Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets

Denbury Resources Third Quarter 2020 Results

Denbury Inc. announced its third quarter 2020 financial and operating results.

Highlights:

- Successfully completed financial restructuring and emerged from Chapter 11 reorganization on September 18, 2020, with a strong balance sheet and strong liquidity position:

- Reduced bond debt by $2.1 billion, resulting in $165 million annual interest savings

- Established a new $575 million senior secured bank credit facility, with $437 million of availability at September 30, 2020 after borrowings of $85 million and outstanding letters of credit

- Relocated corporate headquarters, resulting in $9 million in annual savings

- Appointed a new board of directors consisting of four new independent members and three continuing members

- Commenced trading of new common stock on the NYSE under the ticker symbol "DEN" on September 21, 2020

- Produced 49,686 barrels of oil equivalent ("BOE") per day ("BOE/d") during 3Q 2020, roughly flat with 2Q 2020

- Revenues and other income were $194 million for 3Q 2020, excluding $18 million in hedging receipts

- Adjusted EBITDAX (a non-GAAP measure) was $93 million for 3Q 2020

- Received $25 million of proceeds from the sale of two parcels of marketed Houston area surface acreage, with proceeds of $14 million in July 2020 and $11 million in October 2020

- Reacquired the NEJD and Free State CO2 pipelines, reducing debt by $25 million and lowering interest expense while maximizing flexibility for future CCUS operations

Bankruptcy Emergence

Upon emergence from bankruptcy on September 18, 2020, the Company applied fresh start accounting, which resulted in a new entity for financial reporting purposes. In applying fresh start accounting, the Company's assets and liabilities were recorded at fair value as of the Emergence Date, which differs materially from historical values reflected on the Company's balance sheet prior to the Emergence Date. As a result of the application of fresh start accounting and the effects of the Company's Chapter 11 restructuring, the consolidated financial statements of the Company after September 18, 2020 are not comparable with its consolidated financial statements on or prior to that date. References to "Successor" refer to the new Denbury reporting entity after the Emergence Date, and references to "Successor Period" refer to the period from September 19, 2020 through September 30, 2020. References to "Predecessor" refer to the Denbury entity prior to emergence from bankruptcy, and references to "Predecessor Period" refer to periods (as specified herein) prior to and through September 18, 2020. Under GAAP, Denbury is required to report the Company's financial results for the Successor Period separately from Predecessor Periods, making the information not comparable. In order to provide meaningful comparable results of certain information for the third quarter and year to date periods, the Company has combined the results for the third quarter's Successor Period and Predecessor Period where appropriate, which the Company refers to as "Combined".

Chris Kendall, Denbury's President and CEO, commented, "In less than two months during the third quarter we entered and exited our Chapter 11 restructuring process. As a result of this process, Denbury emerged with a strong balance sheet, a solid liquidity position, and a significantly reduced cost structure providing us with a breakeven oil price near $30 per barrel. Denbury's low base production decline and the flexible, low capital intensity nature of our assets are particularly well suited for today's environment. The industry-leading low carbon footprint of our CO2 EOR-focused oil production sets us apart. Moreover, the potential of the emerging CCUS business presents a unique, exciting, and significant growth opportunity to leverage both our strategically advantaged asset base and our extensive CO2 expertise developed during more than 20 years of CO2 EOR operations.

"I want to thank the Denbury team for their focus, care, and diligence throughout 2020. Even in this challenging environment, the team is setting Company records for safety and efficiency, which is a testament to our employees' professionalism, dedication, quality and resilience.

"Going forward, while ensuring a steadfast focus of building on our strong foundation of safety and operational excellence, our priorities will be to protect and maintain our balance sheet, to continue to invest within cash flow, to further build our EOR-focused business, and to continue to position the Company to be a leader in what we believe will be a high value CCUS business."

Operating & Financial Results

Denbury's oil and natural gas production averaged 49,686 BOE/d during third quarter 2020, relatively flat with second quarter of 2020 (the "prior quarter") production and a decrease of 10% compared to continuing production in the third quarter of 2019 (the "prior-year third quarter"), which is adjusted for production from assets sold in the first quarter of 2020. Production during the second and third quarters of 2020 was impacted by approximately 4,300 BOE/d and 1,700 BOE/d, respectively, of production that was shut-in due to wells that were uneconomic to produce or repair. In addition to shut-in production, the year-over-year production decline was primarily due to production declines at Delhi Field which were mainly associated with the suspension of CO2 purchases since late-February 2020 as a result of the Delta-Tinsley CO2 pipeline being out of service for repairs, as well as reduced levels of workovers and capital investment due to actions taken by the Company to reduce costs in response to the significant decline in oil prices earlier in 2020. In late October 2020, repairs to the Delta-Tinsley pipeline were completed and the pipeline was brought back into service, allowing CO2 purchases to resume at Delhi Field. Further production information is provided on page 18 of this press release.

Denbury's third quarter 2020 average realized oil price, including derivative settlements, was $43.23 per barrel ("Bbl"), an increase of 25% from the prior quarter and a decrease of 27% from the prior-year third quarter. Denbury's NYMEX differential for the third quarter 2020 was $1.64 per Bbl below NYMEX WTI oil prices, compared to $4.03 per Bbl below NYMEX WTI in the prior quarter and $1.30 per Bbl above NYMEX WTI in the prior-year third quarter.

Total revenues and other income in the third quarter of 2020 were $194 million, an increase of 64% from the prior quarter and a decrease of 39% from the prior-year third quarter. The sequential quarterly increase was primarily due to higher realized oil prices, and the decrease from the prior-year third quarter was primarily due to lower oil prices and to a lesser degree lower oil production levels.

Total lease operating expenses in third quarter 2020 were $71 million, or $15.57 per BOE, a decrease of $10 million, or 12%, compared to the prior quarter due primarily to a $15 million insurance reimbursement received in the current quarter related to a 2013 incident at Delhi Field, partially offset by higher workover expense during the current quarter as the Company resumed some repairs and maintenance activity. Compared to the prior-year third quarter, lease operating expenses decreased $47 million, or 40%, due primarily to reductions in all expense categories, with the largest decreases in workover expense, labor, and power and fuel costs, as well as the insurance reimbursement noted above.

Taxes other than income, which includes ad valorem, production and franchise taxes, increased $5 million, or 50%, from the prior quarter and decreased $6 million, or 29%, from the prior-year third quarter, generally due to changes in oil and natural gas revenues.

General and administrative ("G&A") expenses were $17 million in third quarter 2020, a $7 million decrease from the prior quarter, primarily due to the prior quarter including higher than normal compensation-related expenses related to modifications of the Company's 2020 employee compensation programs. During the prior quarter, the Company reinstated a bonus program for 2020 which had previously been suspended in the first quarter, resulting in a higher than normal bonus accrual in the second quarter. Compared to the prior-year third quarter, G&A expenses decreased $2 million, or 8%, due to lower overall employee compensation and related costs due to reduced headcount.

Interest expense, net of capitalized interest, totaled $8 million in third quarter 2020, a $13 million decrease from the prior quarter and a $15 million decrease from the prior-year third quarter. The decreases in both comparative periods were primarily due to the approximate $2.1 billion reduction in bond debt associated with the Company's Chapter 11 restructuring during the third quarter of 2020. A schedule detailing the components of interest expense is included on page 20 of this press release.

The Company recognized a full cost pool ceiling test write-down of $262 million for the Predecessor Period from July 1, 2020 through September 18, 2020 as a result of the continued decline in first-day-of-the-month oil prices for the preceding 12 months. This write-down compares to full cost pool ceiling test write-downs of $662 million during the prior quarter and $73 million during the first quarter of 2020. As a result of fresh start accounting, oil and gas properties were recorded at fair value as of September 18, 2020, and there was no full cost pool ceiling test write-down for the Successor Period.

Depletion, depreciation, and amortization ("DD&A") was $42 million during third quarter 2020, compared to $55 million in both the prior quarter and the prior-year third quarter. The decreases from the prior quarter and the prior-year third quarter were primarily due to the application of fresh start accounting resulting in lower asset balances.

Denbury's effective tax rate for the Predecessor Period from January 1, 2020 through September 18, 2020 was 23%, slightly lower than the Company's estimated statutory rate of 25%, due primarily to the establishment of a valuation allowance on the Company's federal and state deferred tax assets after the application of fresh start accounting. Given the Company's cumulative loss position and the continued low oil price environment, management recorded a total valuation allowance of $129 million on its underlying deferred tax assets as of September 18, 2020. For the Successor Period, the Company continues to offset its deferred tax assets with a valuation allowance. Thus, the income tax expense associated with the Successor's pre-tax book income was offset by a change in valuation allowance.

Bank Credit Facility

In connection with the emergence from Chapter 11 bankruptcy proceedings, the Company entered into a new $575 million senior secured bank credit facility due January 30, 2024, with the lending group remaining consistent with that of the Predecessor's bank credit facility. As of September 30, 2020, the Company had $85 million of outstanding borrowings on the senior secured bank credit facility, leaving $437 million of borrowing base availability after consideration of $53 million of outstanding letters of credit.

Recent Pipeline Update

In late October 2020, the Company restructured its CO2 pipeline financing arrangements with Genesis Energy, L.P. ("Genesis"), whereby (1) Denbury reacquired the NEJD Pipeline system from Genesis in exchange for $70 million to be paid in four equal payments during 2021, representing full settlement of all remaining obligations under the NEJD secured financing lease; and (2) Denbury reacquired the Free State Pipeline from Genesis in exchange for a one-time payment of $23 million made on October 30, 2020.

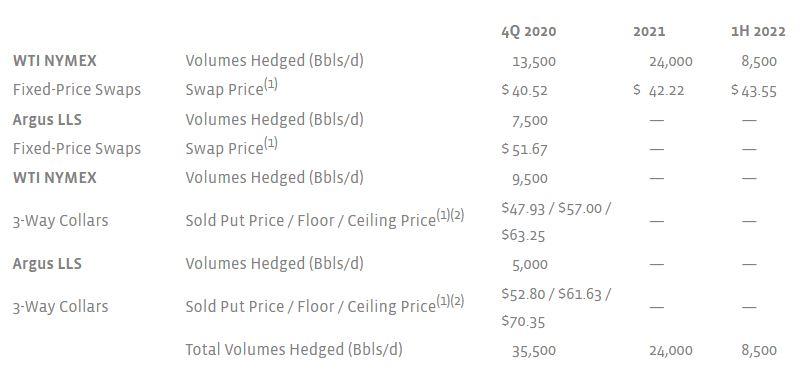

Hedging

Details of the Company's hedging positions as of November 13, 2020 are included below.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Ark-La-Tex News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

E&P Company Slash 2024 Capex & Frac Crews by 50%