Well Lateral Length | Fourth Quarter (4Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Program-Rig Count | Capital Expenditure - 2021

Centennial Ramps Up Drilling 65% for 2021; Production to Fall 10% YOY

Centennial Resource Development, Inc. announced 2020 financial and operational results and 2021 operational plans and targets.

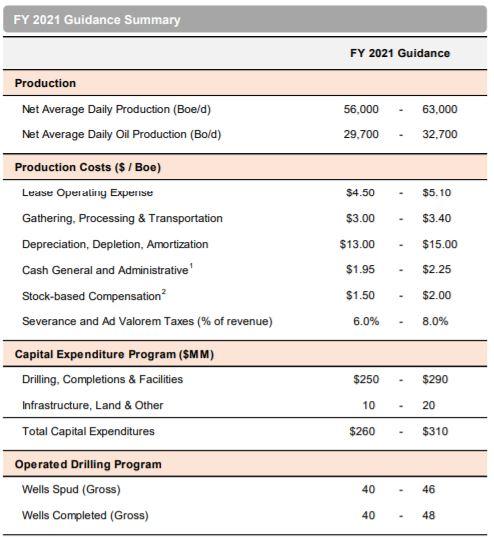

2021 Plan

- Capex: $260-310 million - up 12% at the midpoint vs. 2020 levels of $255MM

- D&C: $350-290 million

- Land & Other: $10-20 million

- Production: 56-63 MBOEPD - down 10% from full year 2020 output

- Oil Production: 29.7-32.7 MBOPD - down 13% from full year 2020

- Wells Spud: 40-46 gross wells - up 65% vs. 2020

- Wells Completed: 40-48 gross wells - up 42% vs. 2020

- During 2021, Centennial anticipates that approximately 70% of its completions will occur in Lea County, New Mexico, with the remaining portion allocated to its Reeves County, Texas position.

- Rig Count: 2 rigs running

The Company expects its average completed lateral length for the full year to increase 17% to approximately 8,800 feet compared to the prior year, driving further capital efficiency improvements.

CEO Sean Smith said: "Our capital plan will position Centennial to be free cash flow positive, while improving our leverage metrics during 2021. Ultimately, we expect to end the year with a net debt-to-LTM EBITDAX2 ratio below 2.5x, assuming current strip pricing."

Q4 / Full Year 2020 Results

Financial and Operational Highlights

- Generated free cash flow and reduced total debt for the second consecutive quarter

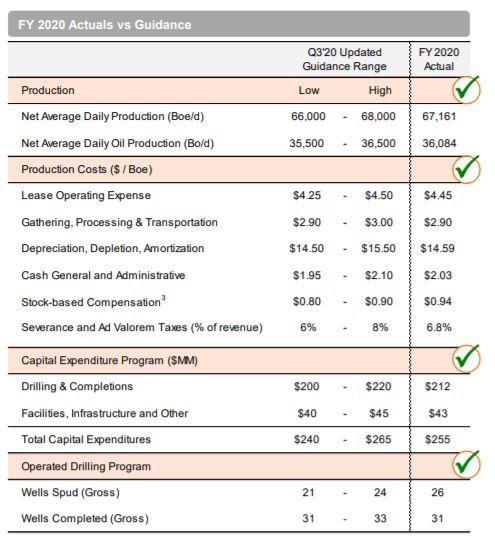

- Reported 2020 production volumes, capital expenditures and total unit costs within full year guidance ranges

- Achieved record spud-to-total depth time for a two-mile lateral

- Increased year-over-year acreage position primarily through cost-free swaps and trades

Financial Results

For the full year, Centennial reported a net loss of $682.8 million, or $2.46 per diluted share, driven primarily by a non-cash impairment charge incurred during the first quarter in addition to historically low oil prices during a portion of the year as a result of the COVID-19 pandemic. Full year results compare to net income of $15.8 million, or $0.06 per diluted share, in the prior year. For the fourth quarter, the Company reported a net loss of $88.7 million, or $0.32 per diluted share, compared to net income of $9.6 million, or $0.03 per diluted share, in the prior year period. As a result of higher realized commodity prices and continued cost discipline, the Company generated net cash from operating activities of $41.1 million and free cash flow1 of $29.0 million in the fourth quarter of 2020.

Full year total equivalent production averaged 67,161 barrels of oil equivalent per day ("Boe/d") compared to 76,072 Boe/d in the prior year. Average daily crude oil production during the full year was 36,084 barrels of oil per day ("Bbls/d") compared to 42,692 Bbls/d in the prior year. For the fourth quarter, crude oil production averaged 30,196 Bbls/d, in-line with Company expectations as no new wells were placed on production during the quarter.

CEO Sean Smith said: "We added a second rig in December and are excited to resume operational activity. Importantly, our team continues to drive higher efficiencies in the field which will remain a key focus for us in 2021. Coupled with current strip pricing, our reduced cost structure, lower well costs and shallower base decline rate set us up for free cash flow generation this year. We expect to organically de-lever the balance sheet and end the year in a stronger financial position."

Recent Winter Weather Impacts

The severe winter weather which recently affected millions of Americans across Texas and other states also impacted Centennial's employees and operations. While the Company continues to assess developments in the field, Centennial recently regained full electric power to its operations and is in the process of placing wells back on production. As a result of these events and the expected timing of operational activity, Centennial expects its first quarter 2021 production levels to decline compared to the previous quarter. The Company expects a modestly increasing quarterly production profile for the remainder of the year.

"Our employees and their families' well-being remain our top priority, and I would like to personally thank our team members in the field for their hard work and dedication over the past two weeks," said Smith. "While the recent winter weather and associated power outages significantly impacted our operations, we now have the majority of our production back online and expect to restore the remaining portion by the end of this week."

Fourth Quarter Operational Results

Centennial operated one drilling rig for a majority of the fourth quarter and added a second drilling rig and commenced completion activity in late December. The Company spud seven wells during the quarter, which was higher than anticipated due to drilling efficiencies.

"Our operations team continues to build upon the efficiencies gained last year. During the fourth quarter, we set a new Company drilling record, reaching spud-to-total depth on a two-mile lateral in just under eight days," said Smith. "These reduced cycle times and structural cost reductions have driven a material reduction in well costs and are evidenced by our year-to-date 2021 completions, which consist of six wells with an average gross cost of approximately $790 per lateral foot."

Additionally, Centennial has placed a heightened focus on reducing the volume of natural gas flared at its production locations. During the fourth quarter, Centennial's flaring rate was 0.5% of total gross operated gas production. "Gas capture will continue to be an ongoing priority, and for 2021, we have set a flaring target of 1%," said Smith.

Total capital expenditures incurred for the quarter were $29.9 million. Fourth quarter drilling and completion capital expenditures totaled $24.1 million and included higher activity than originally anticipated due to continued drilling efficiencies. The remaining $5.8 million was primarily spent on facilities and infrastructure. For the full year, total capital expenditures were $254.8 million, of which nearly 70% was incurred in the first quarter.

Acreage Position Update

In 2020, Centennial increased its acreage position by approximately 3,500 net acres primarily through cost-free acreage swaps and trades, further adding high-quality inventory to its portfolio. As of December 31, 2020, Centennial's Delaware Basin position totaled 81,657 net acres, which is allocated between Texas (71%) and New Mexico (29%). During the year, the Company increased its New Mexico position by 27% to approximately 23,900 net acres. Notably, these additions were comprised almost entirely of state and fee acreage. As a result, the Company's net acreage located on Federal lands is now approximately 4% of its overall Delaware Basin position, representing a slight reduction from the prior year.

Year-End 2020 Proved Reserves

Centennial reported year-end 2020 total proved reserves of 299 MMBoe compared to 301 MMBoe in the prior year. The modest decrease from the prior year was primarily attributable to lower SEC pricing, which was largely offset by the Company's lower DC&F and operating costs that resulted in significant reserve additions during the year. At year-end 2020, proved reserves consisted of 50% oil, 30% natural gas and 20% natural gas liquids. Proved developed reserves were 149 MMBoe (50% of total proved reserves) as of December 31, 2020. For 2020, Centennial's organic reserve replacement ratio was 91%. The Company's 2020 proved developed finding and development cost totaled $11.48 per Boe. Centennial's drill-bit finding and development cost was $13.53 per Boe for 2020. Centennial had a standardized measure of discounted future net cash flows of $1.2 billion at December 31, 2020. The present value at 10% ("PV 10%", a non-GAAP financial measure reconciled within the Appendix) of Centennial's total proved reserves was also $1.2 billion at year-end.

Netherland Sewell & Associates, Inc., an independent reserve engineering firm, prepared Centennial's year-end reserves estimates as of December 31, 2020. (For additional information relating to our reserves, in addition to an explanation of how we calculate and use the organic reserve replacement ratio and finding and development costs, please see the Appendix of this press release.)

Capital Structure and Liquidity

During the quarter, the Company used a portion of its operating cash flow to pay down $25 million in borrowings under its credit facility. As of December 31, 2020, Centennial had approximately $6 million in cash on hand and $330 million of borrowings outstanding under its revolving credit facility. As a result, Centennial's total liquidity position increased by approximately $25 million from the prior quarter to end the year at $340 million, which is based on its $700 million borrowing base, borrowings outstanding, the availability blocker of $32 million and $4 million in current letters of credit outstanding, plus cash on hand.

Hedge Position

For the full year 2021, Centennial has a total of 14,595 Bbls/d of oil hedged, consisting of approximately 85% fixed price swaps. For 2021, the Company currently has 9,734 Bbls/d and 2,870 Bbls/d of oil hedged at weighted average fixed prices of $43.70 per barrel WTI and $50.57 per barrel Brent, respectively. Also for 2021, the Company has 1,990 Bbls/d of WTI oil collars in place with a weighted average floor and ceiling price of $41.13 per barrel and $49.58 per barrel, respectively. Notably, a majority of the Company's oil hedges is weighted towards the first half of 2021. Centennial's oil production is currently unhedged in 2022 and beyond. In addition, Centennial has certain crude oil basis swaps in place for 2021 and certain natural gas hedges in place for 2021 and 2022. (For a summary table of Centennial's derivative contracts as of February 19, 2021, please see the Appendix to this press release.)

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian - Delaware Basin News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?