Drilling & Completions | Rig Count | Production | Proppant | IP Rates-30-Day | Initial Production Rates | Capital Markets | Capital Expenditure | Capex Decrease | Drilling Contractor

Baytex Trims Capex for 2017; Shifts Eagle Ford Focus to Oil Window

Baytex released its Q2 results and praised its production efforts in Eagle Ford while simultaneously decreasing its capital expenditure guidance from $325 to $350 million to $310 to $330 million or about a -2% change.

Eagle Ford

Baytex directed 76% of its capex toward Karnes County acreage in the Eagle Ford during Q2. The Eagle Ford acreage produced 38,500 boe/d, or an increase of 7% from Q1. The company averaged five rigs with about one to two completion crews.

Baytex has shifted its focus from the condensate window to the oil window in the Eagle Ford. Its three recently completed Karnes County pads (11 wells) located in the oil window of the Longhorn acreage, established 30-day initial production rates of approximately 2,150 boe/d per well. Each pad was completed with 30 frac stages per well and proppant per completed foot of ~1,900 pounds, which is more than double the frac intensity of wells previously drilled in the area.

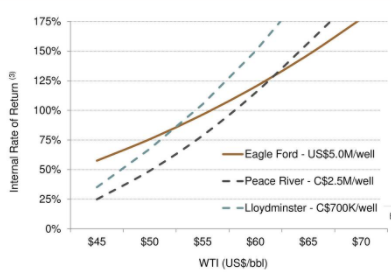

Additionally, Baytex had a well cost ranging between $4.7 and 4.9 million, which is slightly below the $5 million cost the company initially assumed in its 2017 budget.

At the end of the quarter, Baytex had 51 (13 net) wells awaiting completion.

Murphy Asset

Baytex purchased a Murphy asset earlier in 2017. The company reduced the operating cost 30% and is currently seeing production rates of 3,500 bo/d, up from 3,000 to 3,300 bo/d.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Gulf Coast - South Texas News >>>

-

Chesapeake Energy Q4, Full Year 2022 Results; IDs $1.8B 2023 Capex

19.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Adds Finance Exec to Board -

-

Japanese Conglomerate Exits Shale Biz with Sale of Eagle Ford Asset -

-

ConocoPhillips Fourth Quarter, Full Year 2020 Results -

-

Chesapeake IDs 2021 Budget; Focuses on Appalachia, Ark-La-Tex Assets