General News | Capital Markets | Capital Expenditure | Oil & Gas Prices | Corporate Strategy | Capital Expenditure - 2021

Dallas Fed Survey: Firms Bet '21 Capex on $44/Bbl WTI; 2022 Outlook, Energy Shift

The Federal Reserve Bank of Dallas released the results of its latest survey, where E&P and service companies detailed their outlooks regarding commodity prices, business strategy and more.

Quick Takeaway:

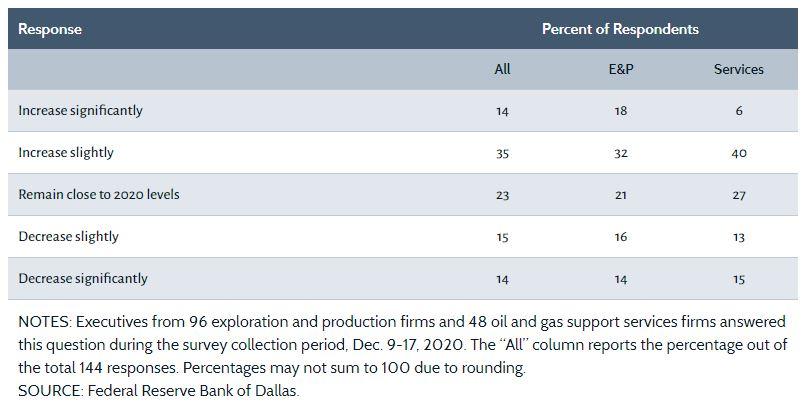

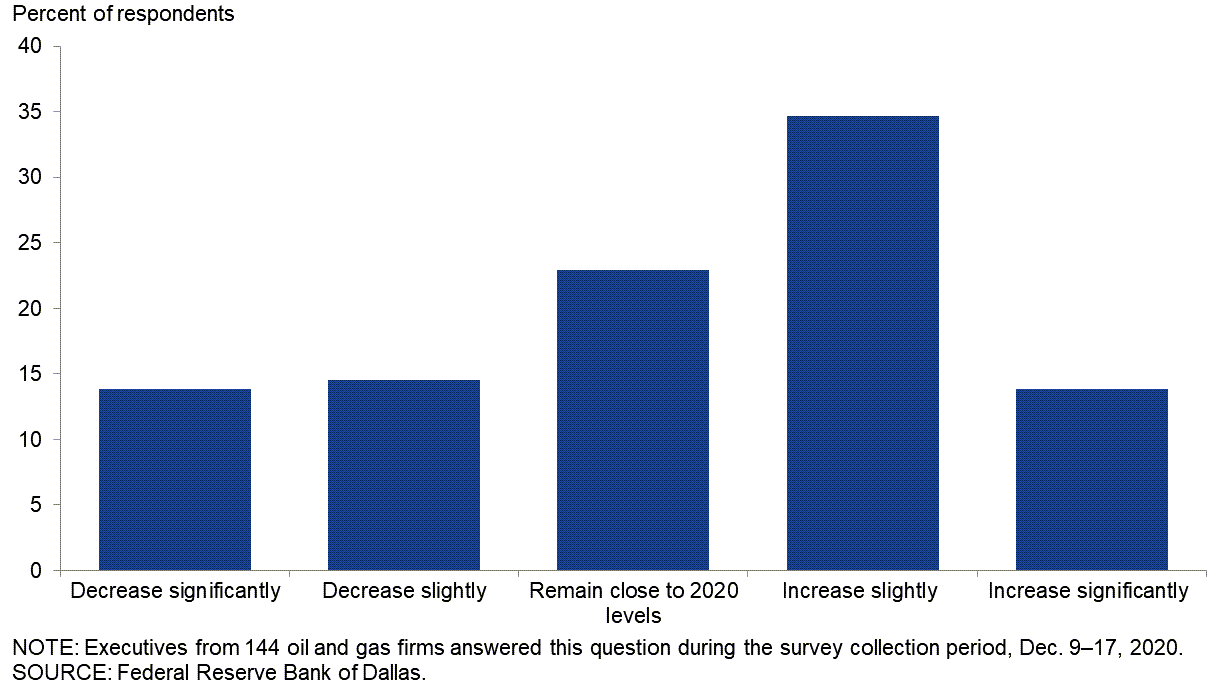

- The majority of firms plan to slightly increase (~35%) or keep spending flat (~23%) in 2021 vs. 2020 levels

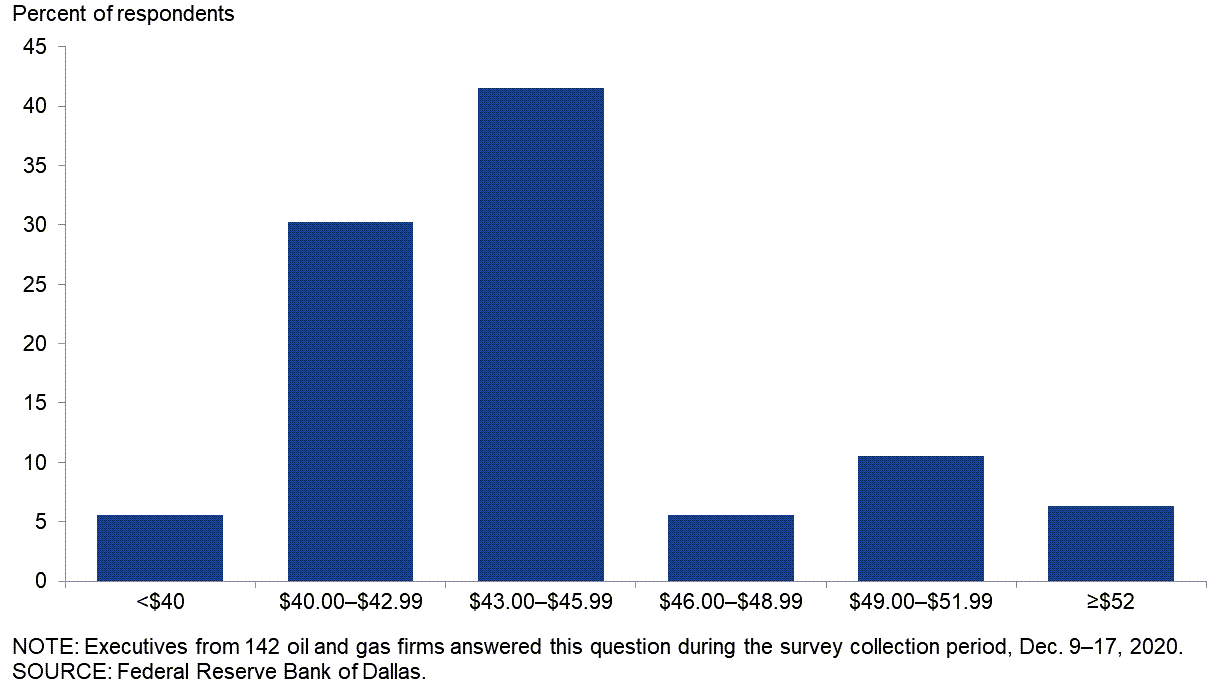

- The majority of firms are basing 2021 budgets on $44/barrel WTI (~43%)

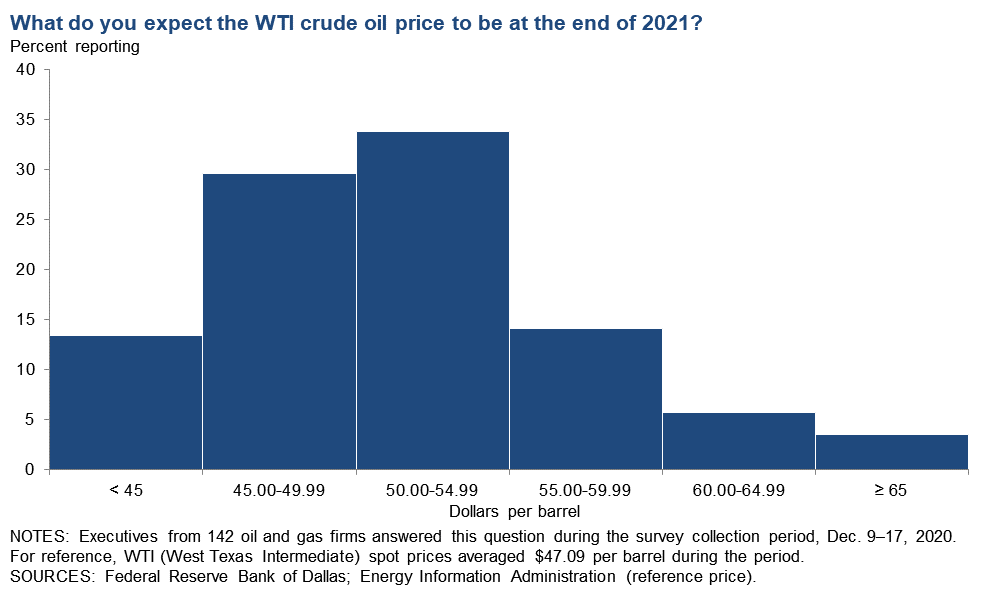

- The majority of firms expect WTI to average between $50-55 / barrel by year-end 2021 (~34%)

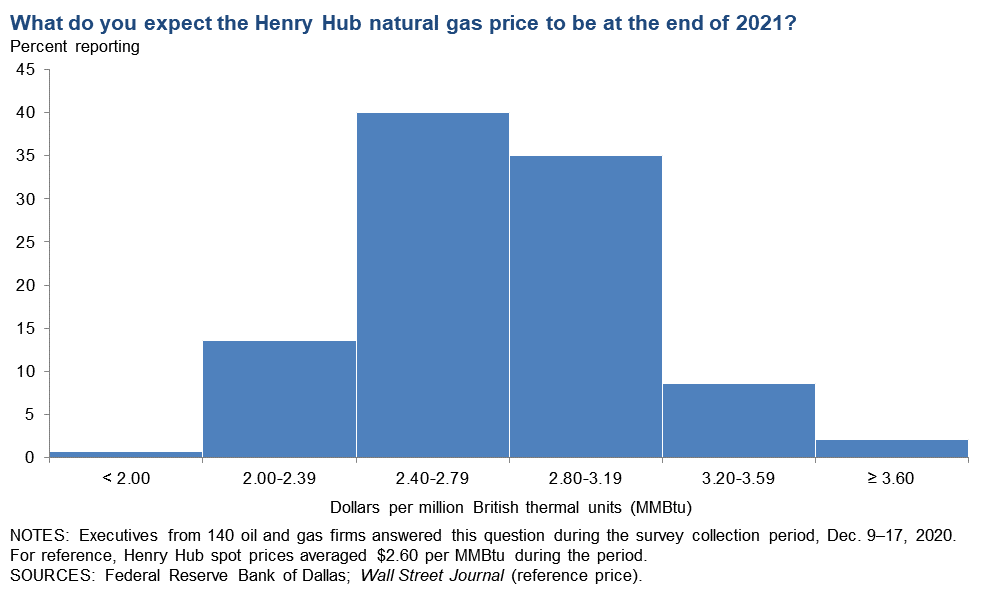

- The majoriy of firms expect Henry Hub natural gas at $2.40-2.79 by year-end 2021 (~40%), although $2.80-3.19 was a close second

- The majority of firms think that 37-48 private E&P companies will remain by year-end 2022 (~47%)

The firms also detailed their positions and plans regarding clean or green energy, which you will find further below.

Commodity Prices: 2021 Budgets, 2022 Outlook

According to the survey, the majority of E&Ps are planning on slightly increasing spending in 2021 vs. 2020.

Additionally, the majority of E&Ps are basing their 2021 capital budgets on ~$44/barrel WTI prices (based on responses provided by execs from 142 firms).

The survey also detailed the responses regarding E&P outlook for prices at year-end 2021 for both WTI and natural gas.

The majority see WTI averaging between $50-55 / barrel and Henry Hub natural gas at $2.40-2.79, although $2.80-3.19 was a close second.

New / Clean Energy Shift

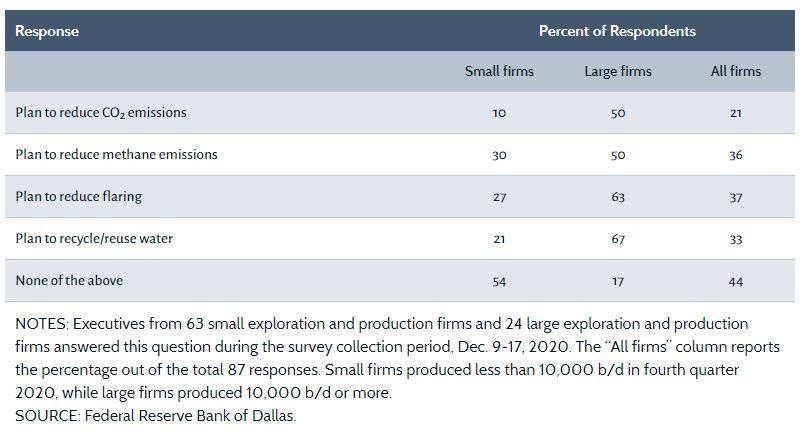

Firms also detailed their outlook on emerging clean energy initiatives, including if the firms plan to incorporate any related items into their business strategies going forward.

Which of the following plans does your firm have? (Check all that apply.)

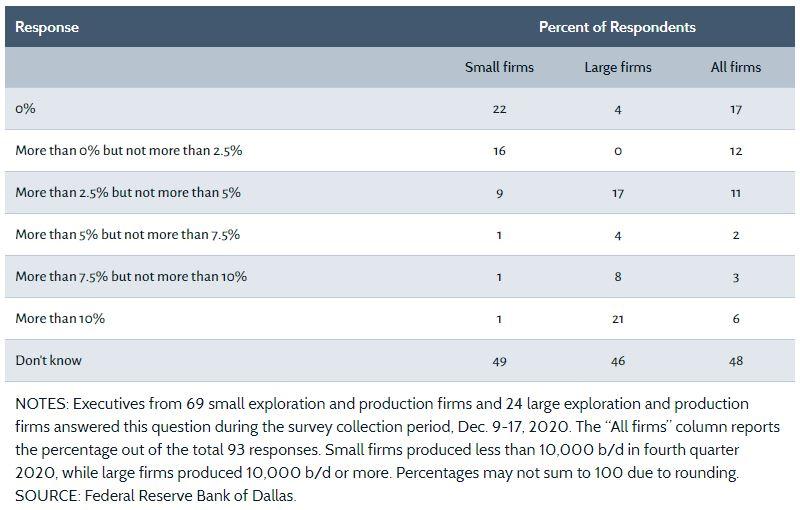

By how much do you expect your firm to reduce greenhouse gas emissions from 2020 to 2025 in terms of barrel-of-oil equivalent produced?

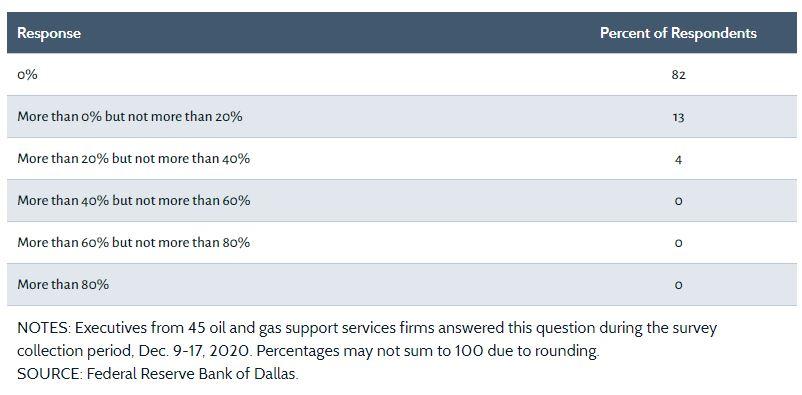

Currently, what percentage of your firm’s revenue do you generate from providing services related to alternative energy (such as offshore/onshore wind, solar, geothermal, hydrogen, and carbon capture use and storage)?

Related Categories :

Trends

More Trends News

-

Permian Drilling Activity Rises; Top Operators Leading Permitting Charge -

-

2020 Marcellus Permit Activity: 2H20 Permits Still Low Despite Gas Price Resurgence -

-

2020 Haynesville Permit Activity: Haynesville is Resilient as Permits Outpace 2019 Levels -

-

2020 Eagle Ford Permit Activity: Permits Trend Upward as 2020 Winds Down -

-

2020 Permian Permit Activity: COVID Spurs Big Drop from Prior Years -

Gulf Coast - South Texas News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Mid-Continent - Anadarko Basin News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?