Drilling & Completions | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Deals - Acquisition, Mergers, Divestitures | Financial Results | Capital Markets | Capital Expenditure

California Resources Corp. Second Quarter 2021 Results

California Resources Corp. reported second quarter 2021 operational and financial results.

Mac McFarland, President and Chief Executive Officer, said: "CRC continued to deliver on its strategy with strong second quarter results driven by robust financial and operational performance, resulting in an increase in 2021 free cash flow1 guidance to $400 to $500 million. Given our financial strength and low stock valuation relative to fundamentals, we are increasing our Share Repurchase Program from $150 million to $250 million. I am also pleased to announce an acquisition of the 90% working interest in the joint venture wells held by our partner as well as a planned divestiture of our non-core Ventura operations. These strategic A&D transactions will simplify our business model, lower our overall operating costs and provide positive net cash proceeds."

Mr. McFarland continued, "We continued to make strides on our ESG strategy and are pleased to announce we have identified approximately one billion metric tons of CO2 permanent storage capacity as well as up to 1,000 megawatts (MW) of front-of-the-meter solar opportunities which will help contribute to the decarbonization of California. As a first step, we are submitting permits for an ~40 million metric ton permanent storage CCS project, Carbon TerraVault I. Further, we are advancing arrangements with SunPower for an initial 12 MW and up to 45 MW of behind-the-meter solar projects.

"I'm also excited to announce the appointment of Nicole Neeman Brady to our Board and look forward to her contributions, particularly on the Sustainability Committee."

Second Quarter 2021 Highlights

Financial

- Reported a net loss attributable to common stock of $111 million, or $1.34 per diluted share. Adjusted net income1 was $78 million, or $0.94 per diluted share

- Generated net cash provided by operating activities of $127 million, adjusted EBITDAX1 of $169 million and free cash flow1 of $77 million

- Closed the quarter with $151 million of cash on hand, an undrawn credit facility and $518 million of liquidity2

- Sustained non-energy operating costs and general and administrative (G&A) expense improvements achieved earlier in 2021

Operational

- Produced an average of 101,000 net barrels of oil equivalent (BOE) per day, including 61,000 barrels per day of oil, with quarterly capital expenditures of $50 million

- Operated two drilling rigs in the San Joaquin Basin and drilled 21 wells (21 online in 2Q21)

- Operated 35 maintenance rigs

- Completed 48 capital workovers

Transactional

- Signed agreements to divest operations in the Ventura basin for total cash consideration of up to $102 million plus additional earn-out consideration that is linked to future commodity prices

- Post quarter end, acquired the working interest in the joint venture wells held by Macquarie Infrastructure and Real Assets, Inc. ("MIRA") for $53 million

- Post quarter end, filing permits for an ~40 MMT CO2 permanent storage CCS project, Carbon TerraVault I

- Advancing a 12 MW behind-the-meter solar project with SunPower for CRC's Mt. Poso field which is expected to be Low Carbon Fuel Standard ("LCFS") eligible; construction is expected to begin in early 2022

Guidance

- Raised 2021 free cash flow1 guidance to $400 to $500 million

- Optimized CRC investment dollars by shifting an additional $20 million from drilling and completions to downhole maintenance projects which provide efficiencies and faster payouts

- Raised the Share Repurchase Program ("SRP") to $250 million from $150 million; repurchased 1.4 million shares for $45 million in 2Q21

2021 Guidance & Capital Program

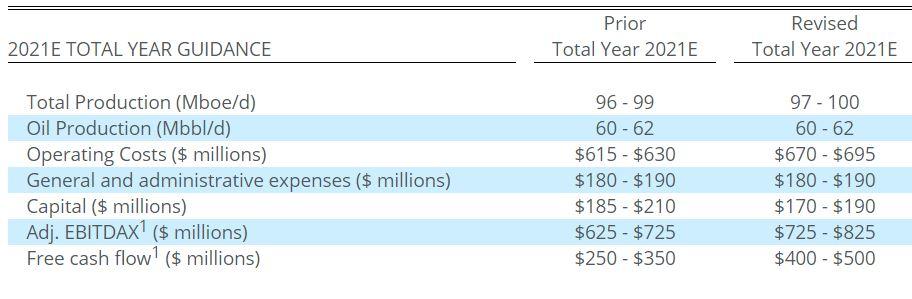

Given the strength of the second quarter results, CRC has raised its full year 2021 free cash flow1 guidance to $400 to $500 million from $250 to $350 million, adjusted EBITDAX1 guidance to $725 to $825 million from $625 to $725 million and production guidance to 97 to 100 MBOE per day from 96 to 99 MBOE per day. Recognizing capital efficiency improvements and faster payouts on downhole maintenance projects, CRC revised its full year 2021 operating cost and capital guidance by shifting an additional $20 million of drilling capital to these opportunities. In addition to this shift from capital to operating costs, an increase in natural gas prices further raises expected operating costs by approximately $35 million, which is more than offset by increased natural gas revenues as CRC is net long natural gas on the whole. These two items result in revised full year 2021 capital guidance of $170 to $190 million from $185 to $210 million and revised full year 2021 operating cost guidance of $670 to $695 million from $615 to $630 million.

CRC made $77 million of capital investments in the first half of 2021. The current capital program anticipates that CRC will maintain a consistent level of investment throughout the remainder of the year. If commodity prices decline significantly from current levels. CRC may need to decrease the size of its capital program in response to market conditions. The Company's capital program will be dynamic in response to oil market volatility while focusing on maintaining its oil production, strong liquidity and maximizing its free cash flow.

Increasing the Share Repurchase Program

In August 2021, CRC's Board of Directors increased the Share Repurchase Program by $100 million to $250 million through March 31, 2022.

Acquisitions and Divestitures

In the second quarter of 2021, CRC entered into agreements to sell its Ventura basin operations for expected cash consideration of up to $102 million plus additional earn-out consideration that is linked to future commodity prices. The consideration includes $82 million of cash to be paid at closing and up to $20 million of potential additional consideration if the buyer does not perform certain abandonment obligations with respect to the divested properties. These transactions will simplify CRC's business model, lower its overall operating costs and decrease its asset retirement obligations. For the three months ending June 30, 2021, CRC's Ventura basin operations were producing 3,600 BOE per day (~65% oil). The closing of the transaction is subject to customary closing conditions, including satisfaction of land and environmental due diligence and third-party consents.

In August 2021, CRC continued to demonstrate its focus on core areas by acquiring the 90% working interest in the joint venture wells held by MIRA for $53 million, before transaction costs. The acquisition of MIRA's working interest would have added oil production of 1,600 BOE per day (~100% oil) for the first half of 2021 with minimal integration costs and underground risk.

CRC's full year guidance will be updated upon the closing of the Ventura basin transactions which are expected in the second half of 2021.

Sustainability Update

According to internal and third party estimates, CRC has some of the lowest carbon intensity production in the U.S. CRC aims to build upon this position through investment in decarbonization projects and other emissions reducing projects to help advance energy transition in California. As part of an initial review, CRC has the potential to permanently store up to 1 billion metric tons of CO2 in its oil and gas reservoirs as well as the opportunity to generate 300 to 1,000 MW of front-of-the-meter solar power for the grid by utilizing CRC's vast surface land footprint. In addition to these opportunities, CRC has the potential for up to 45 MW of behind-the-meter solar development projects with its partner SunPower.

Building on CRC's carbon capture opportunity, CRC is applying for Class VI EPA permits for a project with a capability of up to 40 million metric tons of permanent CO2 storage, referred to as Carbon TerraVault I. Injection for this project could begin in the 2025 time frame with the injection of approximately 1 million metric tons per year, equivalent to the annual emissions of approximately 200,000 passenger vehicles. CRC is proud to be a first mover of CCS operations in California and to help the state make progress on its carbon neutrality goals.

CRC has a dedicated Sustainability Committee chaired by William B. Roby, with members Nicole Neeman Brady and Andrew B. Bremner along with a dedicated corporate function under the executive leadership of Chris Gould as EVP and Chief Sustainability Officer.

Board Enhancement

On August 5, 2021, CRC's Board of Directors elected one new Board member, Nicole Neeman Brady.

Ms. Neeman Brady has over 20 years of experience as an entrepreneur, executive, investor and community leader with global water, energy, and agricultural expertise. She serves as the Chief Executive Officer and a director of Sustainable Development Acquisition Corp. since December 2020. She also served as Principal and Chief Operating Officer at Renewable Resources Group LLC, as well as a member of the Investment Committee and a board member of several of its portfolio companies. Her experience also includes a deep understanding of and passion for the public sector, including board service on the Colorado River Board of California and currently, as a Commissioner on the Los Angeles Department of Water and Power, a Board member of Blue Ocean Mariculture and a Board member of the Library Foundation of Los Angeles.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

West Coast News >>>

-

Kosmos Energy Ltd. First Quarter 2023 Results

-

California Resources Corporation First Quarter 2023 Results -

-

Berry Corporation First Quarter 2023 Results -

-

CPP Investments to acquire 49% stake in Aera Energy -

-

California Resources Third Quarter 2022 Results -