Service & Supply | Top Story | Quarterly / Earnings Reports | Oilfield Services | Third Quarter (3Q) Update

Halliburton Expects Slow 4Q, More Cost Cutting, Stacking Equipment

Halliburton reported its Q3 2019 results. Here are the highlights from its call and report.

Shift from US to International

Similar to Schlumberger, Halliburton noted the shift in activity from North America to the International market as US operators slow completions.

In the conference call, CEO Jeffrey Miller commented: "International activity growth is gaining momentum across multiple regions. Meanwhile, operators' capital discipline weighs on North American activity levels."

"International revenue was flat sequentially, but is up 10% year-to-date. North America revenue decreased 11% sequentially, primarily driven by customer activity declines."

Q4 Outlook - Continued Declines

- Continued declines across North America are expected - rig / completions may be even lower than Q4 2018.

"Looking ahead to the fourth quarter, we see more of the same. We expect customer activity to decline across all basins in North America land, impacting both our drilling and completion businesses.

"Feedback from our customers leads us to believe that the rig count and completions activity may be lower than in the fourth quarter of last year."

2020 Outlook - International to Continue Growth, US Shaky

- In 2020, Halliburton expects to outperform aross the international markets. With North America activity declining, the company is looking to take a disciplined approach in terms to spending next year - cutting fixed costs and taking a proactive approach to stacking equipment.

"Looking to 2020, I see more international topline and margin growth opportunities for Halliburton coming from mature fields and shallow water markets. Barring a global economic slowdown, a broader offshore recovery should add momentum to the international growth going forward.

"In North America, the market is very different. Customer spending has decreased and is largely concentrated in the first half of the year. The US land rig count declined 11% from the second to the third quarter for the first time in 10 years. And while, historically, the third quarter used to be the busiest in terms of hydraulic fracturing activity in the US, stage counts declined every month this quarter."

Cutting North America Costs; Stacking Equipment

"We are the execution company. So, let's talk about how we are proactively executing our North America playbook with a clear purpose to generate returns and free cash flow.

"This is what it looks like. We are stacking equipment. In the third quarter, we stacked more equipment than we did in the first six months of the year. While this impacts our revenues, we would rather err on the side of stacking than work for insufficient margins and wear out our equipment.

"We're reducing costs. You've seen us do this before. We took out $1 billion in 2016. We reorganized and reduced our fixed costs in North America earlier this year. We continue to evaluate the way we work and we'll keep reducing costs in our North American operations."

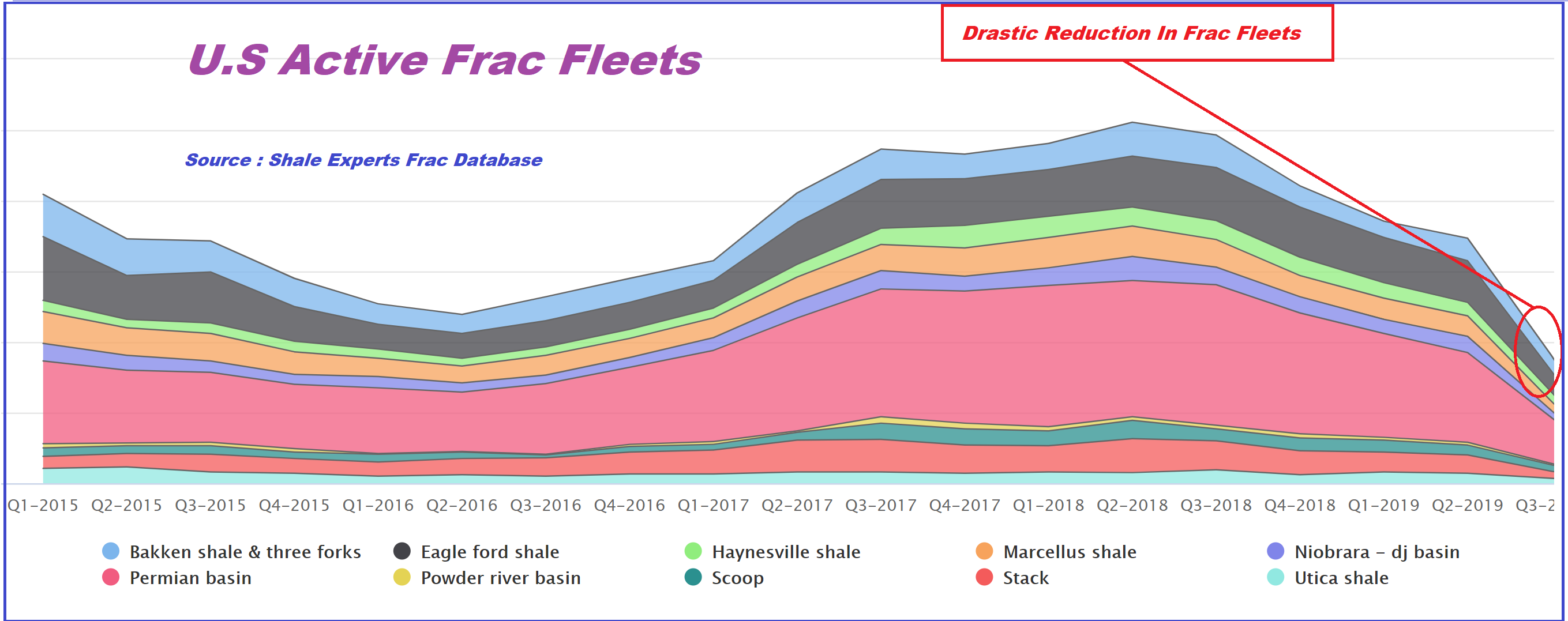

Below is chart from our Frac Database, showing the rapid decline in Frac Fleets.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

International News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Latin America News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -