EQT Corp. reported year-end 2020 total proved reserves of 19.8 Tcfe, an increase of 2.3 Tcfe or 13% compared to year-end 2019.

The increase was driven by the efficiencies realized from the execution of EQT's combo-development strategy, and reserve additions associated with EQT's acquisition of Chevron's upstream Appalachian assets, which closed on November 30, 2020 (the Chevron Acquisition).

EQT actively hedged throughout 2020 and now sits with approximately 80% of its expected 2021 production hedged, an increase of approximately 60% as compared to the hedge position at the beginning of 2020.

Year-End Proved Reserves

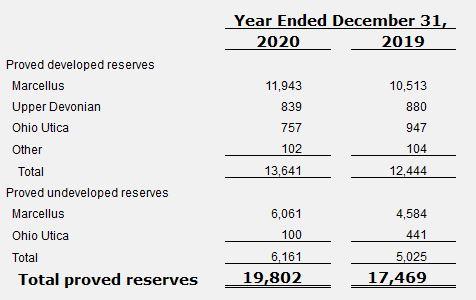

Proved developed reserves increased by 1.2 Tcfe year-over-year, or 10%, to 13.6 Tcfe. This increase was driven by 1.2 Tcfe of reserve additions associated with the Chevron Acquisition.

Proved undeveloped reserves increased by 1.1 Tcfe year-over-year, or 23%, to 6.2 Tcfe, primarily as a result of reserve enhancements driven by a more efficient and optimized future development cadence, with 0.2 Tcfe of the increase attributable to the Chevron Acquisition. These reserves include 279 wells planned to be developed over the next five years, in accordance with US Securities and Exchange Commission (SEC) Regulation S-X Rule 4-10(a). EQT has an additional 13 Tcfe of reserves that meet the definition of proved reserves, except they are planned to be developed beyond five years and are therefore not included in the current estimate of proved reserves.

Over the past 18 months, EQT has realized improvements in well performance driven by a combo-development focused operations schedule and the application of standardized well designs. However, approximately 60% of the year-end 2020 proved developed reserve conversions were subject to sub optimal legacy management development, impacting the expected ultimate recovery (EUR) applied to the proved undeveloped reserves. Over the next 5 years, EQT expects approximately 80% of the proved undeveloped locations are set for highly efficient combo-development. As these reserves are developed, the application of the improving EUR's is expected to enhance the remaining proved undeveloped reserve portfolio.

Future development costs for proved undeveloped reserves are estimated to be approximately $2.26 billion, or $0.37 per Mcfe, a 29% improvement as compared to 2019.

Proved Reserves by Play (Bcfe)

Netherland Sewell and Associates, Inc. an independent consulting firm hired by management, reviewed 100% of the total net natural gas, NGLs and oil proved reserves attributable to EQT's interests as of December 31, 2020.

Hedging Update (as of January 1, 2021)

During the fourth quarter of 2020, EQT continued executing on its hedge strategy to protect against downside commodity risk in 2021. As a result, EQT currently has approximately 80% of its expected 2021 production hedged, assuming maintenance level production, pro forma for the Chevron Acquisition. This represents an increase of approximately 15% as compared to the third-quarter 2020 hedge position.

EQT's total natural gas production NYMEX hedge positions are:

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Frac / Completion Crew (s) |

|

|

|

|

| Wells Completed/Frac(net) |

|

|

|

|

| Production Daily Equivalent(mmcfe/d) |

|

|

|

|

Related Categories :

Reserves

More Reserves News

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Coterra Energy Q4, Full Year 2022 Results; 2023 Plans

-

Civitas Resources Q4, Full Year 2022 Results; 2023 Capital Plans

-

Coterra Energy Third Quarter 2022 Results

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?