Drilling & Completions | Production | Exclusives / Features | Drilling Activity | Drilling Program-Rig Count

Chesapeake's Latest Haynesville Activity: Rigs, Production, Drilling

As part of Shale Experts' June update for the Haynesville Shale play, we took a look at Chesapeake's latest activity in the play.

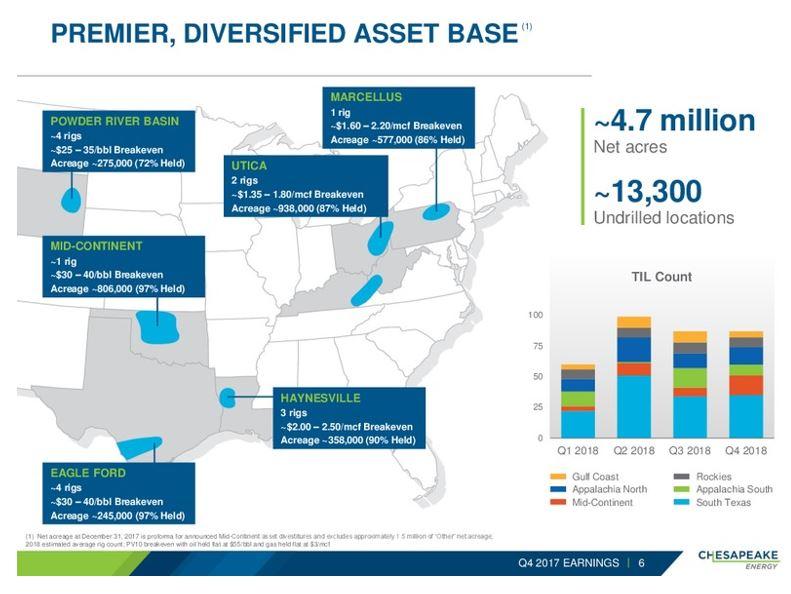

In the Haynesville Shale in Louisiana, Chesapeake is currently utilizing three drilling rigs and placed four wells on production during the 2018 first quarter and expects to place eight wells on production during the 2018 second quarter and up to 25 wells for the full-year 2018.

In the Bossier Shale, in Louisiana, our first 10,000-foot lateral has cumulative production of 4 billion cubic feet in its first 150 days of production, averaging more than 27 million cubic feet per day and making it the best Bossier well per foot of lateral drill. In the Haynesville, we successfully drilled and completed our first 15,000-foot lateral well and placed that well on production yesterday.

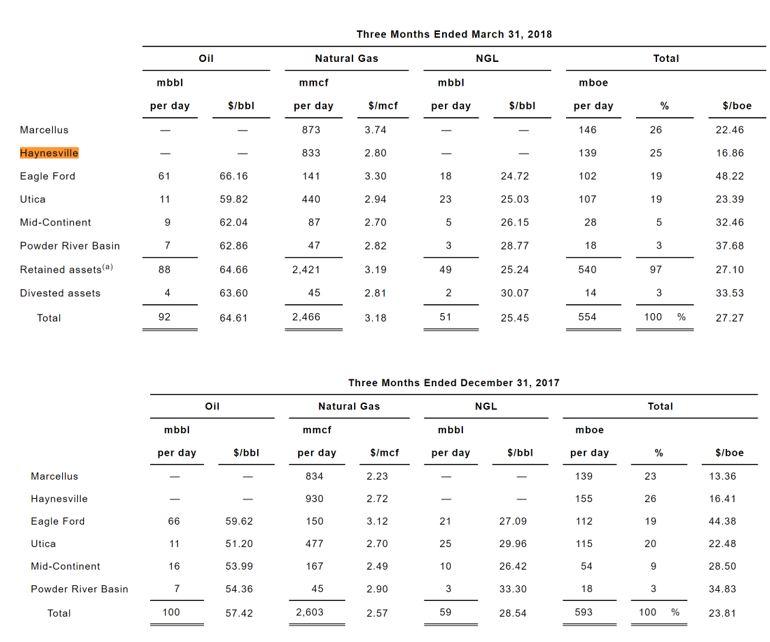

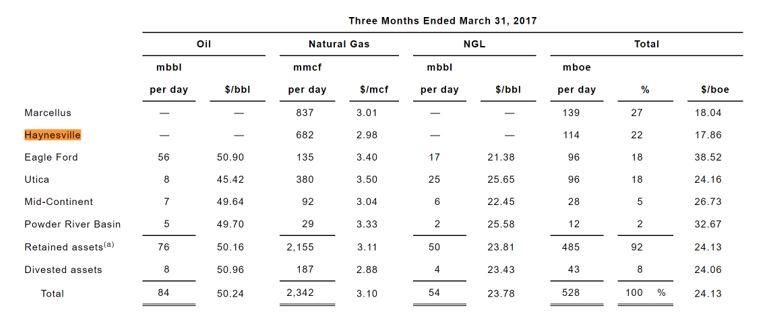

Latest Production Numbers

Charles A. Meade - Johnson Rice & Co. LLC

Frank, that's really helpful operational detail. I appreciate all that. And then, Doug, if I could go back to something in your prepared comments. You talked about a Bossier well. I believe you said it did 4 bcf in 100 days and was averaging $27 million a day for that time period. Can you talk about where in your kind of Haynesville/Bossier footprint that is, and how that result compares with your typical Haynesville, or perhaps your best Haynesville kind of results?

Robert Douglas Lawler - Chesapeake Energy Corp.

You bet. Yeah. We're excited about that opportunity. And as we highlight in many of our areas, the completion technologies and drilling technologies that have resulted in a lot of operational and profitability improvements, we want to make sure we highlight what other stratigraphic intervals also provide material upside to the company as we go forward in our development program. So, specific to the Bossier, I'll turn that to Frank and Jason to comment on some of the details there.

Jason M. Pigott - Chesapeake Energy Corp.

Yeah. This is Jason. I mean, the Bossier wells in the south side of the field there, I mean, we go from Haynesville strong in the north to the Bossier picks up as we go towards the south there. So, that's a unique test there. We're just trying to prove up it. We pumped a very large frac on that. I think it was 4,000 pounds per foot or something. It was a big frac, just to try to get the maximum productivity out of the Bossier that we can. So, we're excited about that.

We're equally excited. We've just TD'd and about to put online our first 15,000-foot Haynesville well to the north. So, that's something that we're really proud of the technical capabilities of our teams and what they can accomplish there as some operators struggle to get to 10,000 feet. That's become the normal for us, and we've now tested, or are about to put online our first 15,000-foot well. So, lots of great things still going on in the Haynesville and trying to continue to optimize and improve our economics and the value of that asset every day.

Marshall Hampton Carver - Heikkinen Energy Advisors LLC

Yes. Thank you. You had a pretty significant drop in Haynesville production from Q4 to Q1. Do you have any color on that?

Frank J. Patterson - Chesapeake Energy Corp.

This is Frank again. What we've done is, basically in all the fields, one of the lessons learned is that trying to align the drilling rigs with the completion crews to create the most efficient logistics stream we can possibly create. So, that's just a situation where we're running three rigs. We're running basically a completion crew, two completion crews right now following those rigs. We've also tried to align in most of our gas fields, because the price of gas has dropped, as you're very aware, with our firm transportation. And so we're just lining that out. We will see the asset basically running at about our firm transportation rate. And that's an asset where if gas price reacts, that's where we can react and drive more gas into the system as needed.

Domenic J. Dell’Osso - Chesapeake Energy Corp.

And, Marshall, this is Nick. Just to add on to that. We only turned in line four wells in the Haynesville in the quarter as we align those operational efforts and get our logistics revised to reduce costs as much as possible and be as efficient as possible. So, as we work through our capital allocation process, as I noted in my prepared notes for the call this morning, we are driving for an optimal allocation to gas, which in today's commodity price environment is not terribly high.

And we are going to be as efficient with our capital as possible. And so, again, a bit of lumpiness there in the turn-in-line schedule. There'll be more wells turned in line in the Haynesville as we move throughout the year. But it's about capital efficiency, and it's about allocating capital across the portfolio, where we frankly don't have a need to invest as much in gas with the gas strip where it is today.

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024 -

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Capex Plans Jump After 2Q: Nearly 30 E&P Companies Raise 2022 Budgets -

-

HAL, SLB 2Q: Double-Digit Revenue Gains, Strengthened Outlooks -

-

2022 Guidance Growth: Several Operators Bolster Capex, Production Outlook -

Ark-La-Tex - North Louisiana News >>>

-

Range Resources Second Quarter 2020 Results

-

Range Adding Two SailingStone-Approved Members to Board; Searches for New EVP

-

Amplify Energy Hires Two New Execs -

-

Vine Doubles Haynesville Production; Drilling, Frac and Maps -

-

Comstock Details Latest Haynesville Drilling Activity as Output Continues to Rise