Capital Markets | Capital Expenditure | Capital Expenditure - 2021

Northern Oil Reports Changes to Marcellus Asset Deal; Adjusts 2021 Outlook

Northern Oil and Gas, Inc. has reported an update regarding its pending acquisition deal with Reliance Industries subsidiary, Reliance Marcellus LLC.

EQT Corp. has exercised their preferential rights to purchase certain properties that would have otherwise been included in Northern's recently announced Marcellus Shale acquisition from Reliance Marcellus, LLC. These properties, primarily consisting of assets subject to a Joint Development Agreement with EQT, will therefore be excluded from Northern's pending acquisition from Reliance that is expected to close in April 2021.

These changes have been noted in the original deal, which can be found here in Shale Experts' M&A Database.

Changes:

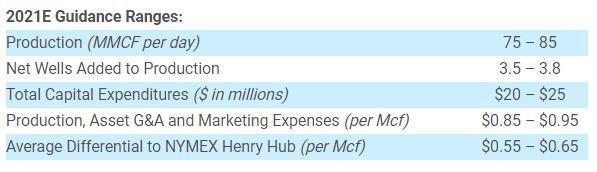

- Unadjusted cash purchase price reduced by $48.6 million to reflect excluded properties, from $175.0 million to $126.4 million

- Acquired assets reduced by approximately 2,200 net acres, or an approximate 3% reduction

- Reduces net undeveloped inventory by only approximately 2 net wells, or 1% of the estimated 231 net undeveloped locations

- Acquired assets expected to produce, on a full year basis, $40 - $45 million of cash flow from operations in 2021 versus $55 - $60 million prior estimate at current commodity price strip

- Capital Expenditures, on a full year basis, expected to range from $20 - $25 million in 2021 versus $25 - $30 million prior estimate

- Northern expects to reallocate a portion of the capital savings into high return Ground Game opportunities, in both the Williston and Permian Basins, with four transactions signed or closed so far in the first quarter of 2021 totaling $11.5 million, inclusive of D&C capital to be incurred in 2021

Nick O'Grady, Chief Executive Officer of Northern Oil, said: "We expect this change to have minimal impact to the Company's free cash flow profile. The exercise of this right immediately reduces our indebtedness and boosts the returns on the acquisition. The JDA assets represent less than 15% of the projected five-year cash flows on the assets and only about 1% of the net inventory, despite reducing the purchase price by approximately 28%."

Adjusted 2021 Guidance

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Frac / Completion Crew (s) |

|

|

|

|

| Wells Completed/Frac(net) |

|

|

|

|

| Production Daily Equivalent(mmcfe/d) |

|

|

|

|

Related Categories :

Deals/ Transaction Update

More Deals/ Transaction Update News

-

PE-Backed Permian E&P to Sell for $4.0 Billion -

-

Shareholders of Arc, 7Gen Approve Pending Merger Deal

-

Ovintiv Looking to Sell Eagle Ford Asset Sale

-

Noble Energy Shareholders Approve Merger with Chevron

-

Report: Petronas Mulling Buying Permian E&P DoublePoint Energy

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?