Quarterly / Earnings Reports | First Quarter (1Q) Update | Financial Results | Capital Markets

Bonanza Creek Energy First Quarter 2021 Results

Bonanza Creek Energy, Inc. reported its Q1 2021 results.

Highlights include:

- Initiating an annual cash dividend of $1.40 per share to be payable quarterly beginning in the second quarter 2021

- Closed merger with HighPoint Resources Corporation ("HighPoint") on April 1, 2021

- Average sales volumes for the first quarter 2021 of 20.9 thousand barrels of oil equivalent per day ("MBoe/d") with oil representing 50% of total volumes

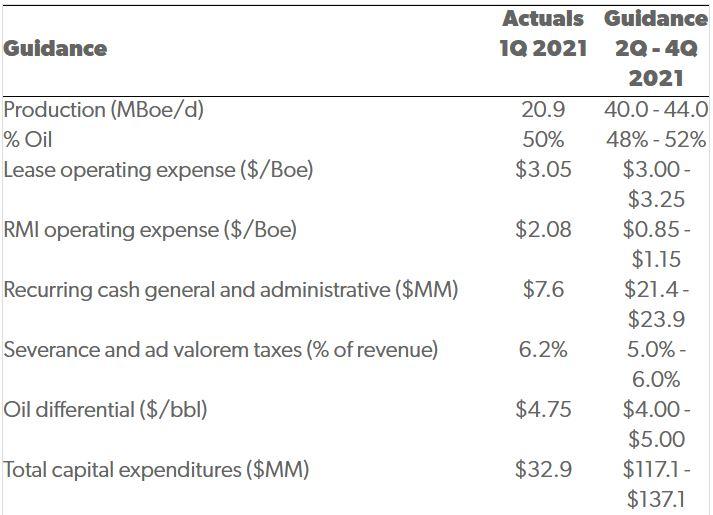

- 2Q - 4Q 2021 production guidance of 40.0 to 44.0 MBoe/d with oil representing 48% to 52% of total volumes

- First quarter 2021 total capital expenditures of $32.9 million

- Total 2021 annual capital expenditures are expected to be between $150 and $170 million

- Lease operating expense ("LOE") of $3.05 per Boe for the first quarter 2021

- 2Q - 4Q 2021 LOE guidance of $3.00 to $3.25 per Boe

- GAAP net loss of $0.1 million

- Adjusted EBITDAX(1) of $43.7 million, or $2.10 per diluted share

- Formation of an ESG Committee of the Board of Directors to assist in fulfilling the Company's responsibilities on a variety of ESG policies, programs, and initiatives

Quarterly Dividend & Capital Discipline Priorities

The Company expects its business plan to produce significant discretionary free cash flow over many years. The Company will pay a sustainable fixed dividend from its free cash flow that is resilient, even in stressed commodity price environments. Cash flow in excess of the fixed dividend will be used to fund a disciplined, returns-driven capital program targeting stable production, maintain the Company's best-in-class balance sheet, and participate in other opportunities aimed at increasing shareholder value.

The Bonanza Creek Board of Directors has established an annual cash dividend of approximately $43 million, or $1.40 per share, to be declared and paid on a quarterly basis. The first fixed dividend is to be paid on June 30, 2021 to shareholders of record at the close of business on June 15, 2021.

Eric Greager, President and Chief Executive Officer of Bonanza Creek, commented, "The decision to initiate a dividend represents a significant milestone for Bonanza Creek. The dividend reinforces our commitment to delivering value to our shareholders. We tested our business at sustained low commodity prices, and the resilient free cash flow and strong balance sheet provide ample flexibility to support this meaningful dividend, while also pursuing other value-accretive opportunities. Free cash flow in excess of our base dividend will be used to maintain our low leverage, and pursue the highest returning opportunities for our shareholders."

First Quarter 2021 Results

During the first quarter of 2021, the Company reported average daily sales of 20.9 MBoe/d. Product mix for the first quarter was 50% oil, 21% NGLs, and 29% residue natural gas. The Company's oil mix fluctuates with the pace, schedule, and thermal maturity of wells that have been turned to sales in recent quarters. The Company had limited activity in 2020 and has seen its oil mix decline in recent quarters, but expects this decline to moderate in 2021 as activity resumes. The table below provides sales volumes, product mix, and average sales prices for the first quarter 2021 and 2020.

| Three Months Ended March 31, | ||||||

| 2021 | 2020 | % Change | ||||

| Avg. Daily Sales Volumes: | ||||||

| Crude oil (Bbls/d) | 10,474 | 13,510 | (22)% | |||

| Natural gas (Mcf/d) | 35,710 | 39,150 | (9)% | |||

| Natural gas liquids (Bbls/d) | 4,424 | 4,801 | (8)% | |||

| Crude oil equivalent (Boe/d) | 20,850 | 24,836 | (16)% | |||

| Product Mix | ||||||

| Crude oil | 50% | 54% | ||||

| Natural gas | 29% | 26% | ||||

| Natural gas liquids | 21% | 20% | ||||

| Average Sales Prices (before derivatives): | ||||||

| Crude oil (per Bbl) | $52.83 | $41.15 | ||||

| Natural gas (per Mcf) | $3.82 | $1.39 | ||||

| Natural gas liquids (per Bbl) | $27.54 | $7.42 | ||||

| Crude oil equivalent (per Boe) | $38.93 | $26.01 | ||||

Capital expenditures were $32.9 million for the first quarter of 2021. At the end of the quarter, the Company turned to sales 9 gross (8.6 net) wells, 6 of which were extended reach lateral ("XRL") wells. Capital expenditures for the first quarter were below our guidance range of $35 to $40 million as a result of lower than budgeted costs on planned activity, and certain non-well activity that will be completed a few weeks later than planned. The Company expects its full-year capital expenditures to be in the range of $150 to $170 million.

Net oil and gas revenue for the first quarter of 2021 was $74.2 million compared to $62.6 million for the fourth quarter of 2020. The increase was a result of higher oil, natural gas, and NGL realized prices, partially offset by a decline in sales volumes. Crude oil accounted for approximately 67% of total revenue for the quarter. Differentials for the Company's oil production increased slightly during the quarter to approximately $4.75 per barrel off NYMEX WTI versus approximately $4.53 per barrel during the fourth quarter of 2020, due to strengthening oil prices. The Company expects its full-year 2021 oil differential to average between $4.00 and $5.00 per barrel.

LOE for the first quarter of 2021 on a per unit basis increased 39% to $3.05 per Boe from $2.20 per Boe in the fourth quarter of 2020. LOE on a per unit basis increased during the first quarter due to declining volumes, and increased expenses related to severe storms during the quarter. The Company's combined LOE guidance for Q2 through Q4 2021 remains at a range of $3.00 to $3.25 per Boe.

RMI net effective cost for the first quarter 2021 was $1.49 per Boe, which consists of $2.08 per Boe of RMI operating expense offset by $0.59 per Boe of RMI operating revenue from working interest partners. RMI operating revenue from working interest partners is based on production volumes, and the fees are not tied to oil or natural gas prices. The Company's RMI operating expense guidance for Q2 through Q4 2021 remains at a range of $0.85 to $1.15 per Boe.

The Company's general and administrative ("G&A") expenses were $9.2 million for the first quarter of 2021, which included $1.6 million in non-cash stock-based compensation. Recurring cash G&A, which excludes non-recurring and non-cash items, of $7.6 million for the first quarter of 2020 increased slightly compared to fourth quarter 2020. On a per-unit basis, the Company's recurring cash G&A increased 27% to $4.07 per Boe in the first quarter of 2021 from $3.20 per Boe in the fourth quarter of 2020. The Company reiterates its recurring cash G&A guidance of $21.4 million to $23.9 million as a combined company in Q2 through Q4 2021.

RMI net effective cost and recurring cash G&A are non-GAAP measures.

Guidance

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Rockies News >>>

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Devon Said To be In Talks to Acquire Enerplus

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans