Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Hedging | Capital Markets | Drilling Activity | 2020 Guidance

EQT Third Quarter 2020 Results

EQT Corp. announced financial and operational performance results for the third quarter 2020.

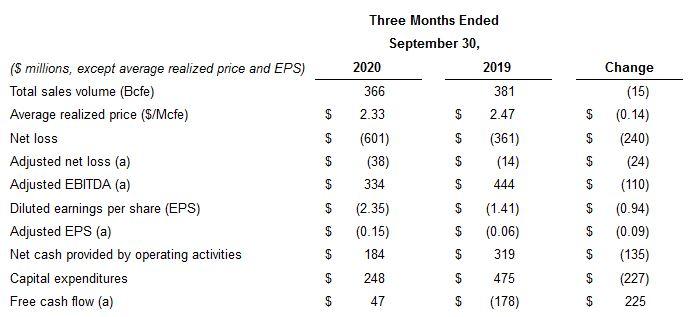

Third Quarter Highlights:

- Sales volumes of 366 Bcfe, in-line with guidance, despite 15 Bcf of volume curtailments

- Received an average realized price of $2.33/Mcfe, a $0.25 premium to NYMEX pricing

- Net cash provided by operating activities of $184 MM; free cash flow(1) of $47 MM

- Capital expenditures of $248 MM, $227 MM lower than 3Q19 and $55 MM lower than 2Q20

- Well costs of $660/foot in the PA Marcellus, surpassing target well costs by $70/foot

- Received $202 million in tax refunds, including accrued interest

- Successfully appealed prior taxes paid; additional tax refunds of $48 MM expected in 4Q20

- Production uptime continues to exceed 98%

- Horizontal drilling speeds and completion stages/day improved 19% and 15%, respectively, compared to 2Q20

- Reduced midpoint of full-year 2020 capital expenditure guidance by $50 MM

President and CEO Toby Rice stated, "Our third quarter results, particularly on the operational side, continue to see meaningful step changes in efficiencies, as we continue to find ways to increase performance and enhance results. For the second consecutive quarter, we have executed at a level meaningfully below our target well costs, developing our Pennsylvania Marcellus asset for $660 per foot, driven almost entirely by sustainable efficiency gains. These results demonstrate this team's continued progress in delivering value for our stakeholders and have paved the way for improvements to certain full-year 2020 guidance.

"Our commitment to operating under the highest environmental, social and governance standards sits at the heart of our corporate strategy. We recently published our revamped ESG Report, which highlights the environmental benefits of our combo-development strategy, enhancements to our data collection, monitoring and reporting platform, and steps we are taking to reduce our greenhouse gas emissions. We believe ESG is a critical component for long-term, sustainable value creation and we intend to be the clear natural gas leader."

Q3 Summary

Net loss for the third quarter of 2020 was $601 million, $2.35 per diluted share, compared to net loss for the same period in 2019 of $361 million, $1.41 per diluted share. The decrease was attributable primarily to decreased operating revenues, increased interest expense and decreased dividend and other income, partly offset by the gain on investment in Equitrans Midstream Corporation (Equitrans Midstream), increased income tax benefit, decreased depreciation and depletion expense, decreased transaction, proxy and reorganization costs and decreased selling, general and administrative expense. EQT recognized a loss in operating revenues of $427 million related primarily to decreases in the fair market value of the Company's NYMEX swaps and options due to increases in NYMEX forward prices.

During 2020, EQT made strategic decisions to temporarily curtail approximately 1.4 Bcf per day of gross production, equivalent to approximately 1.0 Bcf per day of net production, beginning on May 16, 2020 and ending mid-July 2020 and approximately 0.6 Bcf per day of gross production, equivalent to approximately 0.4 Bcf per day of net production, beginning on September 1, 2020 (collectively, the Strategic Production Curtailments). Total sales volumes decreased by approximately 15 Bcfe compared to the same quarter last year due primarily to the Strategic Production Curtailments and also by 6 Bcfe as a result of the sale of non-strategic assets during the second quarter of 2020. In addition, average realized price was 6% lower at $2.33 per Mcfe, due to lower NYMEX prices and unfavorable differential, partly offset by higher cash settled derivatives.

Net cash provided by operating activities decreased by $135 million and free cash flow(1) increased by $225 million compared to the same quarter last year. Despite the impact of the Strategic Production Curtailments, non-strategic asset dispositions and a lower average realized price, free cash flow increased when compared to the same quarter last year due to a $227 million decrease in capital expenditures.

Net loss for the third quarter of 2020 was $601 million, $2.35 per diluted share, compared to net loss for the same period in 2019 of $361 million, $1.41 per diluted share. The decrease was attributable primarily to decreased operating revenues, increased interest expense and decreased dividend and other income, partly offset by the gain on investment in Equitrans Midstream Corporation (Equitrans Midstream), increased income tax benefit, decreased depreciation and depletion expense, decreased transaction, proxy and reorganization costs and decreased selling, general and administrative expense. EQT recognized a loss in operating revenues of $427 million related primarily to decreases in the fair market value of the Company's NYMEX swaps and options due to increases in NYMEX forward prices.

During 2020, EQT made strategic decisions to temporarily curtail approximately 1.4 Bcf per day of gross production, equivalent to approximately 1.0 Bcf per day of net production, beginning on May 16, 2020 and ending mid-July 2020 and approximately 0.6 Bcf per day of gross production, equivalent to approximately 0.4 Bcf per day of net production, beginning on September 1, 2020 (collectively, the Strategic Production Curtailments). Total sales volumes decreased by approximately 15 Bcfe compared to the same quarter last year due primarily to the Strategic Production Curtailments and also by 6 Bcfe as a result of the sale of non-strategic assets during the second quarter of 2020. In addition, average realized price was 6% lower at $2.33 per Mcfe, due to lower NYMEX prices and unfavorable differential, partly offset by higher cash settled derivatives.

Net cash provided by operating activities decreased by $135 million and free cash flow(1) increased by $225 million compared to the same quarter last year. Despite the impact of the Strategic Production Curtailments, non-strategic asset dispositions and a lower average realized price, free cash flow increased when compared to the same quarter last year due to a $227 million decrease in capital expenditures.

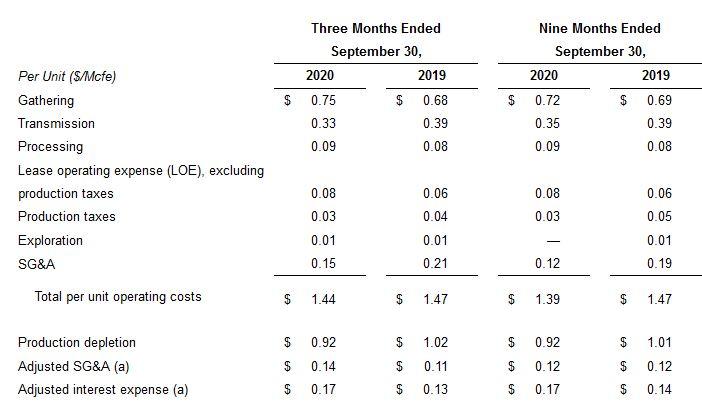

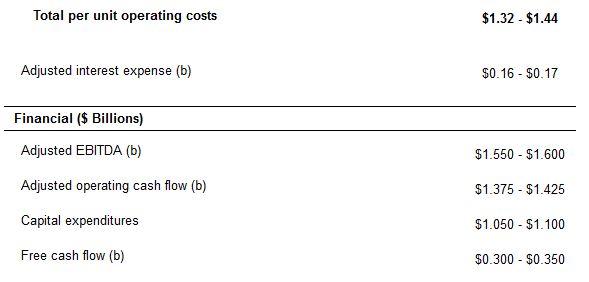

Per Unit Operating CostsThe following presents certain of the Company's production-related operating costs on a per unit basis.

Liquidity

As of September 30, 2020, the Company had $245 million of credit facility borrowings and $0.8 billion of letters of credit outstanding under its $2.5 billion credit facility. The outstanding borrowings under the Company's credit facility were primarily used for collateral and margin deposits associated with the Company's over the counter derivative instrument contracts and exchange traded natural gas contracts, which are reported as a current asset on the consolidated balance sheet.

As of September 30, 2020, total debt was $4,731 million and net debt(1) was $4,717 million compared to $5,293 million and $5,288 million, respectively, as of December 31, 2019.

As of October 16, 2020, the Company had sufficient unused borrowing capacity under its credit facility, net of letters of credit, to satisfy any collateral requests that its counterparties would be permitted to request of the Company pursuant to the Company's over the counter derivative instruments, midstream services contracts and other contracts. As of October 16, 2020, such amounts could be up to approximately $1.2 billion, inclusive of assurances posted of approximately $0.8 billion of letters of credit, $0.1 billion of surety bonds and $0.2 billion of cash collateral posted.

Ops Update

As previously announced, the Company initiated a production curtailment program beginning on September 1, 2020, which remained in effect through the remainder of the third quarter. As a result, approximately 15 Bcf was deferred from the third quarter to be monetized into a more attractive future commodity price environment. The Company began a moderated approach to bring back on-line production on October 1, 2020 and all curtailed production has been returned to sales.

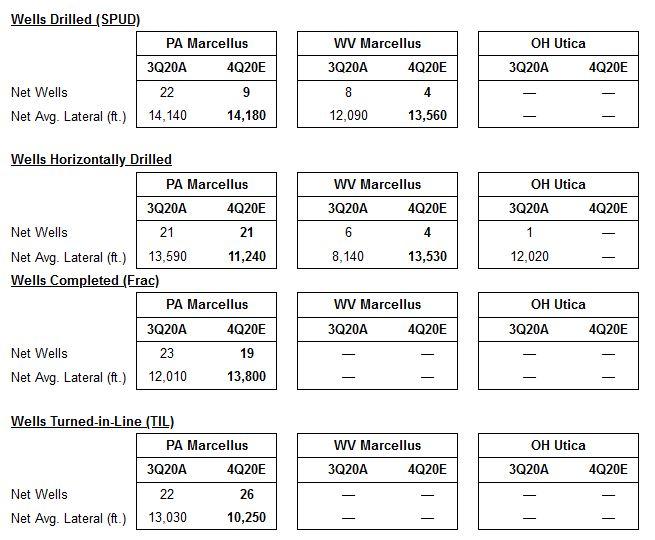

During the third quarter 2020, the Company continued to realize improvements in operational performance, developing its Pennsylvania Marcellus wells for $660 per foot, $20 per foot lower than the second quarter 2020 and 10% below its well cost target of $730 per foot. When compared to the third quarter 2019, the Company has realized a $190 per foot, or 22% improvement in capital efficiency in the development of its Pennsylvania Marcellus asset. Year-to-date, the Company has improved its Pennsylvania Marcellus capital efficiency by 18% or $140 per foot, with over 80% of the improvement being driven by sustainable operational efficiencies.

The Company's strategic initiatives have driven improved operational metrics across the organization. On the production side, the Company's producing asset continues to exceed an aggressive 98% uptime target, maximizing production delivery. Horizontal drilling speeds have improved by 19% quarter-over-quarter, stemming from the continued application of best practices, executed by the same crews, driven by a steady operations schedule. The Company's frac crews continue to improve pumping hours and stages per month, seeing improvements of 15% quarter-over-quarter, due to the continued utilization of next generation frac technology and a centralized operating system, maximizing productive time.

The tables below reflect the Company's operational activity during the third quarter 2020 and planned activity for the fourth quarter 2020.

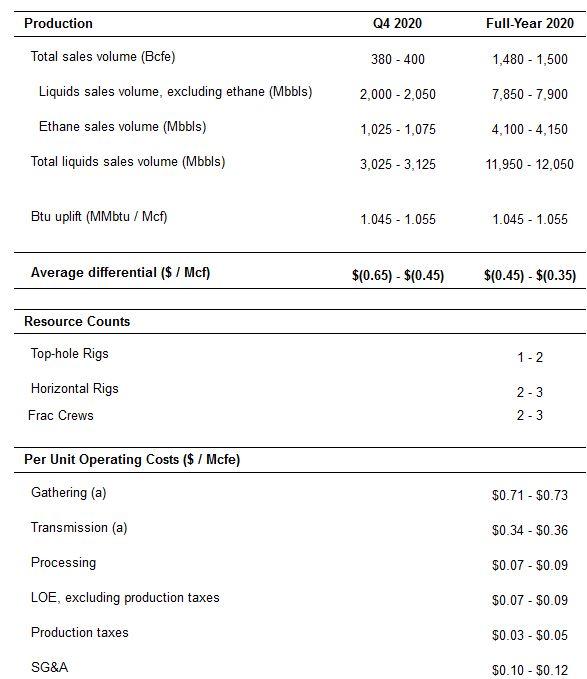

Guidance

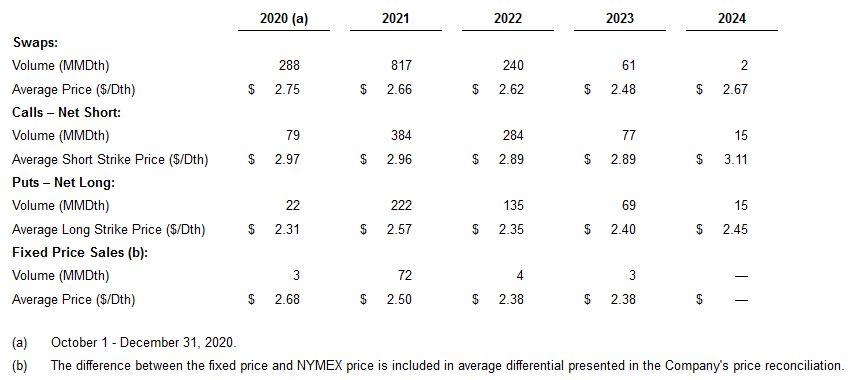

Hedging (as of October 16, 2020)

The Company's total natural gas production NYMEX hedge positions are:

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Frac / Completion Crew (s) |

|

|

|

|

| Wells Completed/Frac(net) |

|

|

|

|

| Production Daily Equivalent(mmcfe/d) |

|

|

|

|

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?