Service & Supply | Quarterly / Earnings Reports | Oilfield Services | Fourth Quarter (4Q) Update | Financial Results | Capital Markets | Corporate Strategy

Halliburton 4Q20: North America Revenues Jump 22%, International Stable

Halliburton reported its Q4 2020 results.

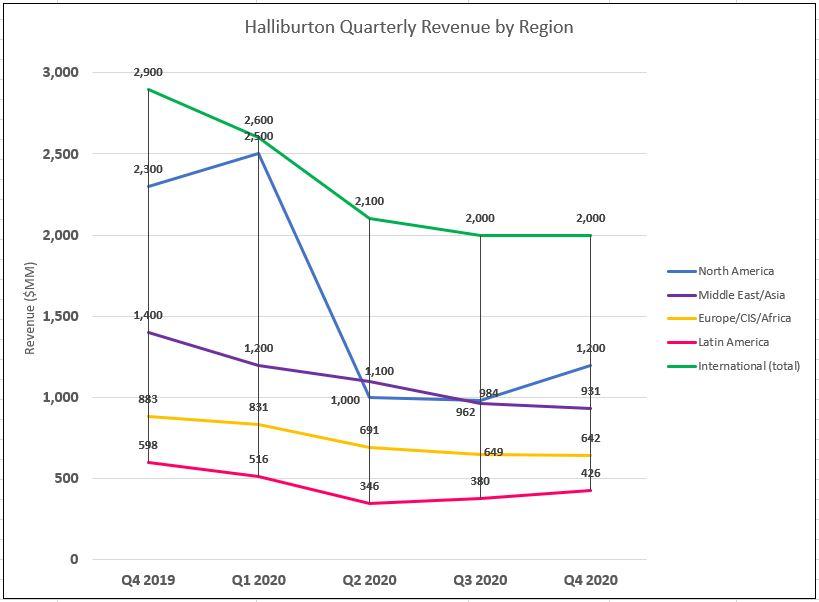

Revenue by Region: North America Revenues Up 22% in Q4

Halliburton saw a sizable resurgence in North America activity, which bolstered revenues 22% versus 3Q20.

As for International activity, it was largely flat from the prior quarter.

Conference Call Highlights

2021 Outlook- Completions to Outpace Drilling Activity: "While we anticipate a slower than normal start to the year in some international regions, we also expect activity momentum in North America to continue with completions activity outpacing drilling activity."

- Flat Spending for 2021 vs. 2020: "Capital expenditures during the quarter were $218 million with our 2020 full year CapEx totaling approximately $730 million. In 2021, we intend to keep our capital expenditures relatively flat at $750 million. We believe that with this level of spend we will be well-equipped to take advantage of the unfolding recovery."

- Activity Increases Predicted for International: "While the international sales cycle tends to be longer, we now have line of sight to activity increases in the coming quarters. Tender activity has picked up recently led by the NOCs in the Middle East and Latin America and new opportunities are emerging with operators in other regions."

- North America to Continue Improvements in 2021: "While the U.S. land rig count recovered from its August 2020 low of 230 rigs, it is still 60% below the pre-pandemic levels. Private and small operators added the most rigs, while large E&Ps and majors moved more slowly. We expect completions activity in North America to continue improving in the first half of 2021 as commodity prices remained supportive and customers complete their backlog of DUCs. Customer consolidation will likely continue and we expect most operators will remain committed to a disciplined capital program."

- Flat Production Expected: "I am optimistic that our customers will sustain activity in order to hold their production flat to 2020 exit levels with completion spend outpacing drilling."

Q: "I don’t know if you can maybe just take a minute and talk to which your expectations are for North American E&P spending this year and then also on the international side, I know you said kind of activity up low double-digits in the back half of this year for international, but I don’t know if that means that we can actually kind of get more flattish spending this year by E&Ps or is that still going to be down?"

- Jeff Miller: "Look, from an international standpoint, I mean, I think that’s a fairly tight range around flat. But I also think what’s more important is the improvement that we are seeing into what we believe is supply and demand balancing in 2022 and that’s the right kind of trajectory to have going into that. And so if we have got double-digit growth in the second half of the year, we have called the bottom in the first quarter of the year, we used to kind of work through that. And like I said, I believe that the tighter range around flat, but I think that’s going to be, it’s got to be the path to solid improvement. And I am pretty optimistic about how all of that plays out. "

- "In North America, again, I think Q1 last year creates a lot of noise in that comparison, but the important thing is I do believe customers will be capital disciplined, but we have got a lot of road to go just to get back to where we were, even pre-pandemic when the first quarter of ‘20. And so I think that and we saw production come off pretty hard in 2020. So, just to keep things flat in 2021, from a production perspective, requires a reasonable amount of activity and actually more activity than we even see today based on kind of our calculation and outlook, which gives me good confidence that while we have got good momentum in the first quarter and we have got pretty good visibility for the year. So, I think that our outlook that, that momentum it builds in the first quarter, but it doesn’t fall off at the pace that it has in the past certainly, I think that just because the drivers will be different. And I think capital discipline and flat production coexist in the market and that’s what gives me confidence."

Q4 Report

- Reported net loss of $0.27 per diluted share

- Adjusted net income of $0.18 per diluted share, excluding impairments and other charges

- Cash flow from operating activities of $638 million and free cash flow of $420 million

The company announced today a net loss of $235 million, or $0.27 per diluted share, for the fourth quarter of 2020.

This compares to a net loss for the third quarter of 2020 of $17 million, or $0.02 per diluted share. Adjusted net income for the fourth quarter of 2020, excluding impairments and other charges, was $160 million, or $0.18 per diluted share. This compares to adjusted net income for the third quarter of 2020, excluding severance and other charges, of $100 million, or $0.11 per diluted share. Halliburton's total revenue in the fourth quarter of 2020 was $3.2 billion, a 9% increase from revenue of $3.0 billion in the third quarter of 2020. Reported operating loss was $96 million in the fourth quarter of 2020 compared to reported operating income of $142 million in the third quarter of 2020. Excluding impairments and other charges, adjusted operating income was $350 million in the fourth quarter of 2020, a 27% increase from adjusted operating income of $275 million in the third quarter of 2020.

Total revenue for the full year of 2020 was $14.4 billion, a decrease of $8.0 billion, or 36% from 2019. Reported operating loss for 2020 was $2.4 billion, compared to reported operating loss of $448 million for 2019. Excluding impairments and other charges, adjusted operating income for 2020 was $1.4 billion, compared to adjusted operating income of $2.1 billion for 2019.

President & CEO Jeff Miller commented: “I am pleased with our solid execution in the fourth quarter and for the full year. Our swift and decisive cost actions and service delivery improvements reset our earnings power, delivering strong margins and cash flow. We also achieved historic bests in safety and service quality.

“I am optimistic about the activity momentum I see in North America, and expect international activity to bottom in the first quarter of this year. I am also encouraged by the growing pipeline of international customer opportunities and the unfolding global activity recovery.

“I believe our strategic priorities will allow us to continue generating industry-leading returns and strong free cash flow and solidify Halliburton’s role in the unfolding energy market recovery,” concluded Miller.

Operating Segments

Completion and ProductionCompletion and Production revenue in the fourth quarter of 2020 was $1.8 billion, an increase of $236 million, or 15%, when compared to the third quarter of 2020, while operating income was $282 million, an increase of $70 million, or 33%. These increases were driven by higher activity across multiple product lines in North America, increased stimulation activity in Argentina and Kuwait, higher completion tools sales in Africa, Southeast Asia, and Norway, and increased well intervention services internationally. These increases were partially offset by lower pressure pumping activity in Saudi Arabia and lower completion tools sales in Eurasia and Australia.

Drilling and EvaluationDrilling and Evaluation revenue in the fourth quarter of 2020 was $1.4 billion, an increase of $26 million, or 2%, when compared to the third quarter of 2020, while operating income was $117 million, an increase of $12 million, or 11%. These increases were primarily due to higher drilling-related services in North America and Brazil, increased wireline activity in North America and Latin America, higher fluids sales in Asia Pacific and Guyana, and increased software sales across all regions. Partially offsetting these increases were lower drilling-related services and project management activity across Europe/Africa/CIS, the Middle East, and Mexico, as well as reduced wireline activity in Asia Pacific and Saudi Arabia.

Geographic Regions

North AmericaNorth America revenue in the fourth quarter of 2020 was $1.2 billion, a 26% increase when compared to the third quarter of 2020. This increase was driven by higher activity in stimulation and artificial lift in U.S. land, as well as higher well construction and wireline services activity, and year-end completion tools and software sales.

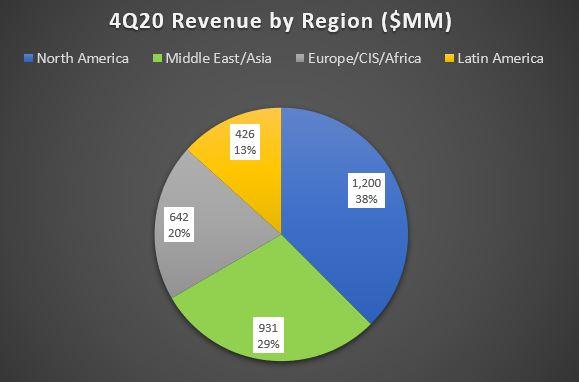

InternationalInternational revenue in the fourth quarter of 2020 was $2.0 billion, essentially flat when compared to the third quarter of 2020. Higher pressure pumping and wireline activity in Argentina, increased fluids sales in Asia Pacific and Guyana, higher completion tools sales in Norway, Africa, and Southeast Asia, and increased software sales across multiple regions were offset by lower activity across multiple product service lines in Saudi Arabia, Mexico, Norway, and Russia.

- Latin America revenue in the fourth quarter of 2020 was $426 million, a 12% increase sequentially, resulting primarily from increased pressure pumping and wireline activity in Argentina, and activity increases in multiple product service lines in Colombia and Ecuador, as well as higher fluids sales in Guyana and drilling services in Brazil. These increases were partially offset by reduced activity across multiple product service lines in Mexico.

- Europe/Africa/CIS revenue in the fourth quarter of 2020 was $642 million, a 1% decrease sequentially, resulting primarily from reduced drilling-related services and completion tools sales in Eurasia, coupled with lower drilling-related activity in Norway. These decreases were partially offset by higher completion tools sales in Africa, Norway, and Continental Europe, as well as increased stimulation and well intervention services in Algeria and Continental Europe.

- Middle East/Asia revenue in the fourth quarter of 2020 was $931 million, a 3% decrease sequentially, largely resulting from lower activity across multiple product service lines in Saudi Arabia, reduced drilling activity in the United Arab Emirates, and decreased project management activity in India. These decreases were partially offset by higher drilling-related services in China, Australia and Malaysia, increased stimulation activity in Kuwait, and higher software sales across the region.

Other Financial Items

Halliburton recognized $446 million of pre-tax impairments and other charges in the fourth quarter of 2020, primarily related to a contemplated structured transaction for its North American real estate assets.

Selective Technology & Highlights

- Halliburton announced its commitment to set science-based targets to reduce greenhouse gas (GHG) emissions. The Company submitted its commitment letter to the Science Based Targets initiative (SBTi), a collaboration between CDP, the United Nations Global Compact, World Resources Institute, and the World Wide Fund for Nature. With this commitment, Halliburton will submit targets in 2021, and SBTi validation is expected in 2022.

- Halliburton successfully deployed the industry’s first electric-powered fracturing operation for Cimarex Energy Co. in the Permian basin. To date, Halliburton has completed over 300 stages across multiple wells using utility-powered electric frac pumps that demonstrated consistent superior performance. Halliburton’s electric-powered equipment is engineered to utilize the maximum power potential from the grid, allowing the customer to achieve pump rates of 30% to 40% higher than with conventional equipment.

- Halliburton and Accenture have teamed up to accelerate Halliburton’s digital supply chain transformation and support digitalization within the Company’s manufacturing and supply chain functions. This new delivery platform will apply advanced analytics and enhanced business intelligence tools for its support teams to improve service levels and unlock operational benefits. This transformation further supports Halliburton’s strategic priority to accelerate digital deployment and integration across the value chain.

- Halliburton introduced Digital Well Operations, a DecisionSpace® 365 cloud solution. Digital Well Operations is the industry’s first open and integrated well operations software that seamlessly connects the entire value chain – operators, service providers, logistics providers and rig providers – to deliver more efficient and safe wells.

- OMV Petrom S.A. will adopt Halliburton’s DecisionSpace 365 application to consolidate asset and production data in an integrated environment as part of OMV Petrom’s DigitUp digitalization program. The solution will integrate the operator’s asset information to assist engineers in monitoring and optimizing production, while enhancing operational efficiency and decision making. This scalable solution will expand over further assets and functional use cases as collaboration between OMV Petrom S.A. and Halliburton continues.

- Halliburton introduced Crush & Shear™ Hybrid Drill Bit, a new technology that combines the efficiency of traditional polycrystalline diamond compact (PDC) cutters with the torque-reducing capabilities of rolling elements to increase drilling efficiency and maximize bit stability through changing formations.

- Halliburton established a Halliburton Business and Engineering Scholarship Fund at Prairie View A&M University (PVAMU). To be administered by PVAMU, scholarships will go to eligible junior and/or senior students majoring in Accounting, Management Information Systems, Finance and Engineering.

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

International News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Touchstone Exploration, Inc., First Quarter 2023 Results -

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

.jpg&new_width=60&new_height=60&imgsize=false)