Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Capital Expenditure

Gulfport Energy Second Quarter 2021 Results

Gulfport Energy Corp. reported its Q2 2021 results.

Second Quarter 2021 Highlights

- Emerged from restructuring process on May 17, 2021

- Right-sized firm transportation commitments and negotiated new, cost-competitive midstream agreements to better align with operating plan

- Reduced total debt by more than $1.2 billion and reduced annual cash interest expense by over $90 million

- Reported $87.3 million of Net Cash Provided by Operating Activities

- Delivered $74.4 million of Free Cash Flow (non-GAAP measure)

2021 Full Year Forecast

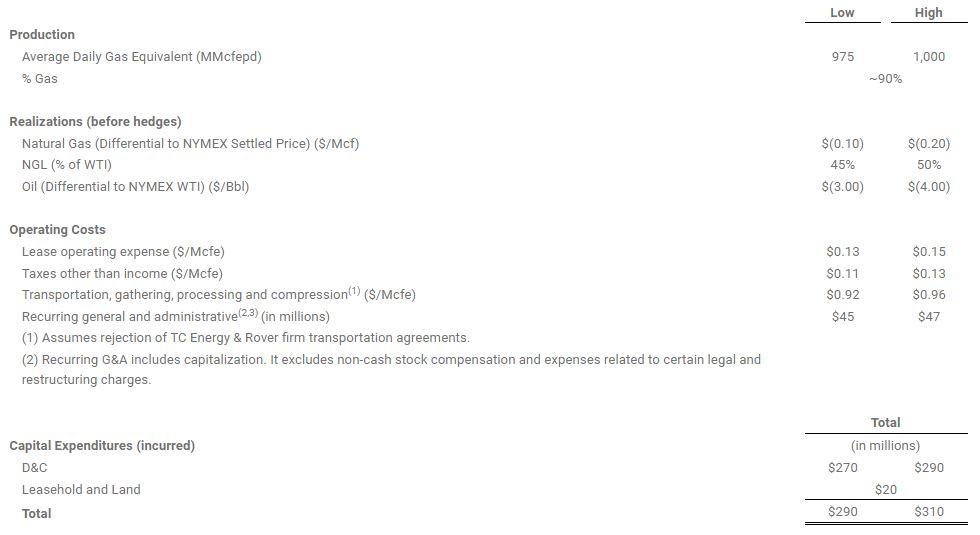

- Intend to invest $290 million to $310 million of capital

- Expect to deliver full year net production of 975 MMcfe to 1,000 MMcfe per day

- Forecast to reduce total per unit expense(2) by more than 23% when compared to 2020

- Plan to generate approximately $290 million to $310 million of Free Cash Flow (non-GAAP measure)

Tim Cutt, Interim CEO, said: "During the second quarter 2021, we emerged from our restructuring process with a continuous improvement mindset, focused on cost effective production and capital discipline, supported by a strong balance sheet. We are fully committed to safely executing in the field and improving our Environmental, Social and Governance performance. We flattened our corporate structure, reduced overhead and are focused on optimizing our development program to deliver the highest returns possible to our investors.

"We plan to develop our assets in a disciplined manner, investing approximately $300 million of capital to deliver 1.0 Bcfe per day of production and targeting sustainable cash flow generation of roughly $300 million per year. We believe that our ability to deliver substantial free cash flow, with top-quartile operating costs and leverage, provides a unique opportunity for investors."

Post-Bankruptcy

On May 17, 2021 ("Emergence Date"), Gulfport successfully completed its restructuring process and emerged from Chapter 11 protection. In connection with the Company's emergence from bankruptcy, the Company qualified for and applied fresh start accounting on the Emergence Date. As a result of the application of fresh start accounting, the consolidated financial statements after May 17, 2021, are not comparable with the consolidated financial statements on or prior to that date. References to "Successor" refer to the Gulfport entity after emergence from bankruptcy on the Emergence Date. References to "Predecessor" refer to the Gulfport entity prior to emergence from bankruptcy.

Operational Update

For the second quarter of 2021, the Company spud one gross operated well in the Utica with a planned lateral length of 12,100 feet and two gross operated wells in the SCOOP with planned lateral lengths of 9,700 feet. In addition, Gulfport turned-to-sales two gross operated wells in the Utica and eight gross operated wells in the SCOOP. The average lateral length for the wells turned-to-sales was approximately 13,000 feet in the Utica and 9,300 feet in the SCOOP.

Gulfport's net daily production for the second quarter of 2021 averaged 989.1 MMcfe per day, primarily consisting of 744.3 MMcfe per day in the Utica and 244.4 MMcfe per day in the SCOOP. For the second quarter of 2021, Gulfport's net daily production mix was comprised of approximately 91% natural gas, 6% natural gas liquids ("NGL") and 3% oil.

Capital Investment

Capital investment was $67.8 million (on an incurred basis) for the second quarter of 2021, of which $67.6 million related to drilling and completion ("D&C") activity and $0.2 million related to leasehold and land investment.

For the six-month period ended June 30, 2021, capital investment was $140.5 million (on an incurred basis), of which $136.2 million related to D&C activity and $4.3 million to leasehold and land investment.

Financial Position and Liquidity

As of June 30, 2021, the Company had $9.4 million of cash and cash equivalents, $105.0 million of borrowings under its revolving credit facility, $180.0 million of borrowings under its term loan, $114.8 million of letters of credit outstanding and $550 million of outstanding 2026 senior notes. The Company was in compliance with the covenants under its credit agreement.

The Company's liquidity at June 30, 2021 totaled approximately $150 million, comprised of the $9.4 million of cash and cash equivalents and approximately $141 million of available borrowing capacity under our revolving credit facility, after adjusting for the $40 million liquidity blocker.

On June 30, 2021, the company paid dividends on its New Preferred Stock, which included 1,006 shares of New Preferred Stock paid in kind and approximately $25,000 of cash-in-lieu of fractional shares.

2021 Development Plan and Financial Guidance

Gulfport released operational guidance and outlook for the full year 2021, including full-year expense estimates and projections for production and capital expenditures. Gulfport's 2021 guidance assumes commodity strip prices as of July 7, 2021, adjusted for applicable commodity and location differentials, and no property acquisitions or divestitures.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Mid-Continent News >>>

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -