted cash as at September 30, 2020).

Bank Facility Renewal. The Company’s banking syndicate has renewed the reserve-based facility until May 31, 2021. The credit facility remains unchanged at $39.9 million which reflects current outstanding letters of credit for long term transportation commitments and is secured by the Company’s restricted cash balances.

Increased Unsecured Letter of Credit Facility. The Company also increased its unsecured letter of credit facility with ATB Capital Markets by $10 million to $40 million which is supported by a performance security guarantee from Export Development Canada.

Long Term Debt. The Company has US$450 million in second lien debt with a maturity of February 24, 2022. The refinancing of Athabasca’s long term debt remains a key 2021 priority.

Risk Management and Market Access

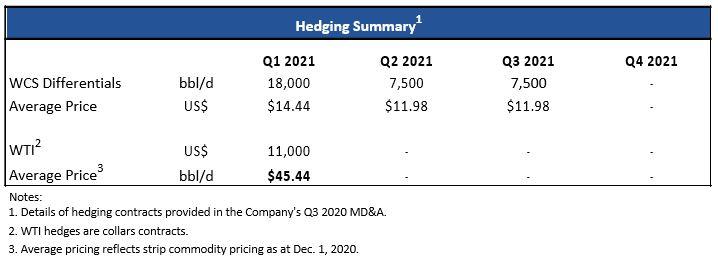

Athabasca protects a base level of capital activity through its risk management program. The hedge program targets up to 50% of corporate production.

The Company has secured ~7,200 bbl/d of Keystone pipeline capacity for a term of 20 years which is expected to commence service in 2021. This capacity diversifies Thermal Oil dilbit sales to the US Gulf Coast at pipeline costs that will allow the Company to further enhance its netback. Longer term, Athabasca has secured egress with capacity on both the TC Energy Keystone XL pipeline and the Trans Mountain Expansion Project.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Canada News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)

-

Rubellite Energy Inc. First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)