Quarterly / Earnings Reports | Production | Second Quarter (2Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Activity | Drilling Program

Legacy Reserves Resumes HZ Drilling in Q2; Adds Rigs

Legacy Reserves LP announced second quarter results for 2016.

Key Points:

- After 6 months of inactivity, we recently resumed horizontal development and currently have two rigs running, one in Lea County, NM and one in Howard County, TX.

- Based on current strip pricing, we anticipate spending our $37 million capital budget but may deviate from such plans based on market conditions.

Highlights:

- Reduced lease operating expenses, excluding ad valorem taxes, to $41.5 million representing an 11% decrease compared to Q1 2016 and a 14% decrease compared to Q4 2015

- Maintained production of 44,615 Boe/d, a 2% reduction compared to both Q1 2016 and Q4 2015 (without adjusting prior periods for recent asset sales)

- Closed an additional $19.0 million of asset sales

- Further reduced debt outstanding by $67.6 million including a $37.0 million reduction in borrowings under our credit facility and $30.6 million of repurchases and exchanges of senior notes

Operational Update

Through Q2 2016, we spent $11.7 million of our $37 million 2016 capital budget representing a year to date spend of 32% of the budgeted total. Approximately 22% was spent on recompletions and workovers in our East Texas region (targets include Cotton Valley and Bossier formations). The majority of the balance was deployed in the Permian on workovers and on horizontal development under our development agreement with an affiliate of TPG Special Situations Partners under which we operate all wells and fund 5% of the parties' development capital.

Since September 2015 we have drilled and completed 12 horizontal wells under the program: 5 in Lea County, NM, 1 in Southern Reagan County, TX and 6 in Howard County, TX (Wolfberry and Bone Spring). After 6 months of inactivity, we recently resumed horizontal development and currently have two rigs running, one in Lea County, NM and one in Howard County, TX. Based on current strip pricing, we anticipate spending our $37 million capital budget but may deviate from such plans based on market conditions.

2016 Asset Sales Update

Through Q2 2016, we closed 18 divestitures generating net proceeds of $87.5 million. Below are the summary statistics of year to date sales:

In July and early August, we completed three additional divestments of properties outside the Midland Basin for approximately $5.0 million, bringing our year-to-date total to $92.5 million.

Capital Structure Update

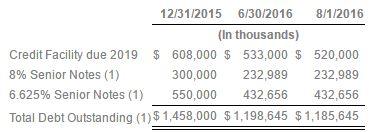

Through August 1, 2016, we have reduced our year-end 2015 total debt outstanding by $272.4 million. Our debt balances as of each of the respective dates are as follows:

Given our borrowing base of $630 million, outstanding borrowings of $520 million and $1.4 million of outstanding letters of credit, we currently have $108.6 million of availability.

Near-Term Outlook and Commentary

Paul T. Horne, Chairman, President and Chief Executive Officer of Legacy's general partner commented, "I am proud of the progress we made in Q2 and over the past several quarters. The difficult macro environment remains challenging but our team continues to make meaningful operational improvements. LOE was down 11% from last quarter and down 3% relative to Q2 2015, which is very impressive, given the significant increase in our property base from our acquisition of East Texas properties. We remain incredibly disciplined with our capital spending. Under our horizontal development program with TSSP, we have funded $4.1 million of capital to date and averaged approximately 850 Boe/d of net production in the quarter. With great asset-level results in that program, we recently resumed drilling under the first tranche with a rig running in both Lea County, NM and Howard County, TX.

Consistent with our view last quarter, we continue to focus on maintaining liquidity and reducing debt outstanding and therefore we have no near-term plans to resume our distributions on either our preferred units or common units. As always, we will continue to closely watch the market and respond with business objectives that match accordingly."

Dan Westcott, Executive Vice President and Chief Financial Officer of Legacy's general partner commented, "We again improved our balance sheet this quarter. Year-to-date, our internally generated free cash flow and $92 million of asset sales has enhanced our liquidity, reduced future plugging obligations, and improved our leverage statistics. We've reduced total debt by $272.4 million and currently have over $100 million of availability under our $630 million borrowing base. Given the volatility of the macro environment, we continue to review alternatives for the business including, among others, additional asset sales and new sources of capital. As noted in the included tables, we've recently added commodity hedges to mitigate some of the impact of the market volatility. In the past few months, we increased our 2H 2016 oil hedges from 29% to 63% of current production and increased 2017 from 10% to 46%. We also increased our 2H 2016 gas hedges from 52% to 82% of current production and increased 2017 from 49% to 54%. We continue to monitor further hedge opportunities, and would have hedged additional volumes, but unfortunately, our banks have been unwilling to act as counterparty for additional hedges, which we believe is based on our credit profile and their desire to reduce exposure to the oil and gas sector. Commodity prices have improved since our last quarterly report and our internally projected cash flow has correspondingly increased, but we remain largely exposed to commodity price volatility. Our plans remain flexible to the environment in which we operate, and as Paul mentioned, we will adjust accordingly to position Legacy for success."

Financial and Operating Results - Q2 2016 vs. Q2 2015

- Production increased 33% to 44,615 Boe/d from 33,571 Boe/d primarily due to our acquisitions in the second half of 2015 including our acquisitions of East Texas properties.

- Average realized price, excluding net cash settlements from commodity derivatives, decreased 37% to $18.07 per Boe in 2016 from $28.74 per Boe in 2015 driven by the significant decline in commodity prices as well as the increase of natural gas production as a percentage of total production. Average realized oil price decreased 21% to $39.72 in 2016 from $50.48 in 2015 driven by a decrease in the average West Texas Intermediate ("WTI") crude oil price of $12.39 per Bbl partially offset by an improvement in realized regional differentials. Average realized natural gas price decreased 29% to $1.68 per Mcf in 2016 from $2.38 per Mcf in 2015. This decrease is primarily a result of the decrease in the average Henry Hub natural gas index price of $0.62 per Mcf. Finally, our average realized NGL price decreased 18% to $0.41 per gallon in 2016 from $0.50 per gallon in 2015.

- Production expenses, excluding ad valorem taxes, decreased 3% to $41.5 million in 2016 from $42.8 million in 2015, primarily due to cost reduction efforts on historical properties, partially offset by production expenses related to our acquisition of East Texas properties ($7.5 million). On an average cost per Boe basis, production expenses excluding ad valorem taxes decreased 27% to $10.23 per Boe in 2016 from $14.02 per Boe in 2015, driven primarily by the inclusion of lower cost production from our acquired East Texas properties as well as cost reduction efforts in our historical properties.

- General and administrative expenses, excluding unit-based Long-Term Incentive Plan compensation expense increased to $8.5 million in 2016 from $8.2 million in 2015, reflecting cost reduction efforts partially offsetting increases in salaries and wages commensurate with a larger asset base following our acquisition of East Texas properties.

- Cash settlements received on our commodity derivatives during 2016 were $22.1 million compared to $37.2 million in 2015. While commodity prices were lower in 2016, the decline in cash settlements received is a result of the reduced nominal volumes hedges in Q2 2016 compared to Q2 2015.

- Total development capital expenditures decreased to $6.9 million in 2016 from $8.4 million in 2015. The 2016 activity was comprised mainly of the drilling and completion of joint development agreement wells and capital costs related to CO2 properties.

Financial and Operating Results - Six-Month 2016 vs. Six Month 2015

- Production increased 34% to 45,066 Boe/d from 33,674 Boe/d primarily due to acquisitions in the second half of 2015 including the acquisition of East Texas properties.

- Average realized price, excluding net cash settlements from commodity derivatives, decreased 39% to $16.97 per Boe in 2016 from $27.78 per Boe in 2015 driven by the significant decline in commodity prices as well as the increase in NGL and natural gas production as a percentage of total production. Average realized oil price decreased 26% to $33.96 in 2016 from $46.14 in 2015 driven by a decrease in the average WTI crude oil price of $13.70 per Bbl partially offset by an improvement in realized regional differentials. Average realized natural gas price decreased 31% to $1.80 per Mcf in 2016 from $2.59 per Mcf in 2015. This decrease is a result of the decrease in the average Henry Hub natural gas index price of approximately $0.75 per Mcf. Finally, our average realized NGL price decreased 23% to $0.36 per gallon in 2016 from $0.47 per gallon in 2015. This decrease is due to lower commodity prices.

- Despite additional expenses from our acquisition of East Texas properties of approximately $16.2 million, our production expenses, excluding ad valorem taxes, decreased 1% to $88.2 million in 2016 from $88.8 million in 2015. On an average cost per Boe basis, production expenses decreased 26% to $10.75 per Boe in 2016 from $14.56 per Boe in 2015. These significant savings were driven primarily by expense reduction efforts across our historical property set ($16.8 million) as well as the inclusion of lower cost natural gas properties acquired in East Texas.

- Non-cash impairment expense totaled $15.4 million driven by the continued decline in commodities futures prices during the first quarter of 2016.

- General and administrative expenses, excluding unit-based LTIP compensation expense totaled $16.3 million in 2016 compared to $16.0 million in 2015, reflecting cost reduction efforts partially offsetting increases in salaries and wages commensurate with a larger asset base following our acquisition of East Texas properties.

- Cash settlements received on our commodity derivatives during 2016 were $44.9 million compared to receipts of $77.5 million in 2015. While commodity prices were lower in 2016, the decline in cash settlements received is a result of the reduced nominal volumes hedges in Q2 2016 compared to Q2 2015.

- Total development capital expenditures decreased to $11.7 million in 2016 from $21.8 million in 2015. The 2016 activity was comprised mainly of the drilling and completion of joint development agreement wells and capital costs related to CO2 properties.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Ark-La-Tex - East Texas News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?