Rig Count | Forecast - Production | Hedging | Capital Markets | Capital Expenditure | Drilling Program-Rig Count | Curtailment/Shut-In

Diamondback's Curtailments Back Online; Cuts 2020 Rig, Production Outlook

Diamondback Energy Inc. has provided an Q2 2020 update and announced revised full year 2020 guidance.

Nearly all curtailed production is back online for Diamondback as of today, according to its update.

Production Update: Q2 Output, Curtailments

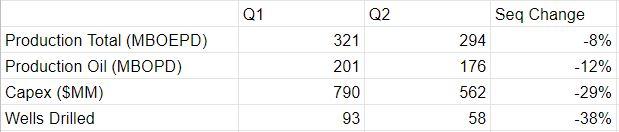

- Q2 2020 average production of 176.3 MBO/d (294.1 MBOE/d) - this is down 8% from Q1 2020 production of 321.1 MBOE/d.

- After voluntarily curtailing 9.0 MBO/d (16.1 MBOE/d) of total Q2 2020 production, primarily in May, Diamondback elected to return this curtailed production in June, with nearly all curtailed production back online today

2020 Rig, Spending Update

- Q2 2020 cash CAPEX of $562 million. Q2 2020 activity-based CAPEX incurred of approximately $348 million

- Drilled 58 gross operated horizontal wells and turned 15 wells to production in the second quarter, with nine wells turned to production in April, six in May and zero in June

- After averaging 13 operated drilling rigs in the second quarter with minimal completion activity, the Company is currently operating seven drilling rigs and three completion crews, with the third completion crew having begun operations in July. Drilling activity is expected to be further reduced to six rigs in July

- Assuming a continuation of current market conditions, Diamondback plans to operate between five and six operated drilling rigs and between three and four completion crews for the remainder of 2020

Lowers 2020 Production Outlook

Due to curtailments and the break in completion activity, Diamondback is revising full year 2020 production guidance lower than expectations announced earlier in 2020.

Details include:

- Full year revised 2020 production guidance of 290 to 305 MBOE/d

- Full year revised 2020 oil production guidance of 178 to 182 MBO/d

- Q4 2020 production guidance of 170 to 175 MBO/d (280 to 290 MBOE/d)

- Full year 2020 cash CAPEX guidance of $1.8 $1.9 billion

- The Company expects to drill between 205 215 gross wells and complete between 170 200 gross (153 180 net) wells with an average lateral length of approximately 10,000 feet in 2020

- The Company plans to exit 2020 with 110 140 drilled but uncompleted wells ("DUCs")

- Diamondback believes it can maintain Q4 2020 oil production through full year 2021 with a capital budget 25% 35% less than 2020's capital budget

Hedging Update

- Q2 2020 average realized hedged prices of $35.21 per barrel of oil, $7.17 per barrel of natural gas liquids and $0.33 per Mcf of natural gas, resulting in a total equivalent price of $22.95 per BOE. Diamondback realized total hedging gains of $211 million in the second quarter, including $11 million of realized gains from the early termination of 10.0 MBO/d of Q3 2020 oil hedges

- Q2 2020 average unhedged realized prices of $21.99 per barrel of oil, $7.17 per barrel of natural gas liquids and $0.63 per Mcf of natural gas, resulting in a total equivalent price of $15.39 per BOE

The Company now has an average of 168.1 thousand barrels of oil per day protected in the second half of 2020, with 98% of those hedges having unlimited downside protection as a swap, put or collar. The Company has an average of 85.5 thousand barrels of oil per day of hedge protection in 2021 through a combination of collars and swaps.

Travis Stice, Chief Executive Officer of Diamondback, said: "Diamondback made the decision to preserve value in the second quarter by suspending almost all completion activity and curtail ~5% of full quarter oil production due to the most volatile oil price market in recent history. With oil prices having recovered significantly since the decision to curtail production was made in April, Diamondback returned this production through the month of June with minimal associated cost. We brought two completion crews back to work in June, and a third crew in July. These completion crews will enable us to honor our lease obligations and subsequently stem production declines, which we expect to do by the fourth quarter of 2020 after production bottoms in the third quarter. Organizationally, we continue to improve our industry-leading cost structure, with controllable cash operating costs per BOE and capital costs per lateral foot at or below all-time lows across the board.

"This year has brought many challenges, including a much different production and capital profile than originally expected. Returning completion crews to work later than originally anticipated put a deeper hole in our production profile for the year, and therefore we have revised full year 2020 oil production guidance lower by 4% at the midpoint, as we continue to provide guidance for purposes of transparency. From an activity perspective, we elected to finish out our rig contracts and limit cash costs associated with early termination fees. Accordingly, our operated rig count declined from 20 rigs on March 31 to seven today. As a result, along with the fact that Diamondback reports cash capital expenditures that match our cash flow statement, which is unique in our industry, we spent $562 million of cash capex in the second quarter. Activity-based capital, or capital costs incurred during the quarter, was approximately $348 million. We expect both cash and activity-based capital expenditures to decline in the second half of 2020, normalizing by the fourth quarter of 2020 at a trend in line with our 2021 maintenance capital run-rate."

"Diamondback will generate significant free cash flow in the second half of 2020 and into 2021 at current commodity prices. Under a maintenance capital scenario in 2021, Diamondback can hold Q4 2020 oil production flat while spending 25% - 35% less capital than 2020. Our long-term capital allocation philosophy and Diamondback's value proposition remain unchanged: protect and grow our dividend as our primary return of capital, protect our balance sheet, and drill, complete and produce barrels with the highest margins at the lowest capital and operating costs in the industry."

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Production Daily Equivalent(boe/d) |

|

|

|

|

| Production Oil(bbls/d) |

|

|

|

|

Related Categories :

Quarterly - Preliminary

More Quarterly - Preliminary News

-

Talos Details Preliminary Q2 Estimates; 65 MBOEPD in Production

-

Ring Energy Details Preliminary 1Q22 Results; Production Beats Expectations

-

HighPeak Energy Preliminary Fourth Quarter Results, Reserve Update

-

Ring Energy Details Preliminary 4Q21 Results, Hedging Update

-

Earthstone Energy Preliminary Fourth Quarter Results, Reserves

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -