Drilling & Completions | Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Capital Markets | Capital Expenditure

Oasis Petroleum Fourth Quarter, Full Year 2021 Results

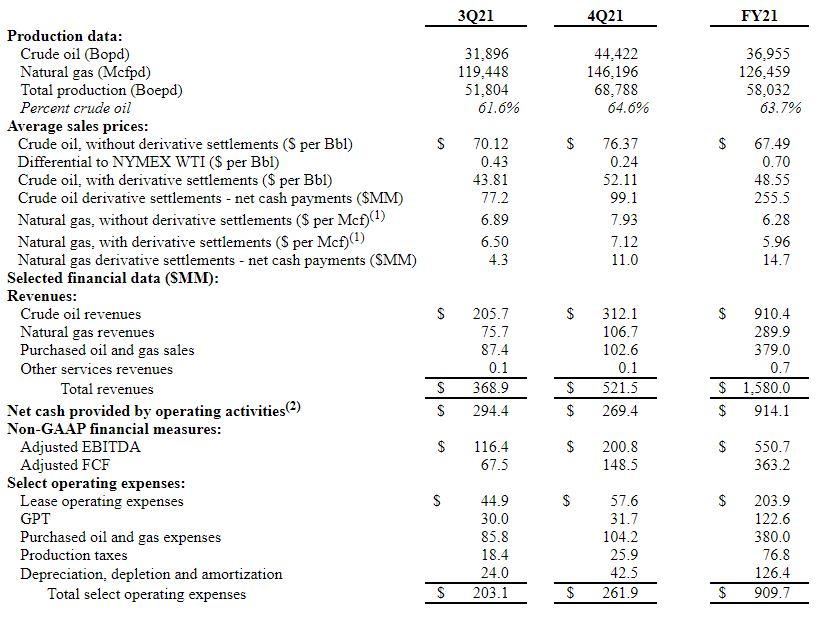

Oasis Petroleum Inc. announced financial and operating results for the quarter and year ending December 31, 2021. Fourth quarter and year end results are consistent with the update released on February 9, 2022.

4Q21 Operational and Financial Highlights:

- Produced 68.8 MBoepd in 4Q21 with oil volumes of 44.4 MBopd;

- E&P CapEx was $45.3MM in 4Q21 and $168.2MM in FY21;

- Net cash provided by operating activities was $269.4MM, net income was $225.9MM and net income from continuing operations was $188.2MM;

- Adjusted EBITDA from continuing operations(1) was $200.8MM and Adjusted Free Cash Flow(1) was $148.5MM;

- Received distribution of $19.0MM from OMP on November 29th ;

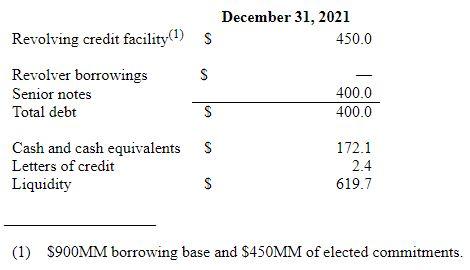

- Pro forma net debt was $67.9MM as of December 31, 2021, including $160.0MM of cash received for the OMP merger with Crestwood, which closed on February 1, 2022. No amounts were drawn under the revolving credit facility ($900MM borrowing base; $450MM of elected commitments);

- Increased base dividend 17% to $0.585/share ($2.34/share annualized) on February 9, 2022. The base dividend will be paid on March 4, 2022 to shareholders of record as of February 21, 2022;

- Completed $100MM share repurchase program.

Results Summary

The Company recorded an income tax benefit from continuing operations of $1.0MM in FY21, resulting in an annual effective tax benefit of (0.3)%.

For 4Q21 and FY21, the Company reported net income from continuing operations of $188.2MM and $189.0MM, respectively, or $8.96 and $9.15 per diluted share, respectively. Excluding certain non-cash items and their tax effect, adjusted net income attributable to Oasis from continuing operations (non-GAAP) was $89.3MM, or $4.25 per diluted share, in 4Q21 and $196.4MM, or $9.52 per diluted share, in FY21.

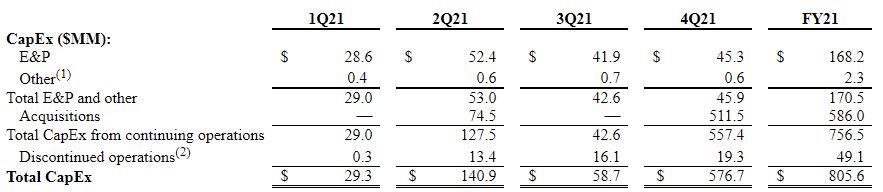

Capital Expenditures

The following table presents the Company's total capital expenditures ("CapEx") by category for the periods presented:

Balance Sheet and Liquidity

The following table presents key balance sheet statistics and liquidity metrics from continuing operations as of December 31, 2021 (in millions):

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -