Quarterly / Earnings Reports | First Quarter (1Q) Update | Production Rates | Capital Markets | Capital Expenditure

Hess Production Falls 17%; Plans to Increase Bakken Rig Count

Hess reported its Q1 2018 results.

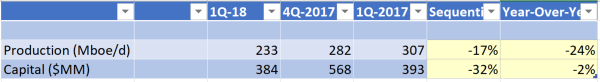

The company reported net corporate production of 233 Mboe/d in 1Q18 which is down -17% sequentially and -24% YoY.

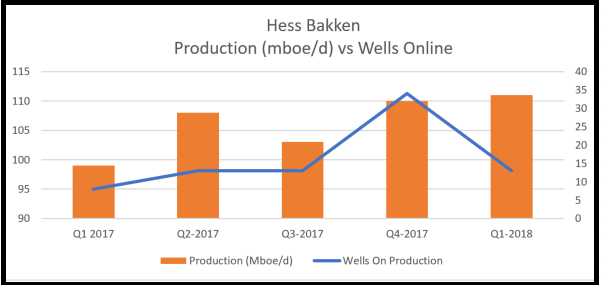

What we found rather interesting was that the company grew its Bakken production a measly 1% where in 4Q17 the company produced 110 Mboe/d vs 1Q18 of 111 Mboe/d. This tiny growth was realized amist putting 13 wells online during the quarter, see the chart below.

The increase in production YoY clearly came from the fact that the company significantly added more wells in Q3 of 2017. The company plans to add a ftith rig in 3Q and size in 4Q this year.

Source : Shale Experts Company Database, Hess Filings

Another interesting piece of data can be found by looking at Hess' production on a sequential basis. We saw that the company had a reduction of -14% production sequentially and -24% YoY.

Source : Shale Experts Company Database, Hess Filings

According to the company :

"Net production, excluding Libya, was 233,000 boepd in the first quarter of 2018, compared to 307,000 boepd in the prior-year quarter. Lower volumes were primarily due to prior-year asset sales, the previously announced unplanned downtime at the third-party operated Enchilada platform in the Gulf of Mexico, and natural decline. These lower volumes were partially offset by higher production in the Bakken and from North Malay Basin. First quarter 2017 net production, excluding asset sales and Libya, was 241,000 boepd. Libya net production was 22,000 boepd in the first quarter of 2018, compared to 4,000 boepd in the prior-year quarter.

Bakken (Onshore U.S.): Net production from the Bakken increased 12 percent to 111,000 boepd from 99,000 boepd in the year-ago quarter due to increased drilling activity and improved well performance. The Corporation operated an average of four rigs in the first quarter, drilling 23 wells and bringing 13 new wells online. The Corporation plans to add a fifth rig in the third quarter and a sixth rig in the fourth quarter of this year.

Gulf of Mexico (Offshore U.S.): Net production from the Gulf of Mexico was 41,000 boepd, compared to 66,000 boepd in the prior-year quarter primarily due to the ongoing shutdown at the third-party operated Enchilada platform from the fourth quarter of 2017. Production recommenced at the Baldpate, Penn State and Llano Fields during the first quarter of 2018, while production is expected to restart at the Conger Field by the end of the third quarter of 2018. At the Stampede development (Hess operated - 25 percent), first production commenced in January 2018 and is expected to ramp up over the next 18 months as we complete additional wells.

North Malay Basin (Offshore Malaysia): Net production from North Malay Basin (Hess - 50 percent) was 22,000 boepd, compared to 2,000 boepd in the prior-year quarter, which commenced production from its full field development in July 2017. In the first quarter, production was impacted by approximately 4,000 boepd due to downtime for planned maintenance of condensate export equipment.

Guyana (Offshore): At the Stabroek Block (Hess - 30 percent), operated by Esso Exploration and Production Guyana Limited, the Pacora-1 exploration well encountered approximately 65 feet of high-quality, oil-bearing sandstone reservoir and is the seventh significant oil discovery on the Block. The well is located approximately four miles west of the Payara-1 well and the operator plans to integrate the discovery into a third phase of development, with first production from this phase planned for late 2023 or early 2024. The Operator also completed drilling at the Liza-5 well with the Stena Carron drillship, and is conducting a series of production tests. In April, drilling commenced at the Sorubim-1 well with the Noble Bob Douglas drillship.

Development activities for Liza Phase 1, which include a floating, production, storage, and offloading vessel (FPSO) with a gross capacity of 120,000 bopd, are on schedule and first production is expected by 2020. Planning continues for a second phase of development, that is expected to include a larger FPSO with a gross capacity of approximately 220,000 bopd, with first production planned by mid-2022.

Ghana (Offshore): In February, we entered into an agreement to sell our interests in Ghana for total consideration of $100 million, consisting of a $25 million payment upon closing and a further payment of $75 million payable upon approval of the Plan of Development for the Deepwater Tano Cape Three Points block, which is expected by year-end 2018. The transaction is subject to government approval and customary closing conditions."

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Gulf of Mexico News >>>

-

Empire Petroleum First Quarter 2023 Results

-

APA Corporation First Quarter 2023 Results -

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

W&T Offshore, Inc., First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)

-

Vitesse Energy, Inc. First Quarter 2023 Results -

2.jpg&new_width=60&new_height=60&imgsize=false)