Drilling & Completions | Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Hedging | Capital Markets

Cimarex Energy Fourth Quarter, Full Year 2020 Results

Cimarex Energy Co. reported its Q4 / full year 2020 results.

Financials

Cimarex reported net income for fourth quarter 2020 of $24.7 million, or $0.25 per share, compared to a net loss of $384.1 million, or $3.87 per share, in the same period a year ago. For the full year, Cimarex reported a net loss of $1,967.5 million, or $19.73 per share, compared to 2019 net loss of $124.6 million, or $1.33 per share. Both fourth quarter and full year results were negatively impacted by a non-cash charge related to the impairment of oil and gas properties. Fourth quarter 2020 adjusted net income (non-GAAP) was $91.3 million, or $0.89 per share, compared to adjusted net income (non-GAAP) of $120.4 million, or $1.18 per share in the same period a year ago1. Full year 2020 adjusted net income (non-GAAP) was $142.2 million, or $1.39 per share, compared to $448.8 million, or $4.46 per share in 20191. Adjusted cash flow from operations (non-GAAP) was $256.6 million in fourth quarter 2020 compared to $416.0 million in the same period a year ago1. Full year 2020 adjusted cash flow from operations (non-GAAP) was $944.2 million compared to $1.46 billion in 20191.

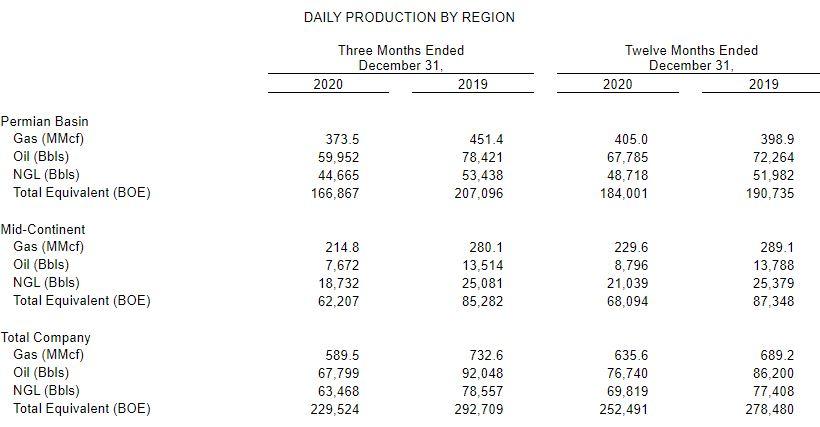

Oil volumes in the fourth quarter were sequentially lower, averaging 67.8 thousand barrels (MBbls) per day. For the full year, Cimarex reported average daily oil volumes of 76.7 MBbls, an 11 percent year-over-year decrease. Cimarex produced 229.5 thousand barrels of oil equivalent (MBOE) per day in the fourth quarter and averaged 252.5 MBOE per day for the year.

In the fourth quarter realized oil prices averaged $40.09 per barrel, down 27 percent from the $54.80 per barrel received in the fourth quarter of 2019. Realized natural gas prices averaged $1.69 per thousand cubic feet (Mcf), up 42 percent from the fourth quarter 2019 average of $1.19 per Mcf. NGL prices averaged $14.02 per barrel, down one percent from the $14.13 per barrel received in the fourth quarter of 2019. For the full year, Cimarex realized $35.59 per barrel of oil, down 33 percent from 2019, $1.05 per Mcf of natural gas and $10.53 per barrel of NGLs sold.

Realized oil and natural gas price differentials to WTI Cushing and Henry Hub improved year-over-year. Our realized Permian oil differential to WTI Cushing averaged $(3.74) per barrel in 2020 compared to $(4.48) in 2019. For the year, Cimarex's average differential on its Permian natural gas production was $(1.39) per Mcf compared to the Henry Hub index versus $(2.14) per Mcf in 2019. Cimarex's 2020 realized gas price differential in the Mid-Continent region was $(0.41) per Mcf compared to Henry Hub versus $(0.68) in 2019.

Cimarex invested a total of $577.2 million in 2020, which includes exploration and development capital (E&D) of $544.9 million, $20.8 million to saltwater disposal and $11.5 million to midstream and other investments. E&D capital is comprised of $417.4 million attributable to drilling and completion (D&C) activities and $127.5 million for capitalized interest and overhead, production capital and leasehold acquisition. Capital investments were funded with cash flow from operations.

Proved reserves at December 31, 2020 totaled 531 million barrels of oil equivalent (MMBOE), down 14 percent year over year. The decrease in proved reserves resulted from a reduction in drilling activity and negative price related revisions, both due to lower commodity prices. Cimarex added 57 MMBOE through extensions and discoveries while revisions reduced proved reserves by 52 MMBOE. Production for 2020 totaled 92 MMBOE. Proved reserves are 84 percent proved developed.

Total debt at December 31, 2020 consisted of $2.0 billion of long-term notes. Cimarex had no borrowings under its revolving credit facility and a cash balance of $273.1 million at year-end.

Cimarex repurchased and canceled 34,335 shares (55 percent) of the outstanding 8.125% Series A Cumulative Perpetual Convertible Preferred Stock in the fourth quarter, for a total consideration of $43.5 million including accrued and unpaid dividends.

Operations Update

Cimarex invested $577.2 million in 2020 including $417.4 million (72 percent) of D&C capital. Also included is $20.8 million to saltwater disposal assets and $11.5 million to midstream. Of the $577.2 million, 93 percent was invested in the Permian region and seven percent in the Mid-Continent.

During 2020, Cimarex participated in the drilling and completion of 149 gross (51.0 net) wells. At year-end, 77 gross (39.6 net) wells were waiting on completion, of which 25 gross (0.5 net) were in the Mid-Continent and 52 gross (39.1 net) were in the Permian. Cimarex is currently operating six drilling rigs and two completion crews.

|

WELLS BROUGHT ON PRODUCTION BY REGION |

||||||||||||

|

Three Months Ended |

Twelve Months Ended |

|||||||||||

|

2020 |

2019 |

2020 |

2019 |

|||||||||

|

Gross wells |

||||||||||||

|

Permian Basin |

33 |

31 |

92 |

131 |

||||||||

|

Mid-Continent |

14 |

16 |

57 |

160 |

||||||||

|

47 |

47 |

149 |

291 |

|||||||||

|

Net wells |

||||||||||||

|

Permian Basin |

15.9 |

22.5 |

48.1 |

75.5 |

||||||||

|

Mid-Continent |

1.2 |

0.5 |

2.9 |

16.6 |

||||||||

|

17.1 |

23.0 |

51.0 |

92.1 |

|||||||||

Permian Region

Production from the Permian region averaged 166.9 MBOE per day in the fourth quarter, or 73 percent of total company volumes. Oil volumes averaged 60.0 MBbls per day, 88 percent of total company oil volumes. For the full year, production averaged 184.0 MBOE per day, 73 percent of total company volumes with Permian oil representing 88 percent of Cimarex's oil volumes in 2020.

Cimarex brought 33 gross (15.9 net) wells on production in the Permian during fourth quarter, bringing the total wells brought on production in 2020 to 92 gross (48.1 net). About 97 percent of our operated wells were drilled from multi-well pads and our average lateral length on our operated wells brought on production in the Permian was 9,268 feet in 2020. Cimarex is currently operating five drilling rigs and two completion crews in the region.

Mid-Continent Region

Production from the Mid-Continent averaged 62.2 MBOE per day for the fourth quarter, down 27 percent from fourth quarter 2019 and down 10 percent sequentially. Oil volumes averaged 7.7 MBbls per day and represented 11 percent of the company's total oil volume in the quarter. For the full year, production averaged 68.1 MBOE per day, down 22 percent year over year. Oil volumes averaged 8.8 MBbls per day in 2020, down 36 percent year over year.

Wells brought on production during the fourth quarter totaled 14 gross (1.2 net) in the Mid-Continent region, bringing the total wells brought on production in 2020 to 57 gross (2.9 net). At the end of the quarter, 25 gross (0.5 net) wells were waiting on completion. Cimarex is currently operating one drilling rig in the region.

Production by Region

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

Mid-Continent News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Mid-Continent - Anadarko Basin News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?