Drilling & Completions | Quarterly / Earnings Reports | First Quarter (1Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

Callon Petroleum First Quarter 2021 Results

Callon Petroleum Co. reported results of operations for the three months ended March 31, 2021.

First Quarter 2021 and Recent Highlights:

- Delivered production of approximately 81.0 MBoe/d (64% oil) in the first quarter of 2021

- Generated net cash provided by operating activities of $137.7 million and adjusted free cash flow1 of $24.2 million

- Net loss of $80.4 million, or $1.89 per diluted share, driven primarily by a loss on derivative contracts of $214.5 million, adjusted EBITDA1 of $170.6 million, and adjusted income1 of $70.0 million, or $1.49 per diluted share

- Achieved an operating margin of $33.46 per Boe, a 58% increase from the previous quarter

- Entered into purchase and sale agreements for certain non-core Delaware Basin properties for aggregate proceeds of approximately $40 million

- Completed the spring redetermination of Callon's senior secured credit facility with the borrowing base and elected commitment reaffirmed at $1.6 billion with unanimous lender support

- Executed Callon's first E-frac of a multi-well, multi-zone pad in the Midland Basin powered by field-produced natural gas

Joe Gatto, President and Chief Executive Officer commented, "The first quarter showcased our team's highly efficient resource development model and operating cost management, underpinned by consistent well performance from our multi-zone, life of field development program. We continued to generate positive free cash flow, even with the effects of the extreme winter weather significantly impacting our production for the quarter. In addition to further reducing the outstanding balance on our credit facility, we recently entered into purchase and sale agreements for non-core Western Delaware Basin acreage for estimated proceeds of approximately $40 million as we methodically advance our monetization goals in an improving market environment. We remain steadfast in our commitment to disciplined rates of capital reinvestment and see a clear path to an accelerated pace of absolute debt reduction and credit metric improvements in the coming quarters."

He continued, "We recently issued our annual meeting proxy statement which outlined the extensive realignment of both our short and long-term compensation programs with critical elements of sustainability and corporate level returns. In addition, we outlined a targeted 40% to 50% in greenhouse gas emissions reductions, including the elimination of all routine field flaring, which we expect to achieve by 2025. We will provide valuable additional disclosure regarding our environmental, social and governance performance and initiatives in our 2021 sustainability report which we expect to issue in June."

Sale of Delaware Basin Assets

During April, Callon executed purchase and sale agreements covering certain non-core assets in the Delaware Basin. Aggregate proceeds for the combined transactions are approximately $40 million. The transactions are primarily comprised of natural gas producing properties in the Western Delaware Basin and also include a small undeveloped acreage position. Current production related to the divestitures are approximately 3,400 Boe/d (~25% oil). The pending transactions will result in an improvement in operating margins and have a de minimis impact on forecasted corporate free cash flow generation.

Credit Facility and Liquidity

Callon recently completed the spring redetermination for its senior secured credit facility. The borrowing base and elected commitment were both reaffirmed at $1.6 billion. As of March 31, 2021, the drawn balance on the facility was $950.0 million and cash balances were approximately $25 million.

Operations Update

At March 31, 2021, Callon had 1,510 gross (1,333.9 net) wells producing from established flow units in the Permian and Eagle Ford. Net daily production for the three months ended March 31, 2021 was 81.0 MBoe/d (64% oil) reflecting an estimated 8 MBoe/d impact from winter storm Uri during the quarter.

For the three months ended March 31, 2021, Callon drilled 18 gross (16.4 net) wells and placed a combined 14 gross (13.3 net) wells on production. Wells placed on production during the quarter were completed in the Eagle Ford in South Texas and the Wolfcamp A, B, and C in the Delaware Basin. The Company expects to operate an average of three drilling rigs throughout the remainder of 2021 and will average just over two completion crews through the second quarter before reducing to one completion crew during the third quarter.

During the first quarter, Callon focused early completion activity on the Eagle Ford with ten gross wells completed and placed on production during the quarter, including the Gardendale four-well pad which averaged more than 12,000 feet per lateral. Towards the end of the quarter, the Company initiated its first completion utilizing an all-electric frac fleet. In total, the project deployed more than 160 completion stages across three wells targeting the Lower Spraberry, Wolfcamp A, and Wolfcamp B in the Midland Basin. The fleet was powered using field-produced natural gas from Callon's local gathering system, resulting in the avoidance of more than 270,000 gallons of diesel fuel usage.

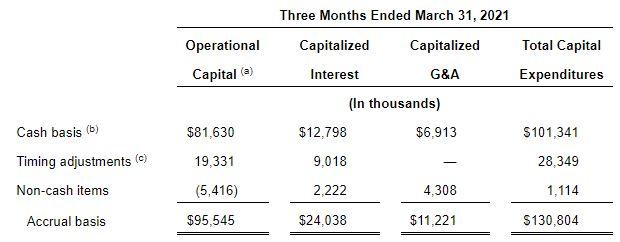

Capital Expenditures

For the three months ended March 31, 2021, Callon incurred $95.5 million in operational capital expenditures on an accrual basis. Total capital expenditures, inclusive of capitalized expenses, are detailed below on an accrual and cash basis:

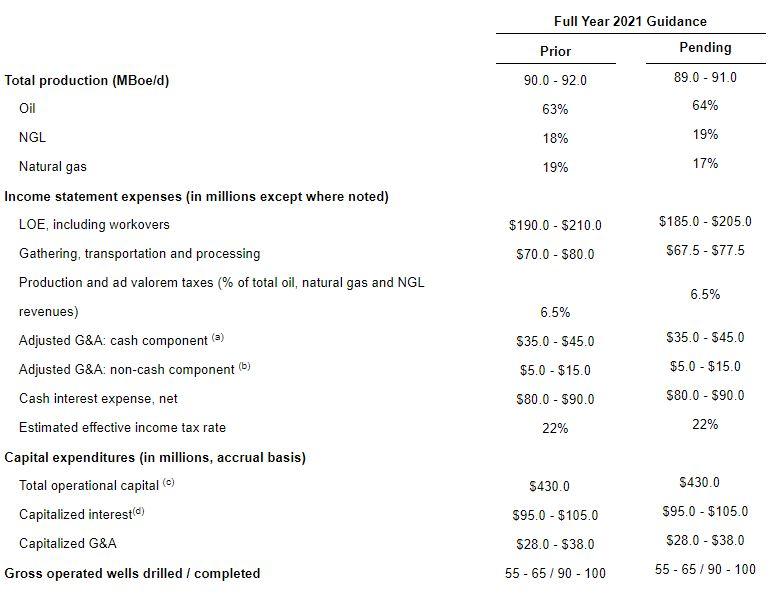

Guidance

For the second quarter, including the impact of the pending divestitures expected to close by early June, the Company expects to produce between 88.0 and 89.5 MBoe per day (64% oil). In addition, Callon projects an operational capital spending level of between $135 and $145 million on an accrual basis, resulting in approximately 55% of the 2021 annual capital budget allocated to first half activity. Full year 2021 guidance has been updated below, pending the closing of the announced Delaware asset divestitures.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -