Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Hedging | Capital Markets

Black Stone Minerals Third Quarter 2020 Results

Black Stone Minerals LP announced its financial and operating results for the third quarter of 2020.

Highlights:

- Total mineral and royalty production for the third quarter of 2020 equaled 31.1 MBoe/d, a decrease of 8.6% over the prior quarter; total production, including working interest volumes, was 37.9 MBoe/d for the quarter.

- Net income and Adjusted EBITDA for the quarter totaled $23.7 million and $65.5 million, respectively.

- Distributable cash flow was $58.8 million for the third quarter, resulting in distribution coverage for all units of 1.9x based on the announced cash distribution of $0.15 per unit.

- Completed the previously-announced asset sales in July 2020 for total cash proceeds of $150 million; recognized a gain of $24.0 million associated with the sales.

- Total debt at the end of the third quarter was $147 million; total debt to trailing twelve-month Adjusted EBITDA was 0.5x at quarter-end. As of October 30, 2020, total debt had been reduced to $124 million.

- Announced distribution of $0.15 per common unit with respect to the third quarter of 2020.

Thomas L. Carter, Jr., Black Stone Minerals' Chief Executive Officer and Chairman commented, "We continued to focus on our core principles of balance sheet strength and active property management during the third quarter. In light of the challenging environment, we substantially reduced our debt levels during the quarter with proceeds from the recent asset sales and retained free cash flow. We are also taking advantage of the relative strength in natural gas prices to aggressively market our extensive acreage positions across the Haynesville Shale and Austin Chalk formations."

Quarterly Financial and Operating Results

Production

Black Stone Minerals reported mineral and royalty volume was 31.1 MBoe/d (69% natural gas) for the third quarter of 2020, compared to 37.5 MBoe/d for the comparable period in 2019. Royalty production for the second quarter of 2020 was 34.0 MBoe/d.

Working interest production for the third quarter of 2020 was 6.9 MBoe/d, and represents decreases of 21% and 40%, respectively, from the levels generated in the quarters ended June 30, 2020 and September 30, 2019. The continued decline in working interest volumes is consistent with the Company's decision in 2017 to farm out its working-interest participation to third-party capital providers.

Total reported production averaged 37.9 MBoe/d (82% mineral and royalty, 73% natural gas) for the third quarter of 2020. Total production was 49.0 MBoe/d and 42.6 MBoe/d for the quarters ended September 30, 2019 and June 30, 2020, respectively.

Realized Prices, Revenues, and Net Income

The Company's average realized price per Boe, excluding the effect of derivative settlements, was $18.18 for the quarter ended September 30, 2020. This is an increase of 27% from $14.37 per Boe for the second quarter of 2020 and a 25% decrease compared to $24.30 for the third quarter of 2019. Realized natural gas prices in the third quarter of 2020 were 97% of the average Henry Hub benchmark price for the quarter, which was consistent with the second quarter of 2020. Realized oil prices for the third quarter of 2020 were 88% of the average West Texas Intermediate ("WTI") benchmark price, a decrease from 106% of WTI in the second quarter of 2020.

Black Stone reported oil and gas revenue of $63.4 million (54% oil and condensate) for the third quarter of 2020, an increase of 14% from $55.7 million in the second quarter of 2020. Oil and gas revenue in the third quarter of 2019 was $109.6 million.

The Company reported a loss on commodity derivative instruments of $21.1 million for the third quarter of 2020, composed of a $21.3 million gain from realized settlements and a non-cash $42.4 million unrealized loss due to the change in value of Black Stone's derivative positions during the quarter. Black Stone reported a loss of $19.2 million and a gain of $24.3 million on commodity derivative instruments for the quarters ended June 30, 2020 and September 30, 2019, respectively.

Lease bonus and other income was $1.4 million for the third quarter of 2020, primarily related to leasing activity in the Haynesville/Bossier play as well as certain surface leases in Polk County, Texas. Lease bonus and other income for the quarters ended June 30, 2020 and September 30, 2019 was $2.0 million and $3.5 million, respectively.

There was no impairment for the quarters ended September 30, 2020 and September 30, 2019.

The Company reported net income of $23.7 million for the quarter ended September 30, 2020, compared to a loss of $8.4 million in the preceding quarter. For the quarter ended September 30, 2019, net income was $70.2 million.

Adjusted EBITDA and Distributable Cash Flow

Adjusted EBITDA for the third quarter of 2020 was $65.5 million, which compares to $72.4 million in the second quarter of 2020 and $96.2 million in the third quarter of 2019. The decrease relative to the prior quarter is primarily attributable to the wider oil differentials discussed above, which are not offset by Black Stone's commodity hedges to WTI prices. Distributable cash flow for the quarter ended September 30, 2020 was $58.8 million. For the quarters ended June 30, 2020 and September 30, 2019, distributable cash flow was $64.4 million and $85.8 million, respectively.

Financial Position and Activities

As of September 30, 2020, Black Stone Minerals had $3.1 million in cash and $147.0 million outstanding under its credit facility. The ratio of total debt at September 30, 2020 to trailing twelve-month Adjusted EBITDA was 0.5x.

During the third quarter of 2020, the Company paid down $176.0 million of outstanding borrowings under its credit facility from the net proceeds of two asset sales and internally-generated cash flow. As of October 30, 2020, $124 million was outstanding under the credit facility and the Company had $2.0 million in cash.

Black Stone and its lenders are currently finalizing the regularly scheduled Fall borrowing base redetermination under the credit facility. The Company expects the borrowing base to be reduced to $400 million from its previous level of $430 million. As part of the redetermination process, Black Stone agreed to increase the interest rate on the credit facility by 25 basis points to LIBOR plus a margin of 2.0 to 3.0 percent. Black Stone is in compliance with all financial covenants associated with its credit facility.

During the third quarter of 2020, the Company made no repurchases of units under the Board-approved $75 million unit repurchase program and issued no units under its at-the-market offering program.

Third Quarter 2020 Distributions

As previously announced, the Board approved a cash distribution of $0.15 for each common unit attributable to the third quarter of 2020. The quarterly distribution coverage ratio attributable to the third quarter of 2020 was approximately 1.9. Distributions will be payable on November 20, 2020 to unitholders of record as of the close of business on November 13, 2020.

Activity Update

Rig Activity

As of September 30, 2020, Black Stone had 29 rigs operating across its acreage position. This is consistent with rig activity on the Company's acreage as of June 30, 2020 and is below the 97 rigs operating on the Company's acreage as of September 30, 2019.

Shelby Trough Update

On May 5, 2020, Black Stone entered into a development agreement with affiliates of Aethon Energy ("Aethon") with respect to the Company's undeveloped Shelby Trough Haynesville and Bossier shale acreage in Angelina County, Texas. The agreement provides for minimum well commitments by Aethon in exchange for reduced royalty rates and exclusive access to Black Stone's mineral and leasehold acreage in the contract area. The agreement calls for a minimum of four wells to be drilled in the initial program year, which begins in the third quarter of 2020, increasing to a minimum of 15 wells per year beginning with the third program year. Aethon plans to drill the first wells under the development agreement in the fourth quarter of 2020.

Black Stone continues to evaluate alternatives to encourage further development activity in the Shelby Trough in San Augustine county through a combination of working with XTO and utilizing the Company's available acreage position and contractual rights to bring in a second operating partner.

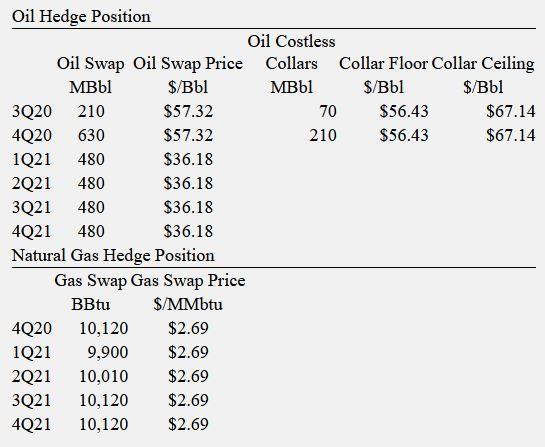

Update to Hedge Position

Black Stone has commodity derivative contracts in place covering portions of its anticipated production for 2020 and 2021. The Company's hedge position as of October 30, 2020 is summarized in the following tables:

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Ark-La-Tex News >>>

-

E&P Company Slash 2024 Capex & Frac Crews by 50%

-

What to Expect From Frac Activity in 2H'23 & 2024 -

-

Top Drilling Contractors Talk 2H '23 and 2024 -

-

Empire Petroleum First Quarter 2023 Results

-

Amplify Energy Corporation First Quarter 2023 Results -