Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets

Earthstone Energy Third Quarter 2020 Results

Earthstone Energy, Inc. reported its Q3 2020 results.

Third Quarter 2020 Highlights:

- Average daily production of 16,959 Boepd

- Adjusted EBITDAX of $36.4 million ($23.33 per Boe)

- All-in cash costs of $9.18 per Boe

- Operating Margin of $20.07 per Boe ($25.54 including realized hedge settlements)

- Operating portion of net cash received in settlement of derivative contracts of $8.5 million

- Free Cash Flow of $33.8 million

- Capital expenditures of $1.4 million

- Reduction of long-term debt of $38.6 million

- Net loss of $(11.9) million, or $(0.18) per Adjusted Diluted Share(2)

- Adjusted net income of $3.7 million, or $0.06 per Adjusted Diluted Share(2)

Year-to-Date 2020 Highlights

- Average daily production of 15,433 Boepd

- Adjusted EBITDAX of $114.4 million ($27.07 per Boe)

- All-in cash costs of $10.72 per Boe

- Operating Margin of $18.60 per Boe ($29.87 including realized hedge settlements)

- Operating portion of net cash received in settlement of derivative contracts of $47.6 million

- Free Cash Flow of $63.8 million

- Capital expenditures of $46.4 million

- Reduction of long-term debt of $40.0 million

- Net loss of $(11.1) million, or $(0.17) per Adjusted Diluted Share(2)

- Adjusted net income of $24.2 million, or $0.37 per Adjusted Diluted Share(2)

Mr. Robert J. Anderson, President and CEO of Earthstone, commented, "We produced outstanding operational and financial results in the third quarter, buoyed in particular by strong production volumes and our continued focus on managing operational and corporate costs. These results continue to validate our economic inventory and operating track record. For the third quarter, despite no drilling or completion activities, we managed to generate Adjusted EBITDAX of over $36 million, which is only a 5% decrease from the first quarter before the impact of COVID-19 on commodity prices had fully occurred. Further, we generated nearly $34 million in Free Cash Flow which allowed us to pay down over $38 million in debt. Since year-end 2019, we generated nearly $64 million in Free Cash Flow which allowed us to pay down debt by $40 million. All of this has contributed to our continued expectation that we will meet our target of being below 1x net debt to Adjusted EBITDAX at year-end.

Mr. Anderson commented further, "With the strength of our production results, we are increasing our production guidance for full year 2020, largely comprised of higher natural gas and natural gas liquids volumes, with oil volumes approximately the same. We are also tightening our lease operating expense guidance, as we have been successful in driving down these costs.

"Additionally, we have initiated completions on a six-well pad in Upton County based on the current forecast for oil prices, reduction in service costs and our expectation of significant production and economic results from this pad, which we expect to be online around year-end. We also anticipate completing the remaining five drilled but uncompleted wells in our inventory in the first quarter of 2021. This completion activity is expected to keep our production relatively flat in 2021, on a year over year basis, which would contribute to significant Free Cash Flow in 2021."

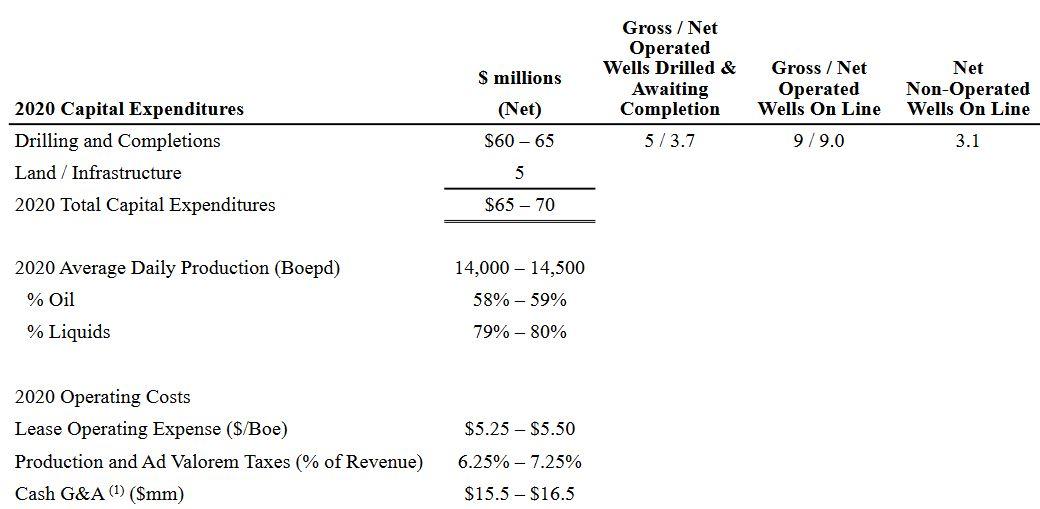

Updated 2020 Guidance

The Company has updated its 2020 guidance based on activities to date and expected for the remainder of 2020 as shown below. The Company has increased its average daily production guidance and decreased its per unit lease operating expense guidance. Further, the Company is increasing its capital expenditure guidance for the year by $12.5 million at the midpoint, which reflects incremental expected fourth quarter 2020 expenditures of approximately $20 million for newly added well completion activities, but offset by lower year-to-date spending of approximately $7.5 million than anticipated.

Operations Update

We have initiated completions on six drilled but uncompleted wells on our Ratliff project in Upton County (100% working interest). These six wells have an average lateral length of approximately 8,400 feet with laterals in the Wolfcamp A, Wolfcamp B Upper and Lower and Wolfcamp C. These four zones have all been successfully produced by us or offset operators in close proximity to this project. These wells are expected to be online by year-end 2020, but we do not anticipate any meaningful production contribution in 2020. We plan to begin completions activity of the remaining five drilled but uncompleted wells on the Hamman Upton project (75% working interest) in January 2021.

Liquidity Update

As of September 30, 2020, we had $5.3 million in cash and $130.0 million of long-term debt outstanding under our senior secured revolving credit facility (our "Credit Facility") with a borrowing base of $240 million. With the $110.0 million of undrawn borrowing base capacity and $5.3 million in cash, we had total liquidity of approximately $115.3 million. Through September 30, 2020, we had incurred $46.4 million of our updated estimated $65 - $70 million in capital expenditures for 2020. We expect to fund our remaining 2020 capital expenditures through internally generated funds.

As of September 30, 2020, we had outstanding borrowings under our Credit Facility of $130 million, which represents a reduction of 24% compared to the $170 million in outstanding borrowings as of December 31, 2019. In addition to this $40 million of debt reduction, we have reduced our Adjusted Working Capital Deficit(1) by $23.4 million since December 31, 2019. We remain in compliance with all covenants under our Credit Facility.

Subsequent to September 30, 2020 and through October 31, 2020, we have paid down an additional $8 million in outstanding borrowings under our Credit Facility. This debt reduction is in line with our 2020 expectations to generate adequate cash flows to further reduce our outstanding borrowings absent any extraordinary events. However, it should be noted that we may borrow temporarily as the timing of our cash flows may fluctuate between reporting periods.

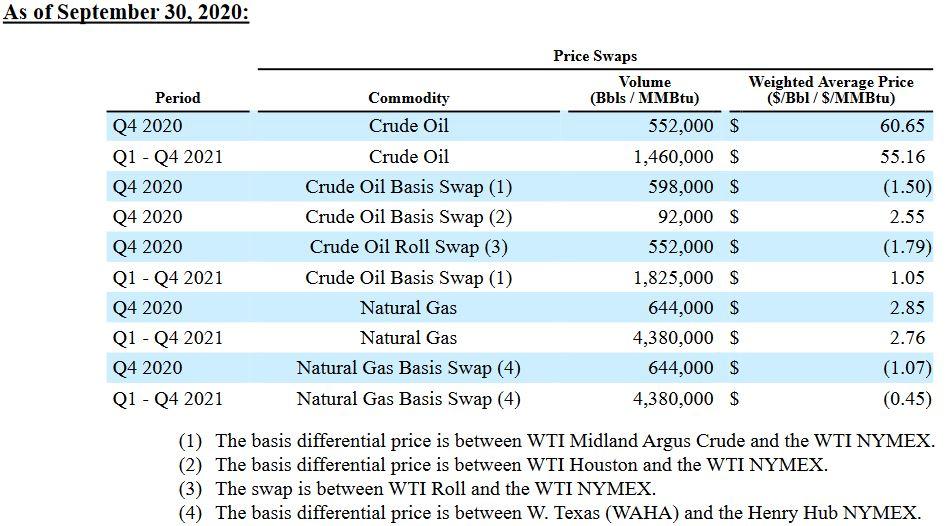

Commodity Hedging

The following table sets forth our outstanding derivative contracts as of September 30, 2020. When aggregating multiple contracts, the weighted average contract price is disclosed.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -