Quarterly / Earnings Reports | Debt | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure | Drilling Activity

HighPoint Resources Second Quarter 2020 Results

HighPoint Resources Corp. reported its Q2 2020 results.

Highlights:

- Reported production sales volume of 2.9 million barrels of oil equivalent ("MMBoe") for the second quarter of 2020, exceeding the high end of guidance by 12% driven by well performance, timing of completions and minimal downtime

- Oil production sales volume of 1.6 million barrels of oil ("MMBbls") for the second quarter of 2020; 57% of total equivalent production sales volume exceeding the high end of guidance by 11%

- Second quarter of 2020 capital expenditures of $25 million were 38% below guidance

- Second quarter of 2020 controllable operating costs1 were $9.13 per Boe. Excluding non-recurring severance and other costs of $1.36 per Boe, controllable operating costs were 12% lower than the first quarter of 2020

- High fluid intensity completions continue to positively impact well performance at Hereford and NE Wattenberg; 2020 development wells are the highest performing to date

- Anticipate generating positive free cash flow in the second half of the year, which will be used to further improve net debt and liquidity

- Strong hedge position bolsters a significant portion of 2020 and 2021 cash flow against fluctuations in crude price

Chief Executive Officer and President Scot Woodall commented, "The second quarter was dominated by the COVID-19 pandemic, its impact on global and macro markets and the associated effect on oil prices. The health and safety of our employees and the communities in which we operate remains our top priority. I'm proud of our employees' professionalism, hard work and dedication in quickly adapting to what has become a new operating environment. Our strong second quarter results demonstrate our ability to execute as we exceeded our objectives despite the many macro challenges that the industry faced. In addition, we took decisive steps in response to lower oil prices by suspending drilling and completion activity and implementing cost saving initiatives to better align our corporate cost structure to the current operating environment.

"As we plan for the second half of the year, we continue to monitor current and future crude oil prices along with a broader macroeconomic recovery to determine the appropriate time to resume activity. We maintain an inventory of DUCs that positions us to quickly resume completion activity when warranted. We expect to generate positive free cash flow in the second half of the year that will allow us to further improve net debt and liquidity from current levels. Our hedge position continues to bolster cash flows and provides some near-term revenue protection from the impact of low oil prices."

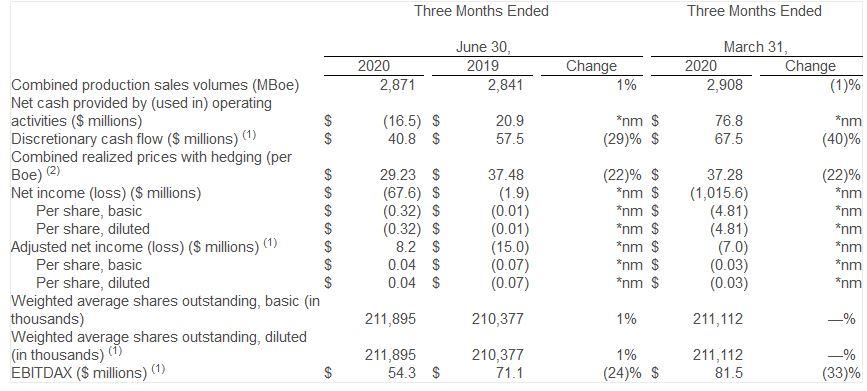

Financial Results

For the second quarter of 2020, the Company reported a net loss of $68 million, or $0.32 per diluted share. Adjusted net income for the second quarter of 2020 was $8 million, or $0.04 per diluted share. EBITDAX for the second quarter of 2020 was $54 million. Excluding non-recurring employee severance and other costs of approximately $4 million, reported EBITDAX would have been approximately $58 million.

The Company reported oil, natural gas and natural gas liquids ("NGL") production of 2.9 MMBoe for the second quarter of 2020, which exceeded the high end of the guidance range of 2.5-2.6 MMBoe. Oil volumes totaled 1.6 MMBbls, which exceeded the high end of the guidance range of 1.4-1.5 MMBbls. The outperformance relative to guidance was primarily due to a combination of well performance, timing of completions and minimal downtime.

Production sales volumes for the second quarter were comprised of approximately 57% oil, 23% natural gas and 20% NGLs.

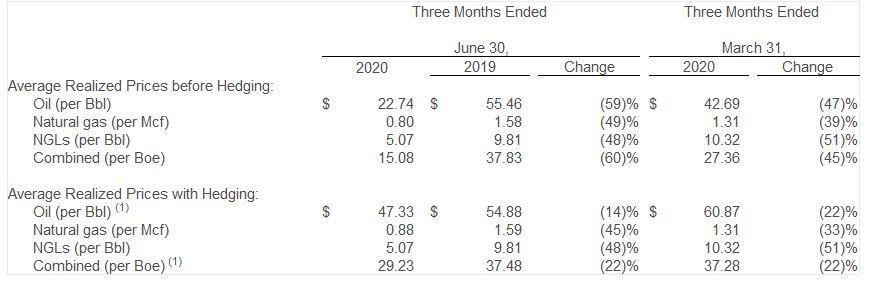

For the second quarter of 2020, West Texas Intermediate ("WTI") oil prices averaged $27.85 per barrel, Northwest Pipeline ("NWPL") natural gas prices averaged $1.47 per MMBtu and NYMEX natural gas prices averaged $1.71 per MMBtu. Commodity price realizations to benchmark pricing were WTI less $5.30 per barrel of oil and NWPL less $0.67 per Mcf of gas. The NGL price averaged approximately 16% of the WTI price per barrel.

For the second quarter of 2020, the Company had derivative commodity swaps in place for 14,000 barrels of oil per day tied to WTI pricing at $59.43 per barrel, 11,703 MMBtu of natural gas per day tied to a NWPL regional pricing of $1.82 per MMBtu and no hedges in place for NGLs.

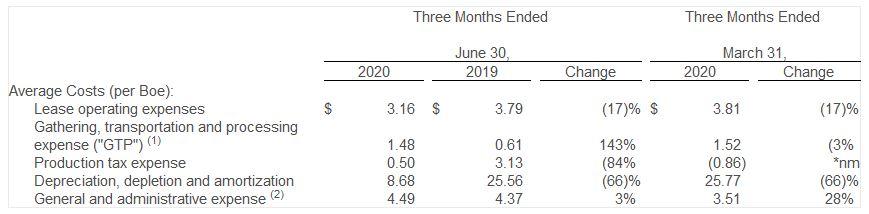

Lease operating expense ("LOE") averaged $3.16 per Boe in the second quarter of 2020 compared to $3.81 per Boe in the first quarter of 2020. Second quarter LOE was lower compared to the first quarter of 2020 as a result of a reduction in water handling and disposal costs and other operational efficiencies.

Production tax expense averaged $0.50 per Boe in the second quarter of 2020 compared to $(0.86) per Boe in the first quarter of 2020. Production taxes for the first quarter of 2020 included an annual true-up of Colorado ad valorem tax based on actual assessments and production taxes for the second quarter of 2020 included severance tax refunds of $1.8 million for the tax period of 2015 to 2017. Excluding the severance tax refunds, production taxes as a percentage of revenues were 7.5%. Production tax expense is expected to average approximately 7%-8% of revenues for the remainder of 2020.

General and administrative expense ("G&A") averaged $4.49 per Boe in the second quarter of 2020 compared to $3.51 per Boe in the first quarter of 2020. Second quarter G&A was higher compared to the first quarter of 2020 as a result of non-recurring costs of approximately $4 million, which were primarily associated with a workforce reduction that was completed in May to align the Company's cost structure to the current operating environment. Excluding the non-recurring costs, second quarter of 2020 G&A was $3.13 per Boe or 11% lower than the first quarter of 2020.

Debt and Liquidity Update

At June 30, 2020, the Company had cash and cash equivalents of $3 million and long-term debt of $795 million, including $175 million outstanding on its credit facility. Working capital changes during the second quarter included the payment of regularly scheduled interest related to the Company's senior notes and ad valorem tax payments. Subsequent to the end of the quarter, bank debt was reduced by $20 million. The Company has a $22 million letter of credit outstanding that reduces ratably per month until it expires on August 31, 2021 and a $5 million letter of credit agreement associated with a separate contractual obligation. Including the letter of credit balances, the Company's current liquidity is approximately $74 million, which is inclusive of the $20 million reduction in bank debt. Given reduced capital expenditures and expected operating cash flows, the Company expects to generate free cash flow for the remainder of the year, which will be used to further improve net debt and liquidity.

Capital Expenditures

Capital expenditures for the second quarter of 2020 totaled $25 million for drilling and completion operations. During the second quarter, the Company spud 4 gross short reach lateral wells and placed 14 gross wells on flowback. As previously reported, due to oil price volatility, the Company suspended drilling and completion activity during the second quarter and will defer further activity until broader market conditions improve.

Ops Update

Northeast WattenbergThe Company produced an average of 23,728 Boe/d (53% oil) in the second quarter of 2020 in NE Wattenberg. Recent activity includes nine XRL wells completed with high fluid intensity completions that were placed on flowback in May and June in DSU 1-64-5. After 75 days of production, the average per well cumulative oil production was approximately 35,000 barrels of oil, which compares favorably to the six wells placed on flowback in February in DSU 4-61-5 and were the central area's highest producing wells to date. Subsequent to the end of the quarter, two additional wells in DSU 1-64-5 were placed on flowback in July.

Hereford FieldProduction sales volumes for the second quarter of 2020 in Hereford averaged 7,639 Boe/d (71% oil). During the second quarter, the Company's completion activity was focused in the Fox Creek area as flowback was initiated on three wells at DSU 12-63-34 and two wells at DSU 12-63-33. Including the two wells that began initial flowback in March at DSU 12-63-27, the average per well cumulative oil of the seven Fox Creek area wells placed on flowback in 2020 is trending approximately 5% greater than the offsetting Section 16 wells after 60 days, which are the economic baseline for Hereford development. These wells continue to demonstrate the Company's ability to positively impact well performance utilizing high fluid intensity completions as the 2020 development program wells are the Company's highest performing wells to date in Hereford.

THIRD QUARTER 2020 GUIDANCE

The Company continues to monitor current and future crude oil prices along with the uncertainties and potential impacts of broader macroeconomic effects on the oil sector to determine the appropriate time to resume activity. Accordingly, the Company is providing guidance for the third quarter of 2020.

For the third quarter of 2020, capital expenditures are anticipated to total approximately $10 million and production is expected to approximate 2.5-2.6 MMBoe, of which approximately 56% is anticipated to be oil. Third quarter guidance assumes no additional drilling and completion activity.

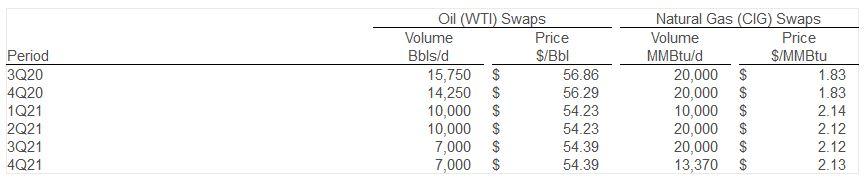

Hedging Update

The following table summarizes the Company's current hedge position as of August 3, 2020:

The Company has sold WTI swaptions of 3,000 bbl/d for calendar 2022 at an average strike price of $55.00/bbl. Realized sales prices will reflect basis differentials from the index prices to the sales location.

The Company has also entered into derivative contracts to hedge its exposure to the WTI NYMEX calendar month average roll, which is a contractual component associated with a portion of its physical crude oil sales prices.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Rockies News >>>

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Devon Said To be In Talks to Acquire Enerplus

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans