Service & Supply | Seismic | Oilfield Services | Third Quarter (3Q) Update

ION reports third quarter 2020 results

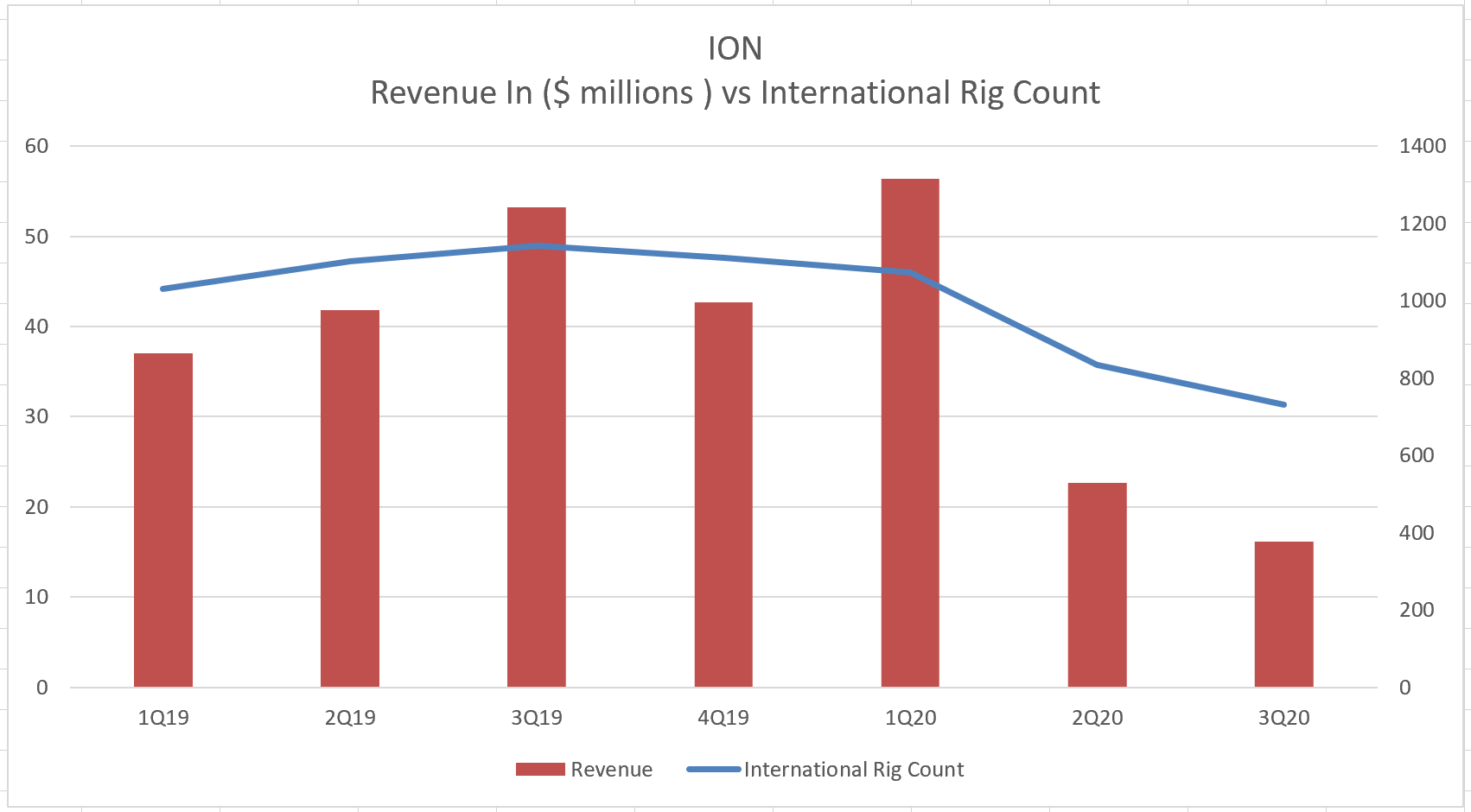

ION Geophysical today reported total net revenues of $16.2 million in the third quarter 2020, a 29% decrease compared to $22.7 million in the second quarter 2020 and a 70% decrease compared to $53.2 million one year ago. At September 30, 2020, backlog, which consists of commitments for multi-client programs and proprietary imaging work, was $17.7 million or 77% higher compared to backlog at June 30, 2020.

Net loss attributable to ION in the third quarter 2020 was $16.6 million, or a loss of $1.16 per share, compared to a net loss attributable to ION of $3.7 million, or a loss of $0.26 per share in the third quarter 2019. The Company reported Adjusted EBITDA of $(6.6) million for the third quarter 2020, a decrease from $15.5 million one year ago. A reconciliation of Adjusted EBITDA to the closest comparable GAAP numbers can be found in the tables of this press release.

Year-to-date net revenues were $95.4 million, a 28% decrease year-over-year compared to the $132.0 million of net revenues one year ago. While year-to-date revenues were down $36.6 million, the net loss attributable to ION improved by $9.6 million primarily due to the over $38 million of structural changes and associated cost reductions implemented earlier this year.

Net loss attributable to ION was $24.1 million in the first nine months of 2020, or a loss of $1.69 per share, compared to a net loss attributable to ION of $33.7 million, or a loss of $2.39 per share in the first nine months of 2019. Year-to-date Adjusted EBITDA was $16.5 million, a decrease from $22.7 million for the first nine months of 2019.

At quarter close, the Company's total liquidity of $59.4 million consisted of $51.1 million of cash (including net revolver borrowings of $22.5 million) and $8.3 million of remaining available borrowing capacity under the revolving credit facility, slightly below total liquidity of $65.5 million from one year ago. In response to the market uncertainty from the COVID-19 pandemic and lower oil and gas prices, the Company drew under its credit facility during the first quarter 2020, of which $22.5 million remains outstanding and in the Company's cash balances as of September 30, 2020. In addition, the Company continues to work with its banking advisors and largest bondholder to proactively address the $121 million bond ahead of its scheduled maturity in December 2021.

"Our third quarter results were negatively impacted by continued challenging market conditions associated with repercussions of the oil price volatility earlier this year," said Chris Usher, ION's President and Chief Executive Officer. "More specifically, this quarter the impact of E&P clients' reduced budgets and restructuring began to materially impact results as many of our contacts found themselves in new or different positions with uncertain budgets. We partially mitigated this impact by fully benefiting from the over $38 million of structural changes and associated cost reductions we outlined early this year. Currently, we are seeing a number of constructive developments evidenced by more stable oil prices, a settling in of new client roles and clearer definition of E&P budgets to high-grade offshore reserves, and line of sight on specific deals for the fourth quarter. Based on these trends and high levels of client engagement on specific deals, including a number postponed from the third quarter, we expect the fourth quarter to be significantly better than the second quarter with the potential to approach our fourth quarter results from last year.

"Despite the macroeconomic backdrop, we have made significant progress executing our strategy. Backlog increased 77% sequentially, reversing several consecutive quarters of steady decline due to our strategic shift to enter the 3D new acquisition multi-client market. We successfully acquired the initial phase of our Mid North Sea High 3D multi-client program and built backlog for the significantly larger second phase next summer. We also commercialized our proprietary Gemini™ extended frequency source technology, a key ingredient for improving 3D subsurface imaging in complex geological settings, where some of the most attractive E&P investment areas reside. In addition, we are seeing increasing traction of our offshore optimization software, Marlin™. Our team is engaged in four trials outside of our core market to optimize port operations and maritime energy logistics and, based on the positive response, we believe we are well positioned for several additional trials and multiple tenders. In fact, we just won a highly competitive tender to provide a Port Management System for a series of ports in the United Kingdom. While we don't include recurring contracted Software revenues as backlog, year-to-date we extended seven multi-year command and control deals in our core market worth over $5 million annually.

"Although we expect the market will remain challenging, we see indications for improving offshore E&P industry dynamics and continue to anticipate significant growth in digitalization over the next decade. In addition to the E&P industry, we continue to work to broaden our offerings into other markets. I'm encouraged by the positive client feedback related to the value delivered from our innovative solutions. For example, clients can now identify, quantify and ultimately improve inefficiencies in vessel transit through the use of our Marlin software. Importantly, we intersect the E&P industry's need to high-grade portfolios and bring lower cost barrels online faster, while achieving environmental compliance goals, such as carbon neutrality. Rapid digital transformation has enabled a smarter, data-rich environment from which to identify high impact wells, maximize production, or improve the safety and efficiency of offshore operations. I strongly believe ION's consistent, pragmatic focus to provide data and software that optimizes decision-making in capital intensive industries positions us well for future success."