Drilling & Completions | Top Story | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Drilling Activity

Ovintiv Inc. Second Quarter 2021 Results

Ovintiv Inc. announced its second quarter 2021 financial and operating results.

In addition, the Company increased its quarterly dividend payment by approximately 50%, accelerated its $4.5 billion net debt target timeline to the end of 2021 and set a new net debt target of $3 billion by year-end 2023, assuming $50 per bbl WTI oil and $2.75 per Mcf NYMEX natural gas prices.

Second Quarter Highlights:

- Generated second quarter cash from operating activities of $750 million, non-GAAP cash flow of $733 million and non-GAAP free cash flow of $350 million

- Reduced net debt(1) by $1.2 billion to $5.2 billion; accelerated expected timeline of $4.5 billion net debt target to year-end 2021

- Continued to demonstrate industry-leading capital efficiencies with operational efficiency gains and supply chain management more than offsetting inflation during the quarter

- Established new net debt target of $3 billion, expected to be achieved by year-end 2023 assuming $50 per barrel (bbl) WTI oil and $2.75 per thousand cubic feet (Mcf) NYMEX natural gas prices

- Announced a 50% increase to quarterly dividend payment; represents dividend of $0.56 per share of common stock on an annualized basis

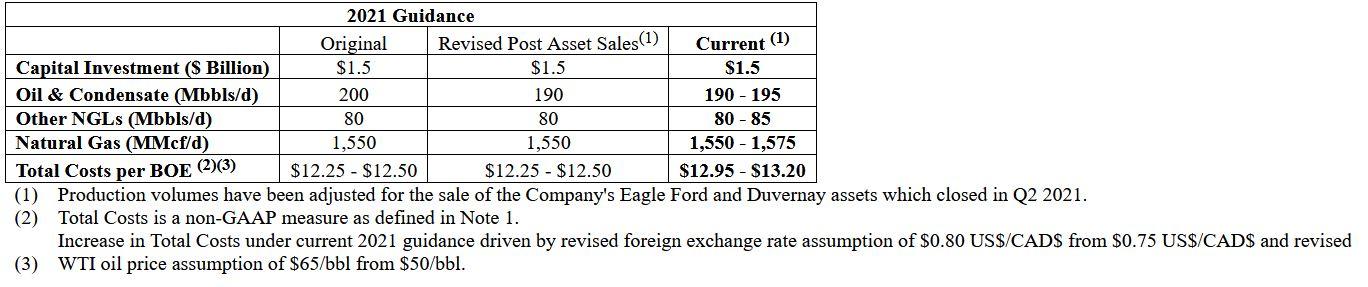

- Increased full-year crude and condensate(2) guidance to 190 - 195 thousand barrels per day (Mbbls/d) as a result of strong production outperformance across our assets; full-year capital guidance of $1.5 billion is unchanged

CEO Doug Suttles said: "Our track record of free cash flow generation continued in the second quarter with another $350 million of free cash, bringing us to a total of $890 million year-to-date. We also expect to reach our original $4.5 billion net debt target before year-end - one year ahead of our original timeline. This achievement will mark almost $3 billion of net debt reduction since the second quarter of 2020. Our business continues to perform exceptionally well with operational efficiency gains and supply chain management more than offsetting cost inflation year-to-date. Ovintiv is positioned to thrive on the road ahead."

Q2 Financial & Operating Results

- The Company recorded a net loss in the second quarter of $205 million, or $0.79 per diluted share of common stock. The results included the impact of net losses on risk management of $799 million, before-tax.

- Second quarter cash from operating activities was $750 million, non-GAAP cash flow was $733 million and capital investment totaled $383 million, resulting in $350 million of non-GAAP free cash flow.

- Average total production was 555 thousand barrels of oil equivalent per day (MBOE/d) and crude and condensate production averaged 201 Mbbls/d.

- Total Costs for the second quarter were $12.90 per barrel of oil equivalent (BOE) and were impacted by an elevated foreign exchange rate of approximately 0.81 US$/C$ (vs. guidance of 0.75 US$/C$), as well as higher production taxes due to higher commodity prices.

- Second quarter 2021 average realized prices, excluding hedge, were $63.47 per barrel for oil and condensate (96% of WTI), $20.83 per barrel for other NGLs (C2-C4) and $2.75 per Mcf for natural gas (97% of NYMEX) resulted in a total average realized price of $34.20 per BOE.

- Second quarter 2021 average realized prices, including hedge, were $52.39 per barrel for oil and condensate, $18.37 per barrel for other NGLs (C2-C4) and $2.74 per Mcf for natural gas, resulted in a total average realized price of $29.76 per BOE. Ovintiv reported second quarter realized risk management losses of $223 million, before tax.

Debt Target Established

During the second quarter, Ovintiv accelerated the timeline to achieve its $4.5 billion net debt target to year-end 2021 from its original target date of year-end 2022. This target represents approximately $3 billion of net debt reduction since the second quarter of 2020.

The Company has set a new net debt target of $3 billion, which it expects to achieve by year-end 2023 and assuming $50 per bbl WTI oil and $2.75 per Mcf NYMEX natural gas prices. Ovintiv expects to meet this target without proceeds from asset sales.

In June 2021, Ovintiv redeemed its $600 million 5.75% senior notes due January 30, 2022. The Company has given notice to redeem its $518 million 3.90% senior notes due November 15, 2021 on August 16, 2021. The combined redemptions represent approximately $1.1 billion of debt repayments, resulting in expected annualized interest savings of over $50 million.

At the end of the second quarter, the balance on the Company's revolving credit facility had been fully paid down and Ovintiv had no commercial paper outstanding. Ovintiv's available liquidity totaled $4.4 billion.

Dividend Increased

On July 27, 2021, Ovintiv's Board declared a dividend of $0.14 per share of common stock payable on September 30, 2021 to common stockholders of record as of September 15, 2021.This represents an increase of approximately 50% from the previous level.

Ongoing Focus on ESG

The Company published full year 2020 ESG metrics on its website today.

Year-over-year highlights include:

- 14% reduction in greenhouse gas emissions intensity

- 33% reduction in methane emissions intensity

- 36% reduction in flaring and venting intensity

- 10% reduction in total recordable injury frequency

- 11% reduction in spill intensity performance

"With our $4.5 billion net debt target firmly in sight, we are well positioned to increase our cash return to shareholders with this sustainable increase in our base dividend," said Ovintiv's President and incoming CEO, Brendan McCracken. "We are also furthering our commitment to balance sheet strength by reducing our targeted net debt to $3 billion. This equates to approximately one times net debt to adjusted EBITDA leverage ratio at mid-cycle prices. Our latest ESG performance demonstrates our commitment to rapidly reducing our emissions in real time. Looking forward, we will maintain our disciplined focus on generating significant free cash and delivering quality returns."

Asset Highlights

The Company continued to demonstrate industry-leading capital efficiencies across its Core 3 assets during the second quarter.

Permian

Permian production averaged 126 MBOE/d (82% liquids) in the quarter. The Company averaged three gross rigs, drilled 21 net wells, and had 33 net wells turned in line (TIL).

Permian drilling and completion (D&C) costs have averaged $480 per foot year-to-date and are 11% lower than the 2020 program average. Both drilling and completion efficiency records were achieved in the quarter, including an average drilling cost of $170 per foot, 17% lower than the 2020 average. Among wells rig released in the quarter, the average lateral length drilled was 12,050 feet, approximately 20% longer than the 2020 average. Underpinned by Simul-frac operations, the Company completed 3,500 lateral feet per day and pumped 9.5 million pounds of sand per day on a single pad, its most efficient well set to date. During the quarter, 30 out of the 33 net wells were completed using Simul-frac. Ovintiv also began sourcing in-basin, wet sand from a Howard County mine during the quarter.

Anadarko

Anadarko production averaged 133 MBOE/d (62% liquids) in the quarter. The Company averaged two gross rigs, drilled 16 net wells, and had 22 net wells TIL, of which 21 were operated by Ovintiv.

STACK D&C costs have averaged $430 per foot year-to-date, and are 10% lower than the 2020 program average. During the quarter, 17 wells were completed in the STACK, with two wells drilled and completed for $3.5 million. All the STACK wells were completed using Simul-frac operations, where the Company pumped an average of 150,000 bbls per day, 40% more than the 2020 program average. Ovintiv also achieved a new spud-to-rig release drill time pacesetter of 5.9 days. The team has now recorded faster average drilling times in the STACK for the third consecutive quarter.

In SCOOP, four net Woodford/Caney oil wells were brought on-line in the quarter with an average D&C cost of $5.3 million.

Montney

Montney production averaged 235 MBOE/d (25% liquids) in the quarter. The Company averaged four gross rigs, drilled 18 net wells and had 30 net wells TIL.

Montney year-to-date D&C costs have averaged $410 per foot and are 9% lower than the 2020 program average. All the quarterly wells TIL targeted the volatile oil and liquids-rich condensate fairway of the play with an expected liquids composition of 30-70%. Ovintiv drilled five wells at or below $100 per foot, 20% of the total quarter rig releases. Six wells were drilled faster than the previous pacesetter and all six wells achieved drilling rates greater than 2,050 feet per day.

Base Assets

Bakken production averaged 24 MBOE/d (79% liquids) in the quarter. The company drilled one net well and had two net wells TIL. The two net wells brought online in the quarter exhibited strong production performance, achieving an average 60-day initial production rate of 1,235 bbls of oil per well. D&C costs from 2020 to 2021 have averaged $510 per foot, 14% lower than the 2019 average.

Revised 2021 Guidance

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Production Oil(bbls/d) |

|

|

|

|

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Canada News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -