Quarterly / Earnings Reports | First Quarter (1Q) Update | IP Rates-30-Day | Initial Production Rates | Financial Results | Capital Markets | Drilling Activity

Encana's Q1 2018 Production Fall; Activity Ramp Up

Encana reported its Q1 2018 results. Here is a quick read on the production numbers and operational updates.

Production

Total Equivalent production was down -3% from 335.2 Mboe/d in Q4 2017 to 324 Mboe/d in Q1 2018.

Liquids Production is down -5% from 152.8 in Q4 2017 (sequentially) to 145.2 in Q1 2018.

Natural Gas production was also down -2% from 1096 MMcf/d in Q4 2017 to 1075 in Q1 2018.

The company is forecasting that its Q4 2018 production from "core assets", Eagle ford, Permian, Duvernay and Montney will produce between 400 - 425 Mboe/d. The company has decided to ramp up Eagle Ford drilling by increasing its rig count to 3 and restart the Duvernay drilling program.

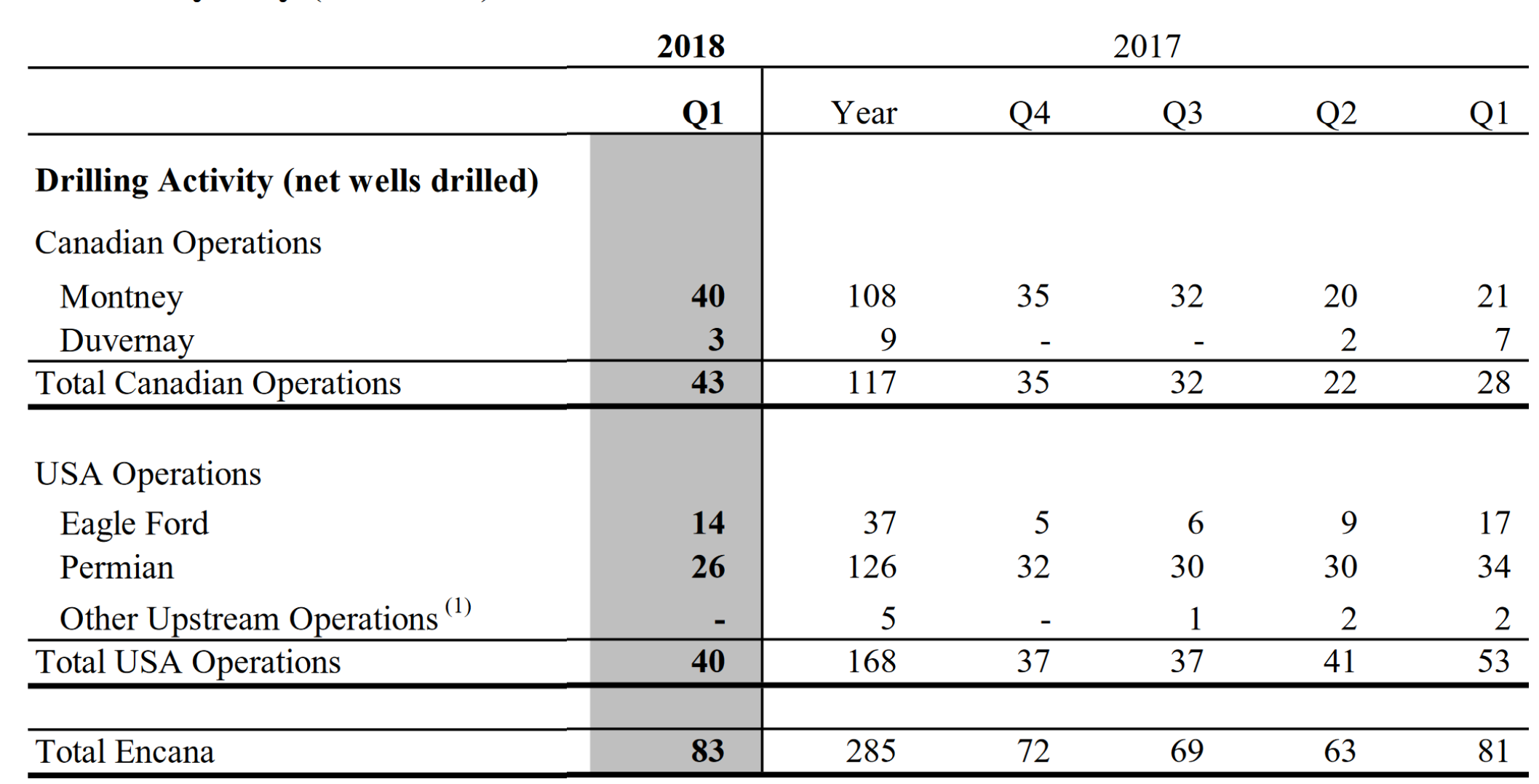

Drilling Activity

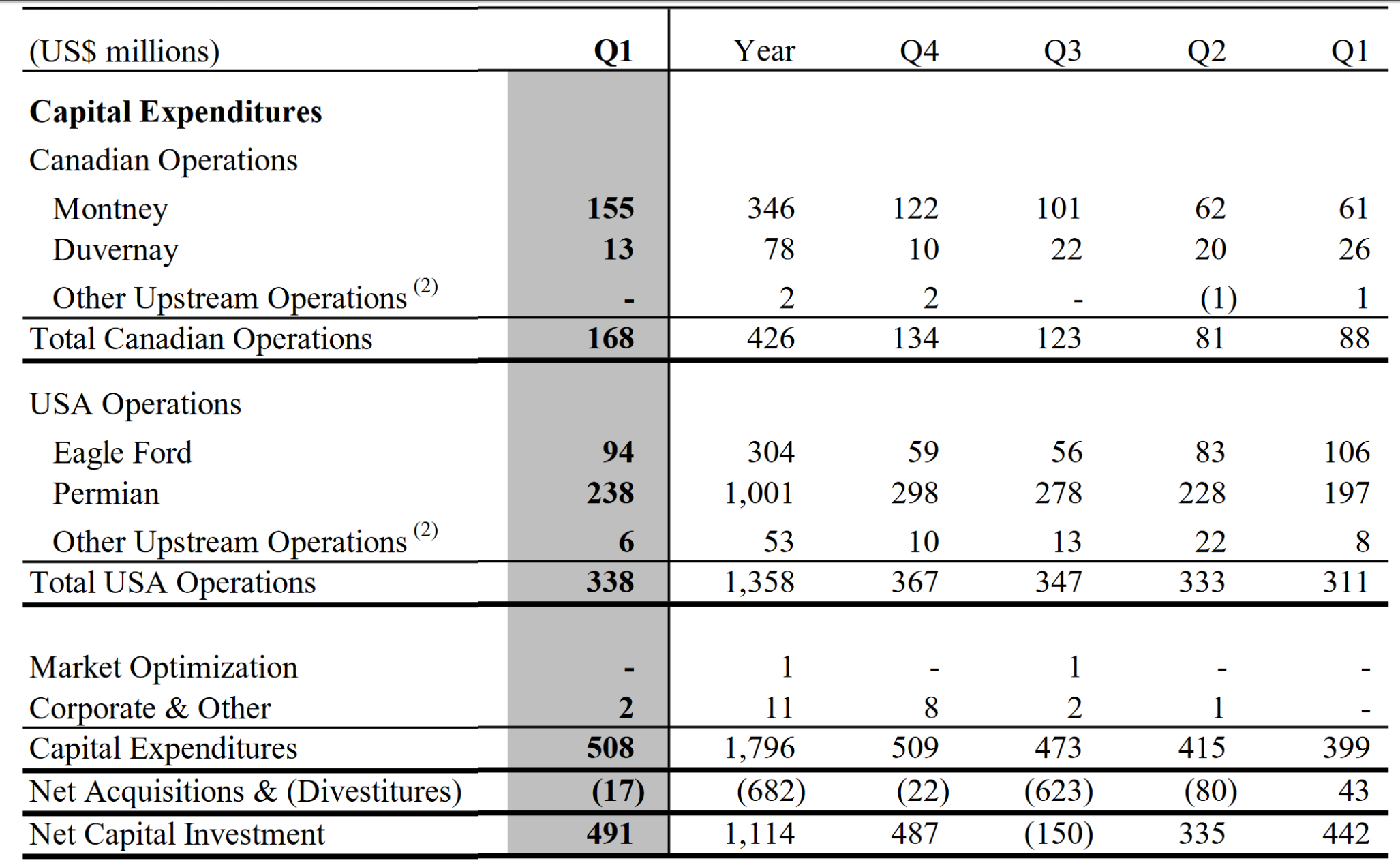

Capital Expenditure

Operational Highlights

Eagle Ford and Duvernay: Ramping Up Ops

- delivered total combined first quarter production of 58,400 BOE/d down -16.1% from 4Q17.

- restarted the Duvernay drilling program and ramped up the Eagle Ford program from one to three rigs; both assets expected to return to growth in the third quarter

- two Austin Chalk wells in the Eagle Ford delivered average IP30 of 1,925 BOE/d of which 70 percent was oil

Permian: Oil Growth

- first quarter oil production of 54,200 bbls/d and total production of 83,800 BOE/d; on track to deliver approximately 30 percent annual growth

- a 10-well Martin county cube delivered average IP90 of 1,300 BOE/d including 1,000 bbls/d of oil

- the latest Midland eight well cube delivered average IP30 of 1,500 BOE/d including 1,150 bbls/d of oil

Montney: Looks to Double Liquids Production

- first quarter production of 165,300 BOE/d including 30,400 bbls/d of liquids production; on track to deliver 55,000 to 65,000 bbls/d total liquids production in the fourth quarter

- five cubes completed in the quarter, each with six to 14 wells, delivered average IP30 of 300 bbls/d of condensate

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Production Oil(bbls/d) |

|

|

|

|

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Canada News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)